FX Weekly Strategy: May 26th-30th

US/EU tariffs the main focus

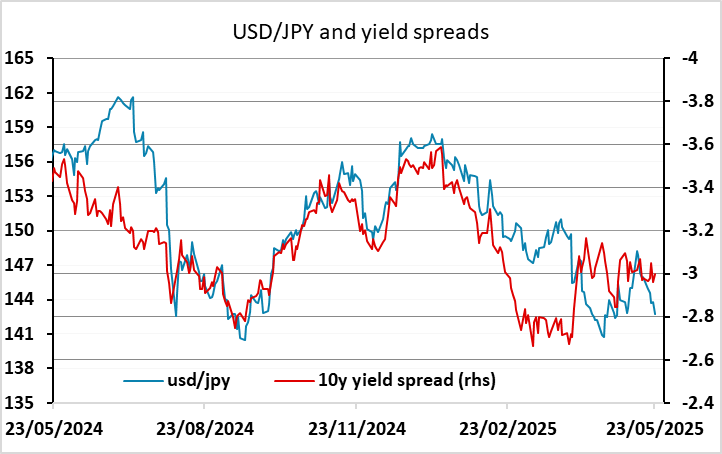

USD weakness and JPY strength likely to extend modestly

AUD still looks well supported at 0.64

A quiet week for data is likely to be dominated by speculation around the 50% tariff on the EU which Trump announced on Friday would be imposed from June 1. Gains in EUR/USD that had been seen earlier on Friday on the back of the upward revision in German Q1 GDP were initially reversed, but EUR/USD subsequently bounced and was still slightly higher on the day. More notably, the USD was generally lower against all the other majors, and the EUR was weaker on the crosses, underlining the market view that a tariff/trade war between the US and EU would hurt the US and EU relative to other countries.

In practice, most will assume that these tariffs are unlikely to actually be imposed, or if they are they won’t last for long, judging by what has happened with China, but for now this is likely to weigh on the USD and EUR on the crosses. It was notable that the USD weakened against the riskier currencies as well as the safe havens on Friday, despite the decline in equities, and we continue to see upside scope for the AUD in particular, with the 0.6400 area now looking like very solid support. However, this still depends on the economic fallout from tariffs being manageable. A 50% tariff on the EU, and the retaliatory measures that would result, would certainly be damaging for the world economy, and if imposed for any extended period could be expected to significantly damage risk sentiment. In that case, the JPY looks like the only currency near certain to benefit. But a playbook similar to that seen with China, with some resolution in a few weeks’ time involving tariffs at 15% or less would likely allow USD declines on a broad front.

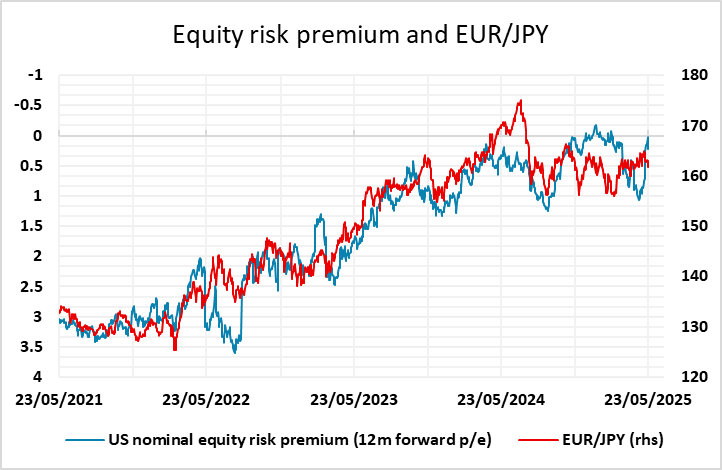

Thus far, the hit to equities from the announcement has been quite modest. Equity risk premia are still very low, and still suggest JPY crosses can hold current levels. But we do see the current level of equities, particularly in the US, as being hard to sustain with the risk of slower growth increasing and US yields also holding at higher levels with demand at auctions seemingly weakening. The lack of significant data this week and the solid US PMIs last week suggest we are still unlikely to see major short term volatility unless the threat of the 50% tariff being sustained for a long period somehow becomes more credible, so for now mild USD weakness and JPY strength looks the most likely scenario.

