Preview: Due June 4 - U.S. May ADP Employment - Less weak than April, but trend is slowing

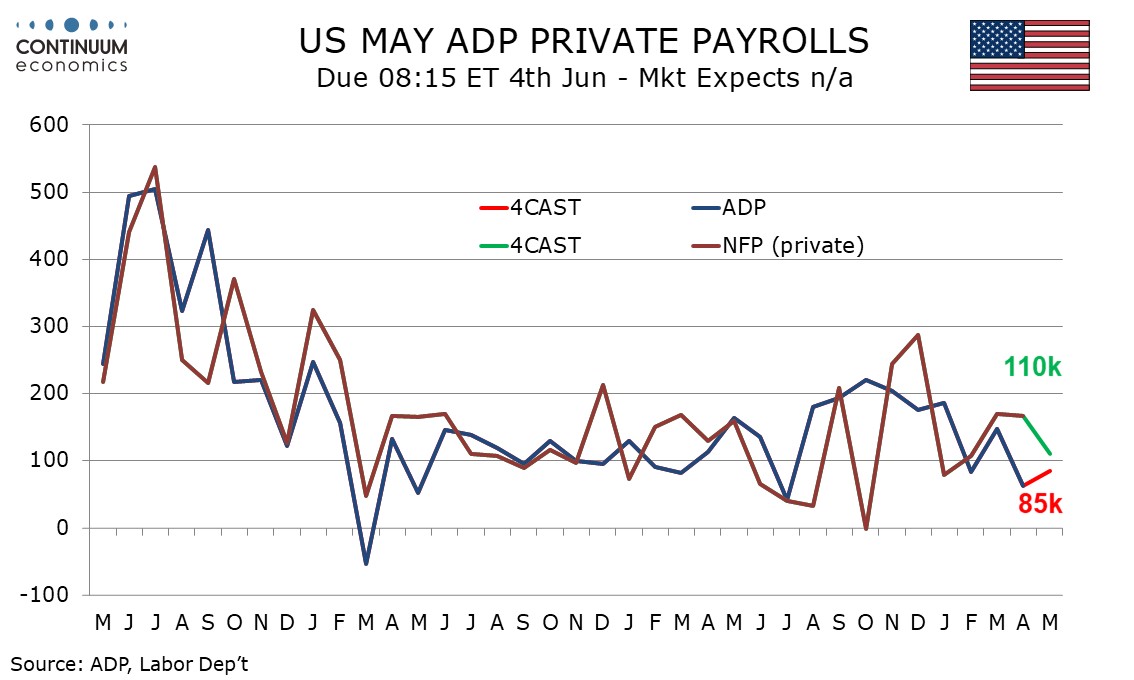

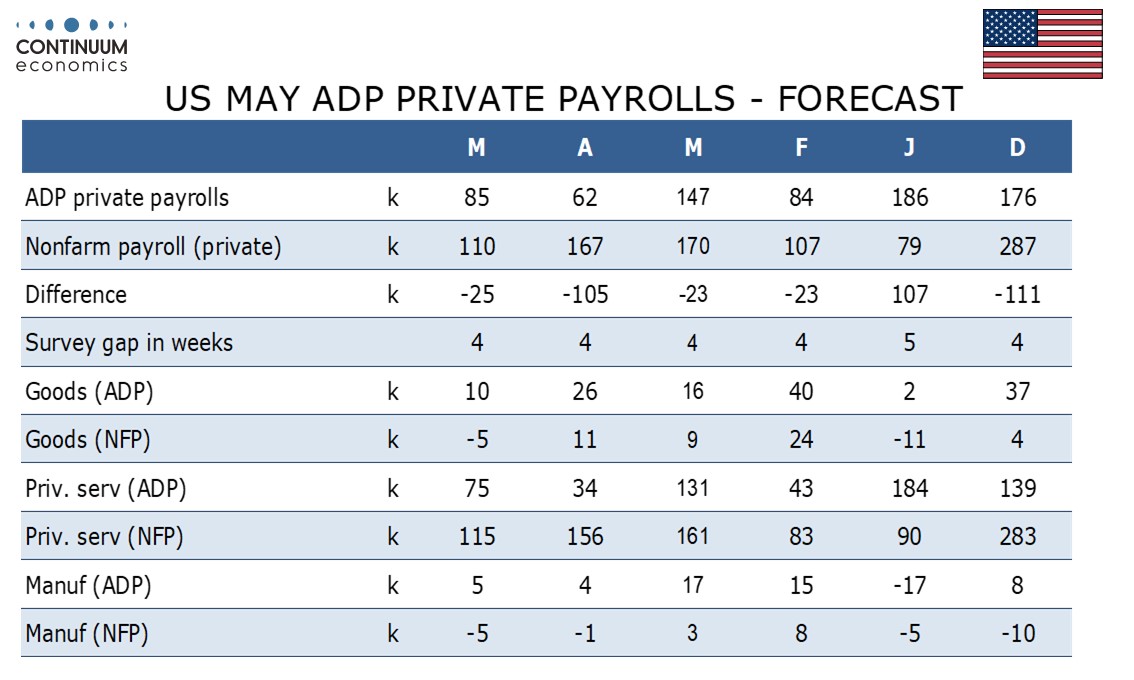

We expect a rise of 85k in May’s ADP estimate for private sector employment growth. This would be stronger than April’s 62k but closer to April than to March’s 147k and thus consistent with a further slowing in trend. We expect ADP data to underperform a 110k rise in May’s private sector non-farm payroll, with overall payrolls to rise by 120k.

A 25k underperformance of private sector non-farm payrolls would be a fourth straight, similar to those seen in February and March but less than a 105k underperformance in April. April’s sharp contrast was largely due to ADP data showing a 23k decline in education and