U.S. April Durable Goods Orders - Subdued underlying picture, business investment slipping back in Q2

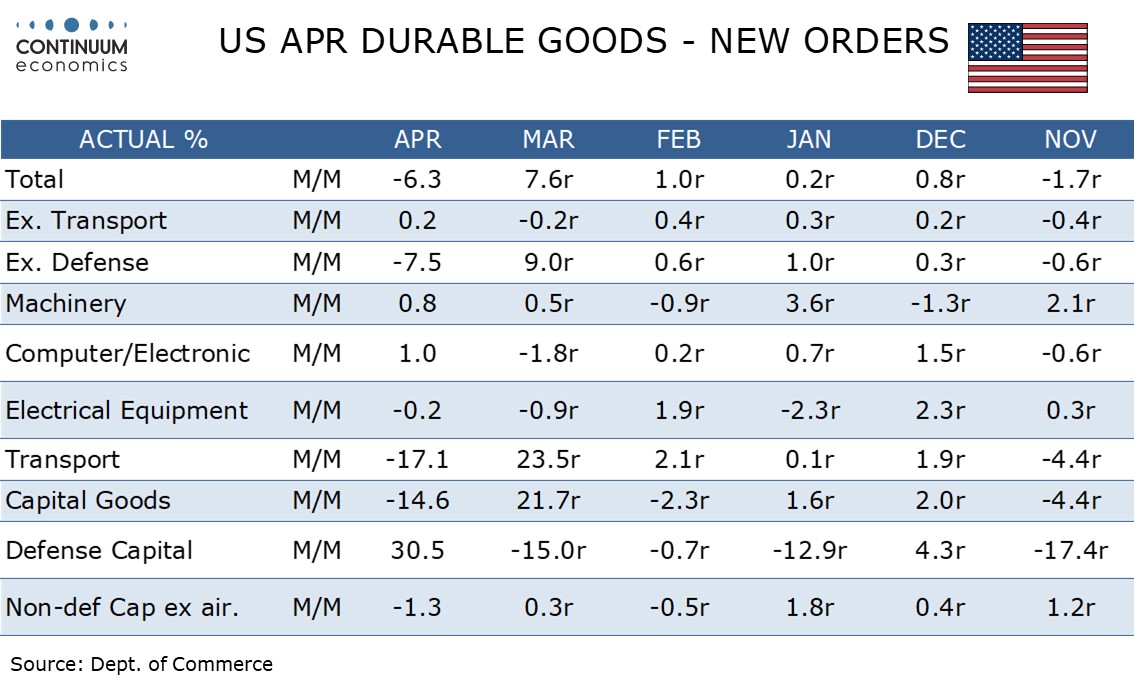

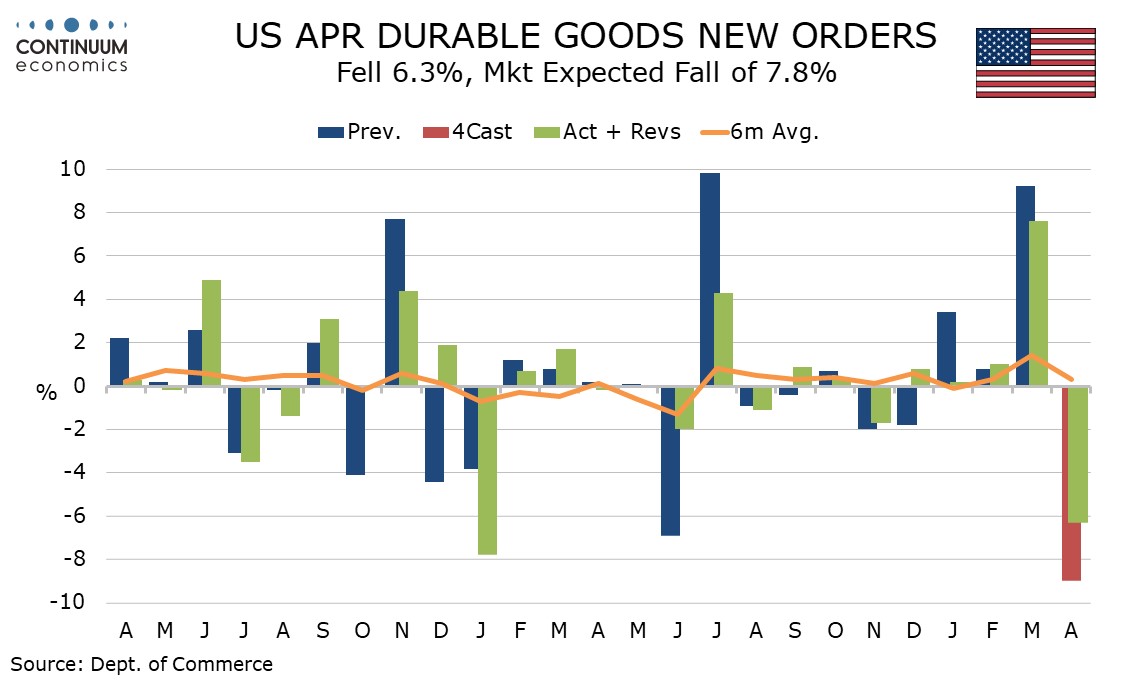

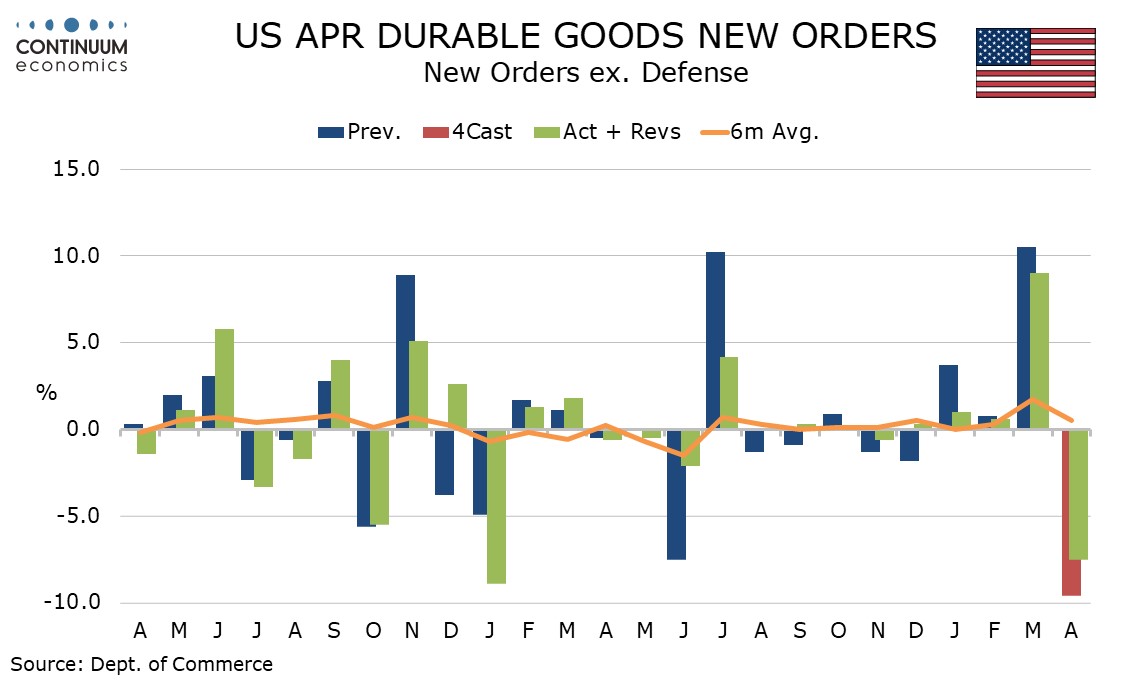

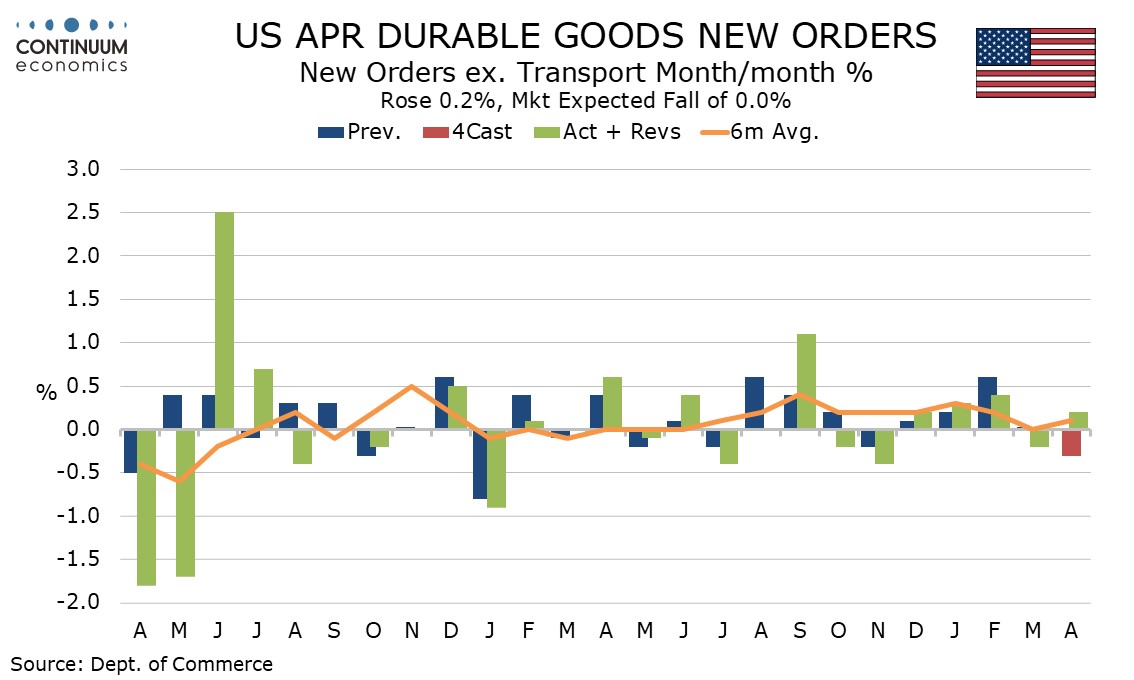

April durable goods orders with a 6.3% fall are a little less weak than expected and failed to fully reverse a 7.6% March increase that was led by aircraft (and originally reported as up 9.2%). The ex transport gain of 0.2% is a little stronger than expected, but only reverses a 0.2% decline in March.

