ECB July Account: Policy ‘On Hold’ Leaves Easing Door Open But Less Widely So

The account of the July 23-24 ECB Council meeting saw some discussion about cutting at that juncture but with no immediate pressure to change policy rates what was then exceptional uncertainty added to arguments for keeping interest rates unchanged. In particular, it was seen that maintaining policy rates would allow more time to see how trade negotiations unfolded and to thoroughly assess previous policy moves. It was suggested that by September, a better understanding of how the economy was responding to economic challenges would be possible, and to us this looks very much like keeping policy on hold this month not least given that the Council member focus on PMI data may only reinforce the discussion of EZ economic resilience highlighted in the account. But the main tone was that the Council thinking had moved from the speed at which interest rates should be normalised, to potential (more) marginal adjustments for the remainder of 2025.

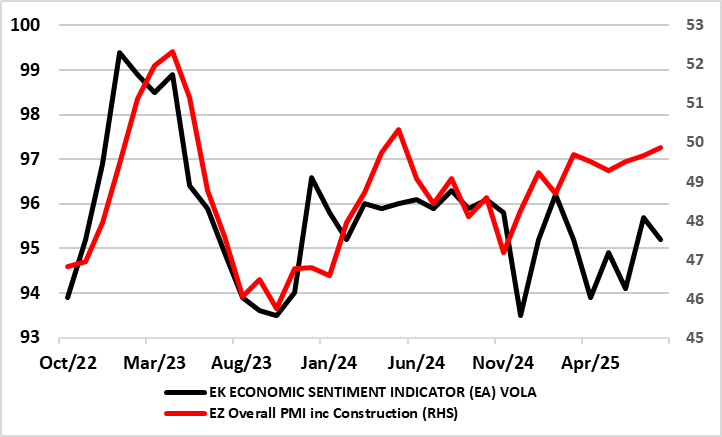

Figure 1: Business Surveys Offering Diverging Outlooks

Source; Markit European Commission

The account noted that macroeconomic data had surprised on the upside, indicating that the economy was more resilient than initially expected, this apparently partly reflecting the Governing Council’s past interest rate cuts. However, in assessing economic resilience we think the ECB focus on PMI data is somewhat excessive, especially as alternative survey data from the European Commission are telling a more sobering story (Figure 1), all the more important as these latter numbers encompass both a wider amount of geographical and sectorial detail than the PMIs and have better track record. This to us makes it likely that the potential marginal adjustments in policy seen as possible for the remainder of 2025 will a) actually occur and b) now probably continue into early 2026.

In this regard the ECB is not offering policy guidance – the very opposite. It suggested that ‘Communication should maintain a careful, neutral tone and be deliberately uninformative about future interest rate decisions’. Effectively, this means more data dependence in terms of how the incoming data would influence the medium-term outlook, rather than overreacting to individual data points – a view we think that increases the need for the ECB to look at a broader array of data, particularly up-to-date survey numbers such as those from the European Commission. In fact, while the trade deal with the U.S is probably within the ECB’s parameters, we think the ECB is still being somewhat complacent about other issues not least its assertion that one key factor insulating EZ long-term yields from global upward pressures was the region’s stronger fiscal position relative to other economies – try telling French policy makers this.

Given the uncertainty overhanging policy makers worldwide, we think the ECB is under-estimating a disinflation picture reflecting still-tight financial conditions which is seeing near zero real credit growth and a softer labor market. As for the current ECB message, it is a clear wait and see, with the easing door left open and where this bias will be exercised but probably now in December and then early 2026.