U.S. May Consumer Confidence bounce likely supported by equities

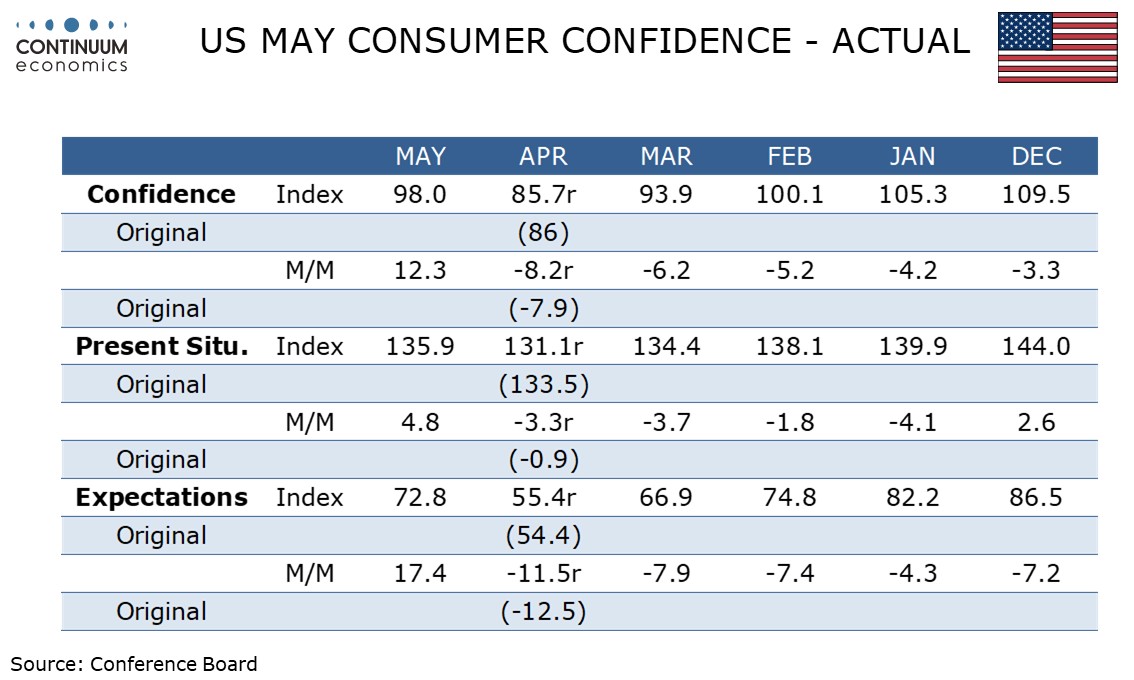

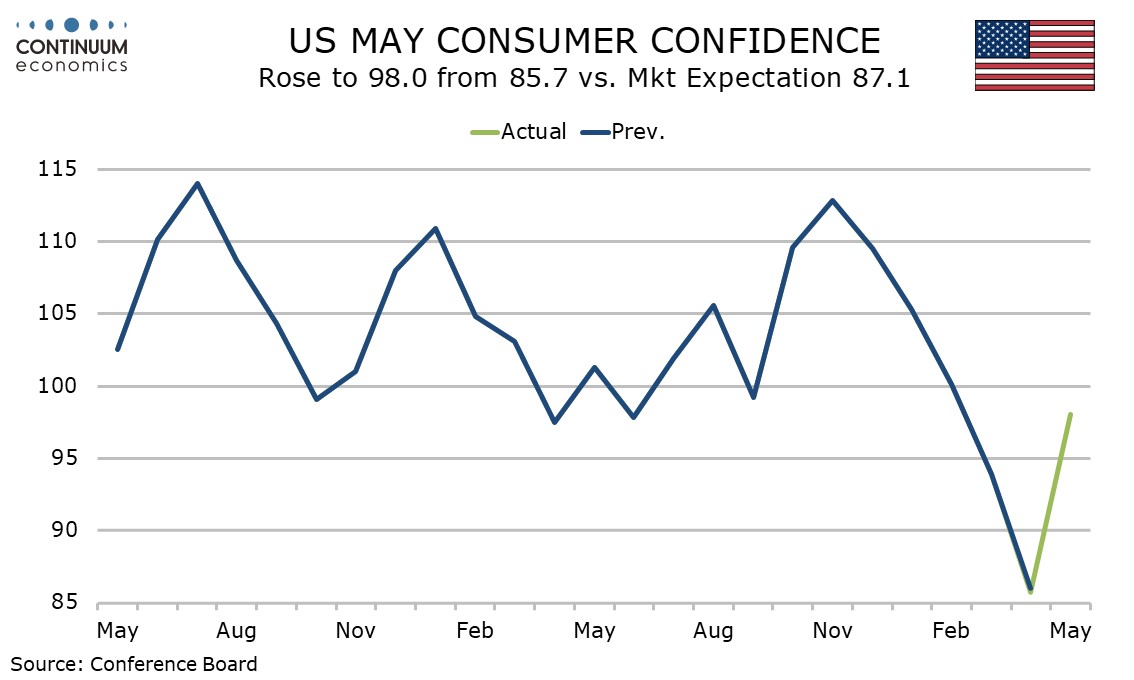

Contrasting continued weakness in the Michigan CSI, the Conference Board’s Consumer Confidence Index has seen a sharp bounce in May, to 98.0 from 85.7, led by consumer expectations, which appears related to rising equities as trade tensions reduced somewhat.