health, a sector that has been leading recent non-farm payroll growth. May’s contrast is likely to be less sharp, but payrolls are still likely to outperform.

Signs of a slowing in the labor market remain modest, but initial claims have moved marginally higher, and while layoffs may remain low, strong seasonal hiring usually seen in May might not fully materialize. ADP trend picked up in late 2024 but now seems to be slowing,

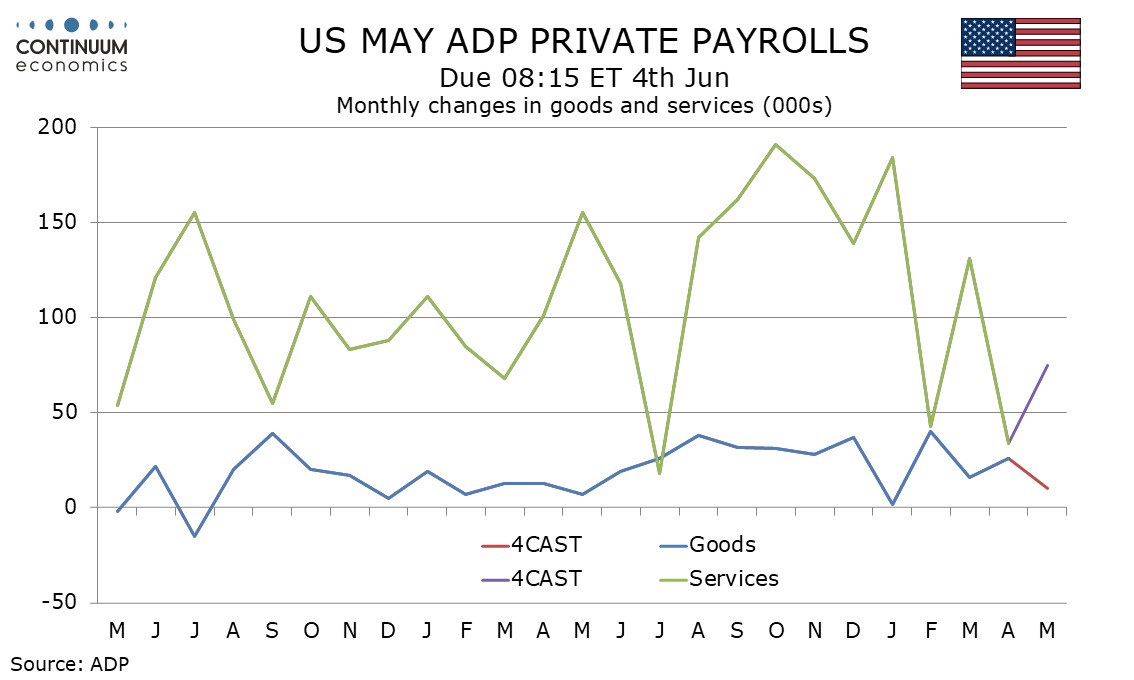

We expect May’s ADP detail to show goods slowing to 10k after a modest pick up to 26 in April but services picking up to 75k after a significant slowing to 34k in April, largely on education and health. Services will remain well below where trend was at the start of the year, suggesting some loss of economic momentum.