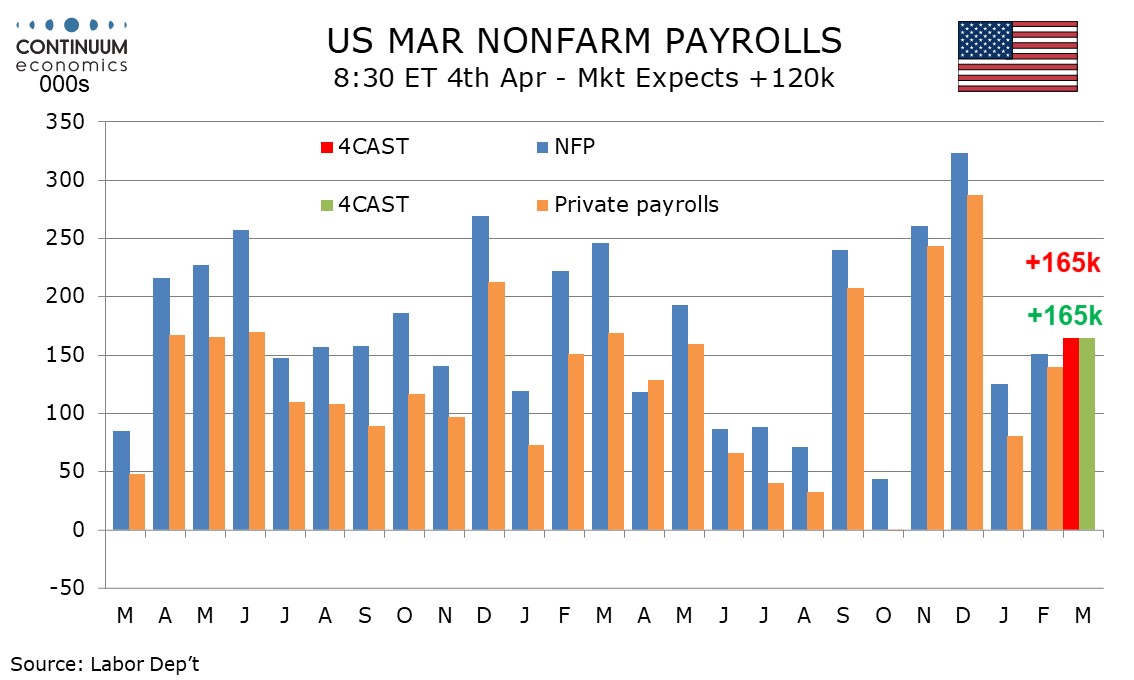

Preview: Due April 4 - U.S. March Employment (Non-Farm Payrolls) - Stronger than January, but slower than November and December