The latest index is above March’s 93.9 as well as April, though below February’s 100.1 and the November high of 112.8. It is however above two readings seen in 2024, in April and June, and that suggests we are moving away from a recessionary signal.

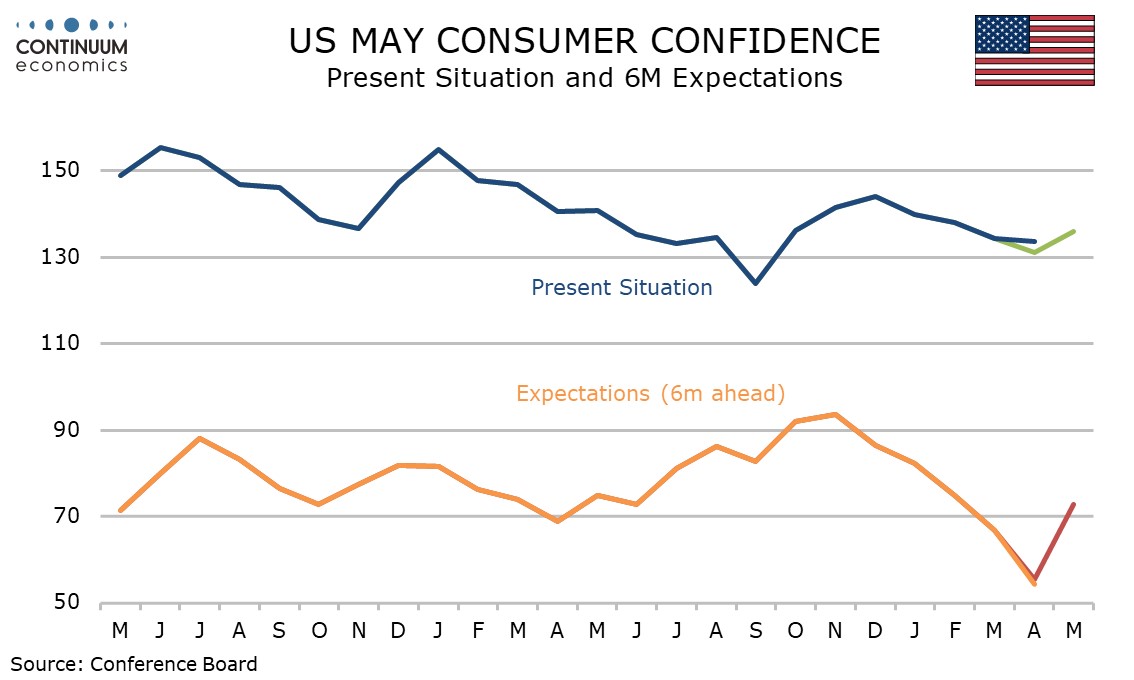

Both expectations and the present situation are above their March and April levels but still below February’s, but expectations saw a much sharper rise, to 72.8 from 55.4. The present situation, which has been less volatile, rose to 135.9 from 131.1.

