China CPI: Core Slows and 10bps June 17 MLF Cut?

China disinflation is clear in the latest numbers for May, with core falling 0.2% on the month. Further stimulus will likely arrive in the form of monetary easing. While it is a close call, we look for a 10bps cut in the medium-term lending facility rate (MLF) from 2.50% on June 17.

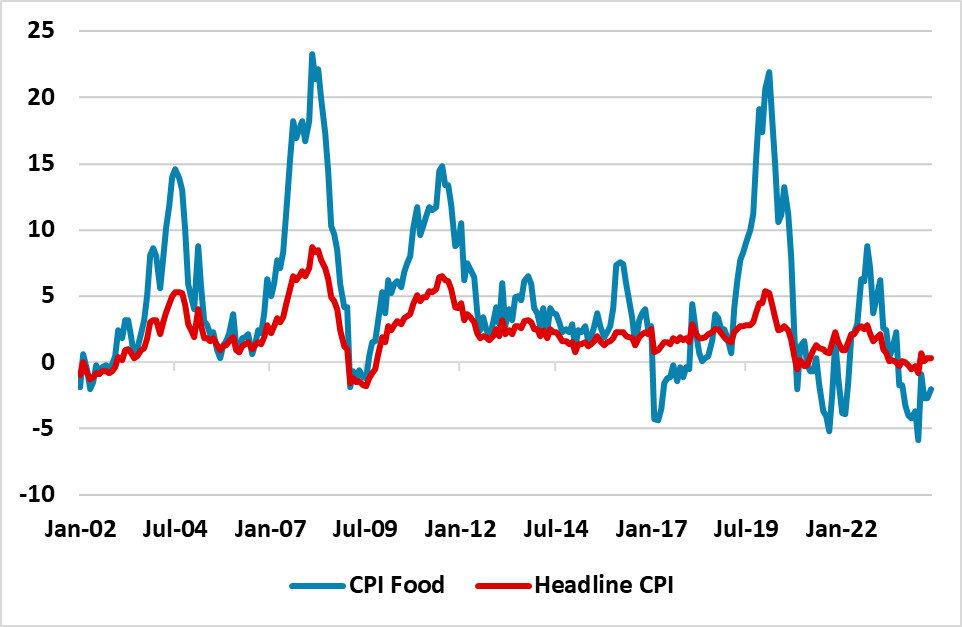

Figure 1: China Headline and Food CPI (Yr/Yr %)

Source: Datastream/Continuum Economics

The disinflation story remains in place during May, with an unchanged 0.3% Yr/Yr headline but a 0.1% fall on the month. Though food price decline are less (Figure 1), core disinflation pressures remain intense with core Yr/Yr slowing from 0.7% to 0.6% and a 0.2% core decline on the month. Excess production is causing PPI to remain negative (-1.4%), while weak domestic demand is also causing pressure on profit margins – consumer goods prices fell for the 3 month in a row.

The CPI data alone argues for more stimulus, which will likely be reinforced by the May retail sales data on June 17. While fiscal policy has been in the spotlight, we feel that monetary easing will likely be next. The Politburo is open to including monetary policy, though China authorities do not want to widen interest rate differentials too far and put the Yuan under too much downward pressure. An additional 25bps reserve requirement ratio (RRR) cut would meet these objectives. However, we feel that the most likely option is a 10bps cut in the MLF rate to 2.40% to be followed by 10bps cuts in the 1 and 5yr loan prime rate on June 20. This would signal stimulation intent, but not be too big to hurt the Yuan too much. Additionally, though the Fed is talking a higher for longer, they are still leaving rate cuts on the table for later in the year and the ECB has started its easing cycle. We would see an RRR cut arriving in Q3. Nevertheless, it is a close call, as China authorities are also not happy with government bond yields having come too low and causing risk aversion in markets.