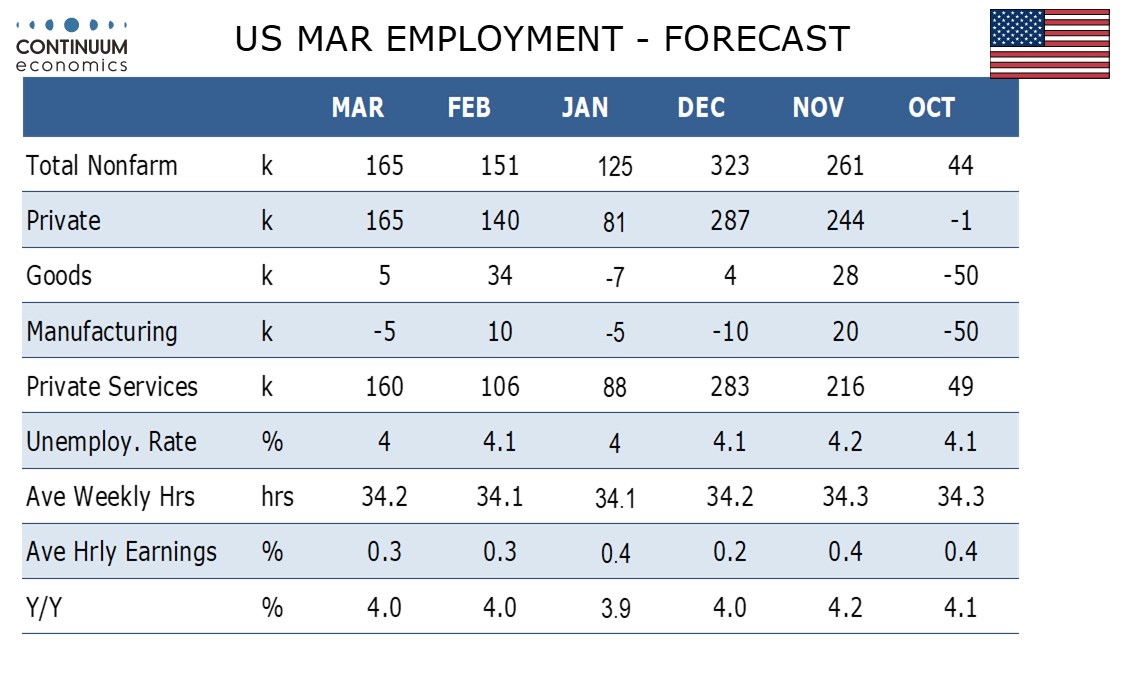

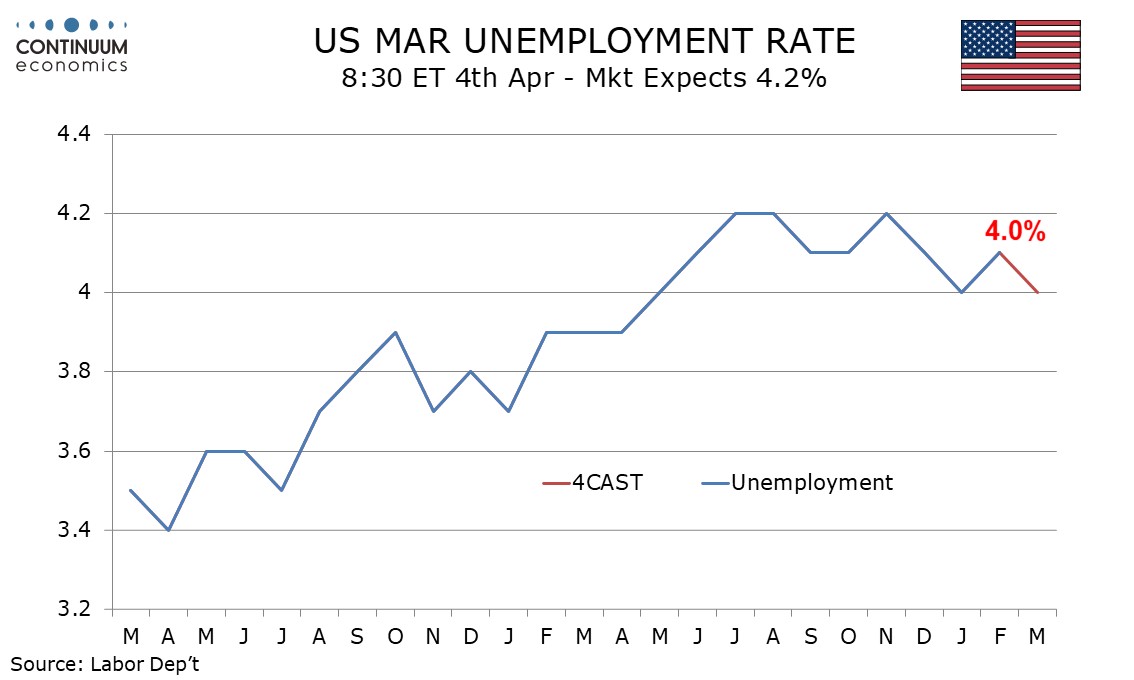

We expect a 165k increase in March’s non-farm payroll, both overall and in the private sector, to show the labor market remains healthy despite growing downside economic risks. We expect the unemployment rate to slip to 4.0% from 4.1%, and an in line with trend 0.3% increase in average hourly earnings.

A 165k increase would be stronger than February’s 151k and January’s 125k, both of which were probably restrained by unusually cold weather. Weather was mostly mild in March though storms in the South provide some downside risk. While survey evidence is showing signs of weakness hard data generally remains solid, particularly weekly initial claims.

Leisure and hospitality is a sector to watch for a bounce after two straight declines that may have been weather-influenced, though there is also a risk that the sector is being hit by reduced tourism, particularly from Canadians who have been refusing to holiday in the US due to the trade dispute.

We expect 30k in layoffs of Federal government workers, up from 10k in February, but this is likely to be offset by continued hiring and the state and local level. A flat total from government would be the weakest month since a decline seen in May 2024, a fall that corrected two particularly strong months.

A fall in unemployment to 4.0% from 4.1% would reverse an increase seen in February. The household survey, which calculates the unemployment rate, showed employment and the labor force falling, and a correction higher in both is likely. However reduced immigration may see the labor force seeing the smaller gain.

