View:

May 27, 2025

Preview: Due June 4 - U.S. May ADP Employment - Less weak than April, but trend is slowing

May 27, 2025 4:26 PM UTC

We expect a rise of 85k in May’s ADP estimate for private sector employment growth. This would be stronger than April’s 62k but closer to April than to March’s 147k and thus consistent with a further slowing in trend. We expect ADP data to underperform a 110k rise in May’s private sector non

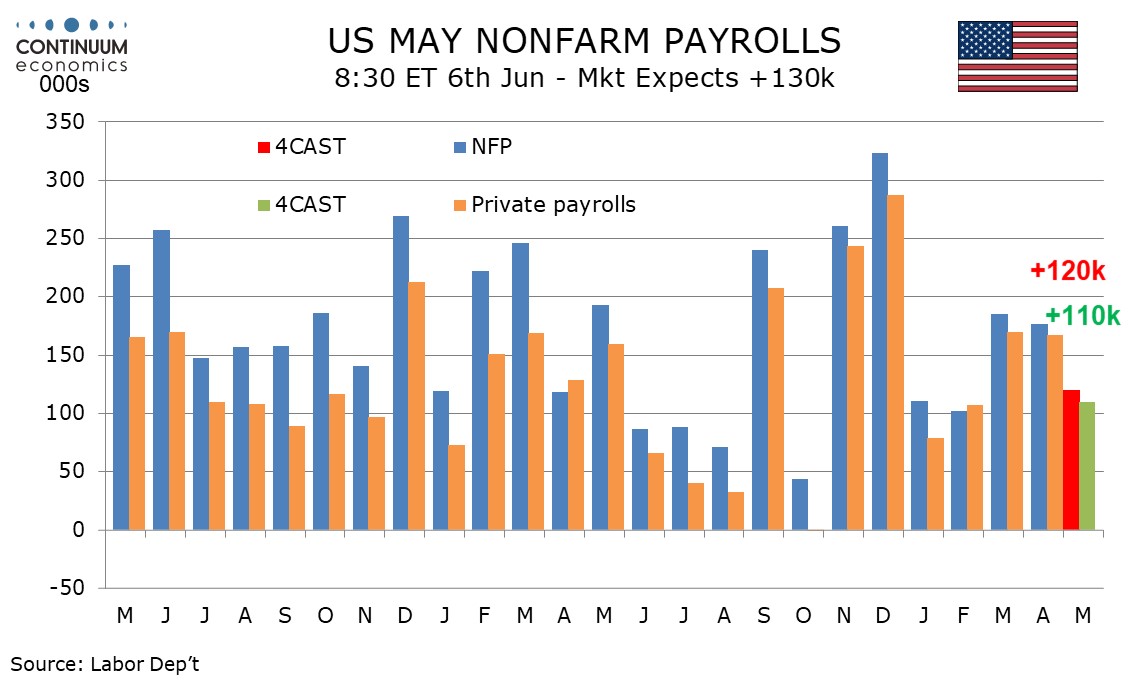

Preview: Due June 6 - U.S. May Employment (Non-Farm Payrolls) - Some slowing, but not a recession signal

May 27, 2025 3:32 PM UTC

We expect a 120k increase in May’s non-farm payroll, with 110k in the private sector, slower than seen in March and April but stronger than what may have been weather-restrained months in January and February. We expect a slightly stronger 0.3% rise in average hourly earnings and an unchanged unem

U.S. May Consumer Confidence bounce likely supported by equities

May 27, 2025 2:21 PM UTC

Contrasting continued weakness in the Michigan CSI, the Conference Board’s Consumer Confidence Index has seen a sharp bounce in May, to 98.0 from 85.7, led by consumer expectations, which appears related to rising equities as trade tensions reduced somewhat.

U.S. April Durable Goods Orders - Subdued underlying picture, business investment slipping back in Q2

May 27, 2025 12:54 PM UTC

April durable goods orders with a 6.3% fall are a little less weak than expected and failed to fully reverse a 7.6% March increase that was led by aircraft (and originally reported as up 9.2%). The ex transport gain of 0.2% is a little stronger than expected, but only reverses a 0.2% decline in Marc

EZ HICP and Labor Market Preview (Jun 3): Headline Back Below Target as Services Inflation Reverses Easter Effect?

May 27, 2025 11:17 AM UTC

Exceeding expectations, EZ HICP inflation failed to fall in April, instead staying at 2.2%. More notably, services inflation jumped 0.5 ppt to 4.0%, very probably due to the impact of the timing of Easter affecting airfares and holiday costs. As already seen in flash French May numbers, and as was

Eurozone: US Stepped-Up Tariff Threat – Negotiations or Concessions?

May 27, 2025 9:22 AM UTC

At least within markets there is some relief that President Trump has deferred his ramped up 50% tariff threat from early June to July 9. Unambiguously positive is the fact that a better line of communication, if not rapport, now seems to exist between the U.S. president and EU Commission Presiden