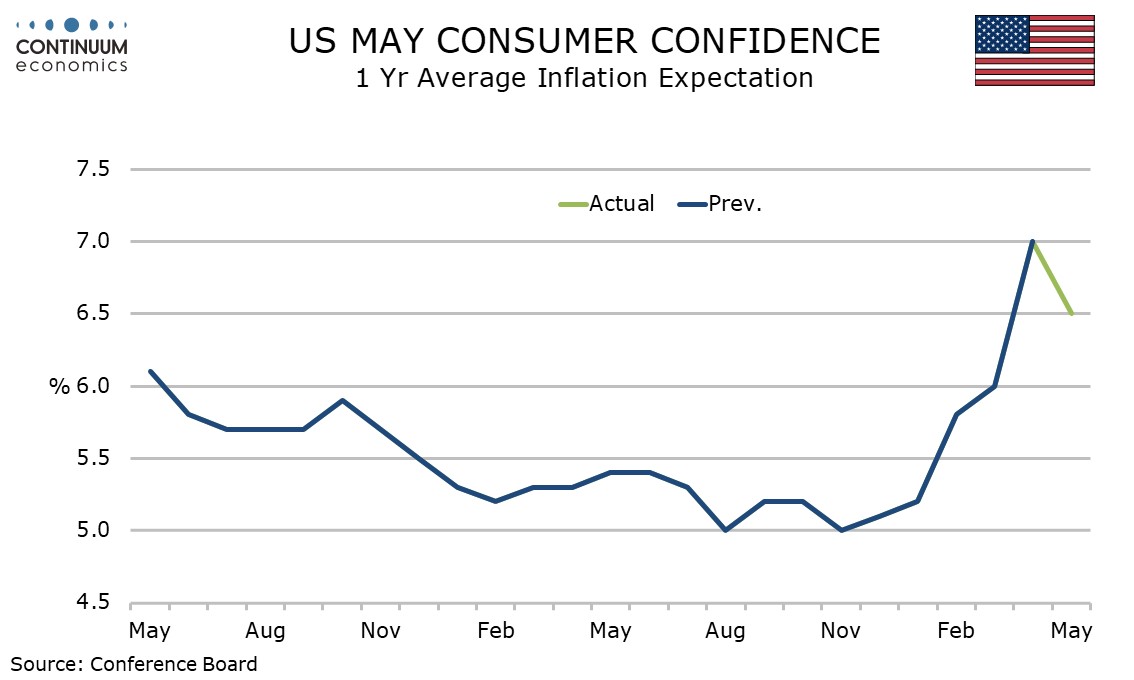

Contrasting a further acceleration in the Michigan CSI detail, inflation expectations slowed in May, the average to 6.5% from 7.0% and the median to 5.3% from 5.9%, though both remain above March levels of 6.0% and 4.9% respectively.

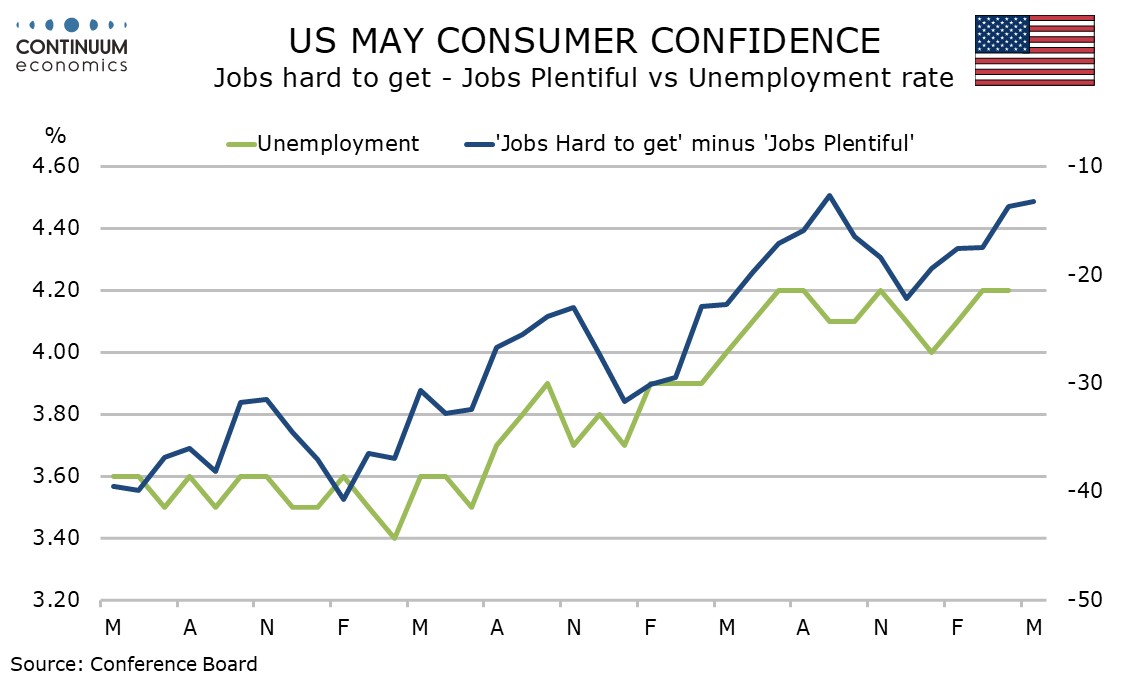

Labor market perceptions are a little weaker, with the proportion seeing jobs as plentiful exceeding those seeing them as hard to get by 13.2%, down from 13.7% in April and the lowest differential since September. This implies some slowing in the labor market, but not a sharp one.

With labor market perceptions slightly weaker and the slowing of inflation expectations not July reversing an April acceleration there must be something else behind the fact confidence is now higher than in march. The recovery in equities is the most plausible explanation.