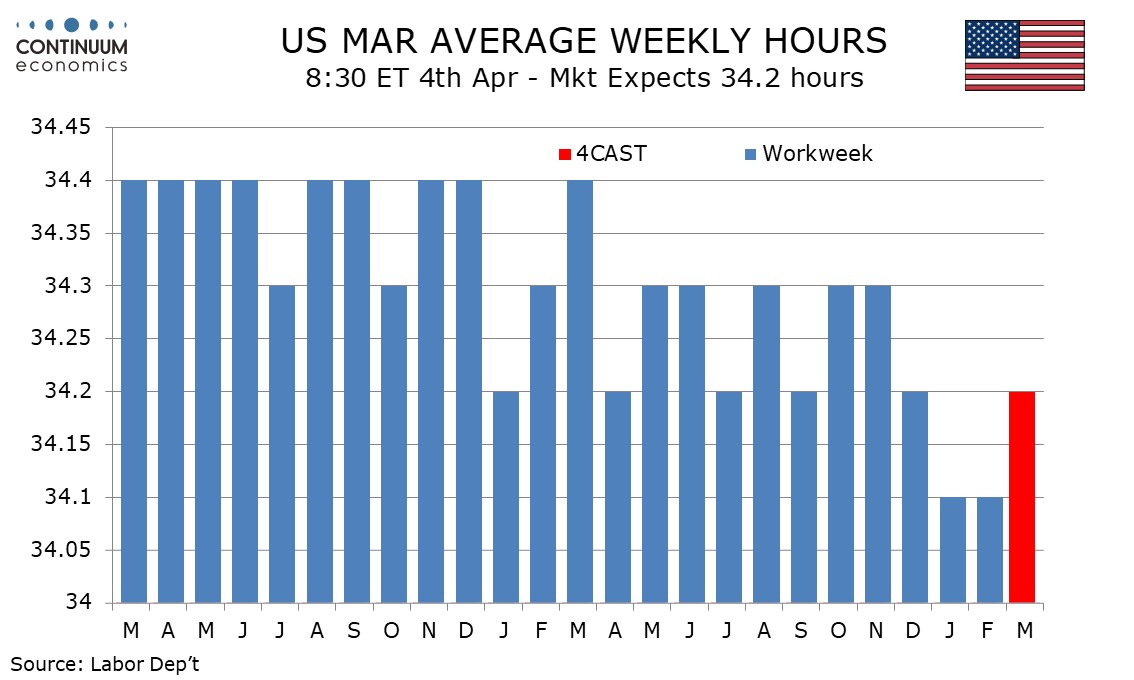

We expect a rise in the workweek to 34.2 hours after two months at 34.1 that may have been reduced by bad weather. That would leave aggregate hours worked up by 0.4% on the month but almost unchanged in Q1.

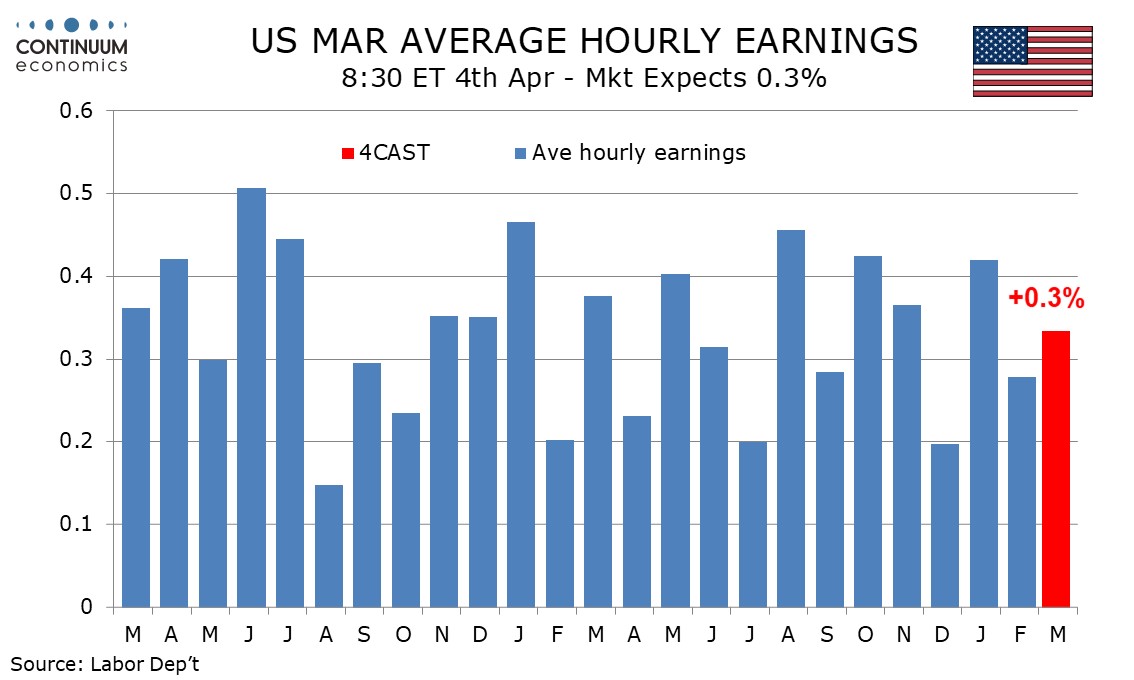

A 0.3% rise in average hourly earnings would leave yr/yr growth unchanged at 4.0% and we expect the rise, as is trend, to be marginally above 0.3% before rounding. Falling immigration poses upside risk, but a longer workweek would reduce the risk of an above trend outcome this month.