There are some CPI numbers in Australia, Japan and Germany, and the RBNZ meeting which is expected to deliver a 25bp rate cut, but we doubt that any of these will have significant market impact in a holiday shortened week with the focus on Trump and tariffs.

Data and events for the week ahead

USA

After Monday’s Memorial Day holiday, Tuesday sees April durable goods orders. We expect a 9.0% fall led by aircraft to follow a 9.2% March increase. Ex transport we expect a fall of 0.3%. March house price data from FHFA and S and P Case-Shiller and more significantly May consumer confidence follow. Fed’s Kashkari will speak on Tuesday. Fed’s Williams speaks on Wednesday, which will also see FOMC minutes from March 7. These are likely to have a hawkish tone expressing fears over inflation and reluctance to ease. The meeting took place before the reduction in tariffs on China.

On Thursday we expect Q1 GDP to be revised marginally lower to -0.4% from -0.3% but an upward revision in the core PCE price index to 3.7% from 3.5%. Weekly initial claims are also due with April pending home sales following. Fed’s Barkin, Goolsbee and Daly will speak. On Friday we expect a subdued 0.1% increase in April’s core PCE price index with gains of 0.3% in both personal income and spending. We expect April’s advance goods trade deficit to fall sharply to $110.0bn from March’s record $163.2bn as imports start to reverse a Q1 pre-tariff surge. May’s final Michigan CSI follows. Preliminary data was weaker. Fed’s Logan is due to speak on Friday.

Canada

Canada releases Q1 current account data on Thursday and Q1 GDP on Friday. We expect a 1.5% annualized GDP increase. We expect March GDP to increase by 0.1% in line with a preliminary estimate made with February data, but expect April’s preliminary estimate to suggest a weak start to Q2.

UK

BoE Chief Economist Pill speaks again on Wednesday, possibly advertising his recent dissent but focusing on the economy’s supply side. But there is little data wise.

Eurozone

A semi-busy week data wise includes European Commission survey data (Tue) and ECB money/credit on Friday, the former watched to see if they echo the last set of (weak) PMI data. Wednesday sees the ECB consumer expectations survey update.

Friday sees German HICP inflation which is likely to fall back to the 2.0% target in flash May data, the question being what will happen to services prices which in April rose for the first time in three months and by a sizeable 0.4 ppt to a seemingly hefty 4.5%. As was the case in April 20129, this was probably caused by the timing of Easter and this effect should reverse in the May data where a drop in the headline will be compounded a by a further m/m fall in fuel prices, this coming alongside a fall in the core rate to a 13-month low of 2.9%. French (Tue) and Spanish CPI data (Fri) will provide added inflation and particularly services prices insights for the month.

Rest of Western Europe

There are a few key events in Sweden, most notably amid what have been volatile monthly GDP indicator numbers, comes a formal glimpse at Q1 numbers too (Fri). Tuesday sees the monthly Economic Tendency Survey and Wednesday sees the Riksbank Financial Stability Review. On Friday, Norway has important jobless data this coming alongside Swiss KOF survey data.

Japan

Tokyo CPI on Thursday will be the highlight for Japanese calendar next week. The National CPI this week has shown an elevated inflationary pressure and seems to see little sign of such inflationary pressure to ease in May. However, with trade conflict between U.S. and Japan persists, BoJ’s hands are remain tied and should see a less lasting impact on any economics data. Retail Trade, Industrial production and unemployment rate are also released on the same data.

Australia

Monthly CPI on Wednesday is expected to stay within target range but has potential to be choppy in the coming months. If we see another downside surprise, it is likely market participants’ speculation of another imminent cut from the RBA. Else, retail sales on Friday could provide insights on consumption recovery.

NZ

RBNZ rate decision is on Wednesday and we do not see a deviation from their OCR forecast path. However, as we are getting closer to terminal rate, the forward guidance would be critical for the Kiwi. Followed by ANZ Business outlook, confidence and consumer confidence on Thursday.