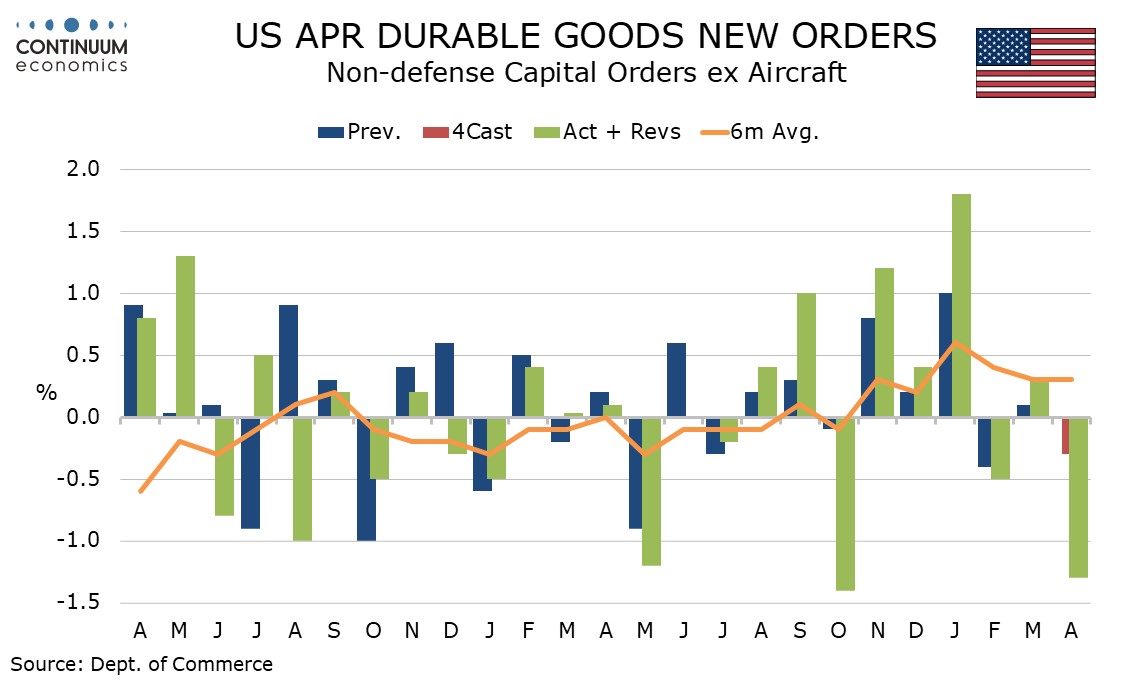

One area of weakness in the detail is a 1.3% decline in non-defense capital goods ex aircraft, a key indicator of business investment. Business investment was strong in Q1 though that appears to reflect front loading fueled by imports ahead of tariffs. April’s data suggest Q1 strength will not persist in Q2.

Civil aircraft fell sharply after a strong March but the level was still stronger than in each month from September through February. Autos fell by 2.9% after two straight gains that may have been in anticipation of tariffs.

Defense capital orders, which have an overlap with transport, surged by 30.5% after three straight declines. Orders ex defense fell by 7.5%.

The ex transport data is

ISM manufacturing new orders were positive in November, December and January but slipped in February and March. A slightly less negative April can be seen as consistent with the slightly stronger April ex transport reading but the underlying picture is looking subdued.