South Africa Inflation Moderately Eased to 3.5% y/y in January

Bottom Line: Statistics South Africa (Stats SA) announced on February 18 that annual inflation slightly edged down moderately to 3.5% y/y in January, driven by higher housing and utilities, food and non-alcoholic beverages, and insurance and financial services. Annual core inflation came in at 3.4% in January, its highest reading in 11 months. The inflation stayed within the South African Reserve Bank’s (SARB) 1 percentage point tolerance band of new 3% target supported by suspended power cuts (loadshedding), stronger Rand (ZAR), lower oil prices and decrease in inflation expectations. We think subdued inflation could keep the door open for a 25 bps interest rate cut during the next MPC on March 26 despite core inflation remains worrying. We expect the rate decision will be a close call since cautious SARB will keep an eye on inflation expectations and global developments.

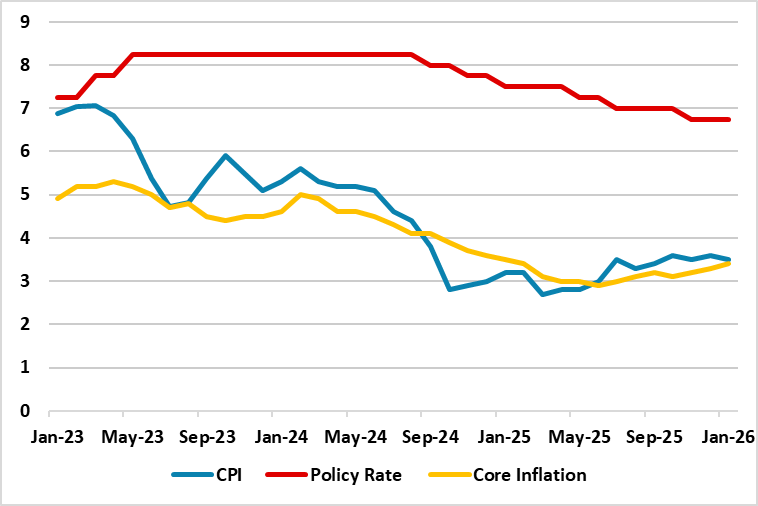

Figure 1: Policy Rate (%), CPI and Core Inflation (YoY, % Change), January 2023 – January 2026

Source: Continuum Economics

After hitting 3.6% y/y in December, annual inflation softened to 3.5% y/y in January driven by housing and utilities, food and non-alcoholic beverages, and insurance and financial services. According to StatsSA announcement on February 18, food inflation remained at 4.4% for a third consecutive month. The monthly change for petrol was -3.1% and diesel -5.4% while the price of inland 95-octane petrol was R20.75 per litre in January, the lowest in almost four years.

MoM prices surged by 0.2% in January from the previous month. Annual core inflation came in at 3.4% in January, its highest reading in 11 months.

On the power cuts front, South Africa’s national electricity utility company Eskom announced on February 13 that South Africa has now experienced 273 consecutive days without an interrupted supply, with only 26 hours of loadshedding recorded in April and May. The energy availability factor (EAF) also rose to 65.04% for the financial year to date (April 1, 2025 to February 12, 2026), which was a significant development.

Low oil prices and suspension of loadshedding continued to help businesses and households to relieve facing increasing costs, contributing at lower inflation figures. We think January inflation outlook has also been supported by a stronger ZAR, which hovered around 16.1-16.5 against the USD.

Additionally, there was a fall in the inflation expectations. The Bureau for Economic Research’s (BER) latest survey for the SARB in December showed that in Q4 2025 (the first survey after the inflation target changed to 3%), the two- and five-year inflation expectations on average, fell to a record low of 3.7% (from 4.2% before). Next-year expectations were also down by a significant margin (0.4% pts) to 3.8%.

The inflation stayed within the SARB's 1 percentage point tolerance band of 3% target supported by suspended power cuts, stronger ZAR, lower oil prices and decrease in inflation expectations while any increases in utility costs and food prices could pressurize prices. We think subdued inflation could keep the door open for a 25 bps interest rate cut during the next MPC on March 26 despite core inflation remains worrying. We expect the rate decision will be a close call since cautious SARB will keep an eye on inflation expectations and global developments.