China: Q1 Upside Surprise, but March Disappoints

Q1 GDP upside surprise was driven mainly by public sector investment. With the government still to implement the Yuan 1trn of special sovereign bonds for infrastructure spending, public investment will likely remain a key driving force. However, the breakdown of the March data show that retail sales continues to slow and spread to a catering slowdown, while residential property investment remains a negative drag on GDP. The 1.1% decline in the GDP deflator also means a mere 4.2% nominal GDP growth, which will restrain aggressive fiscal action. Overall, we are revising 2024 real GDP growth to 4.6% from 4.4% and keep 2025 at 4.0%.

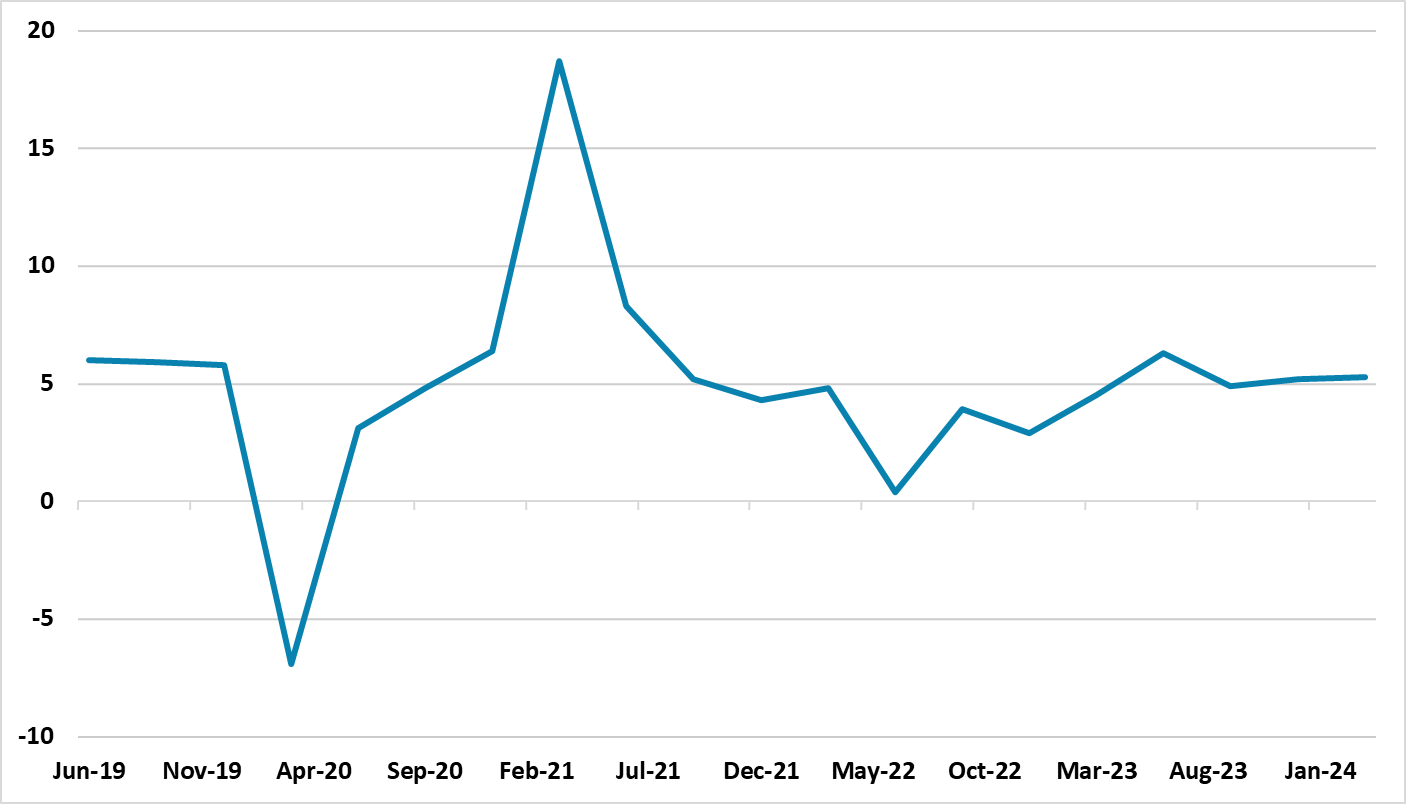

Figure 1: China Quarterly GDP (Yr/Yr)

Source: Continuum Economics

The Q1 China GDP at 5.3% Yr/Yr was much better than expected. The main reason was that public investment surged by 7.8% Yr/Yr, which produced an upside surprise to fixed investment and GDP. Some of this is the feedthrough of the Yuan1trn flood defense infrastructure build, but the data suggests it also reflects the March decision to set a larger budget deficit.

However, the breakdown of the March monthly data, suggest that momentum faded at the end of Q1. Retail sales grew 3.1% in March Yr/Yr and was well below consensus. The breakdown was also a concern as previously buoyant catering slowed to 6.9% Yr/Yr from 12.5% in Jan/Feb, with consumer appearing to be more cautious after the lunar New Year celebrations. Auto sales were also worrying at -3.7% Yr/Yr versus +8.7% Yr/Yr in January/February. Meanwhile, industrial production at +4.5% in March Yr/Yr also surprised on the downside. The residential property sector remains a drag on growth meanwhile, with a fall of 9.5% YTD Yr/Yr and property sales down 30.7% on the YTD Yr/Yr.

The good Q1 number does prompt us to revise up the 2024 GDP forecast. However, the weak March momentum means we are revising down Q2 to Q4 to 4.5%, 4.4% and 4.3% respectively – Q2 will be hurt by base effects given the boost to GDP in Q2 2023 from the end of zero COVID restrictions. Additionally, it is worth noting that the Q1 GDP deflator was -1.1% Yr/Yr, which means that nominal GDP was a mere +4.2%. With the growth of debt remaining faster, this suggests China will remain on a path towards a higher total debt/GDP ratio and this will restrain the scale of additionally fiscal policy action. Overall, we are revising 2024 to 4.6% from 4.4% and keep 2025 at 4.0%.