FX Daily Strategy: Asia, August 6th

Labor Cash Earning Remains Critical for BoJ Decision

A Few Fed Speakers May Have a Change of Mind

Rather Empty Calendar let Trump to Move Market

The June Labor Cash Earning will be released in early Asia. It remain a critical data point as BoJ has referenced the pace of wage growth being key in deciding the timing of next hike. The wage growth has been growing slower in the past few months, seems to be an impact of tariff uncertainty. It is expected to rebound in June to above 2% as the fog of trade war clears, at least partially. If labor cash earning remains below 2% in June, the possibility of another 25bps hike will be delayed, for BoJ favor sustainable inflation coming from the demand side.

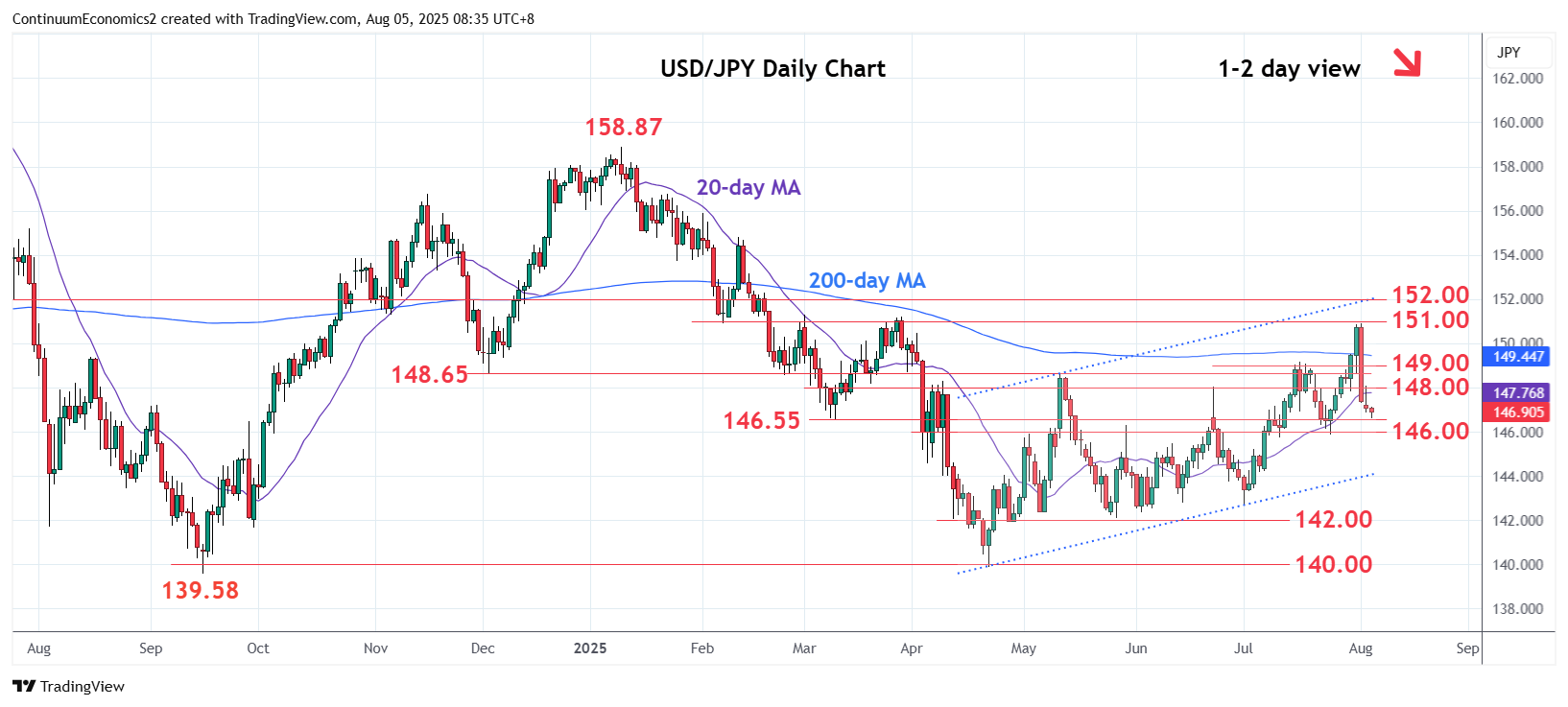

On the chart, pressure remains on the downside with break below 147.00 level extending sharp rejection from the 150.90, Friday's high. Daily and weekly studies are unwinding overbought readings and suggest room to further retrace the April/August gains. Nearby see strong support at the 146.55/146.00 area while break will see further extension to the 145.00 congestion and 144.00, April channel support. Meanwhile, resistance is lowered to the 148.00 congestion which is expected to cap and sustain losses from 150.90 high.

Wednesday's economic calendar is rather empty with a few economic release from Eurozone, apart from the Japanese labor cash earning. Without such, the market will likely be at the mercy of Trump and his tariff and geopolitical policy. Japan's trade negotiator will return to Washington to press the U.S. for fast enforcement of new auto trade tariffs and further confirm the details of trade agreement. Given Japan's latest take on the trade agreement, it is hard to tell whether they are exactly happy about the agreement and we will likely hear from about the agreement after the scheduled talk.

Besides, Trump has returned verbal fire with Russia by suggesting tactical position of nuclear submarine. It seems to be an act of strong arm to force Russia to speed up peace negotiation with Ukraine. However, such act and other sanction seems to have historically little impact towards Putin's decision. With the deadline closing, it will be interesting to see what Trump's next step will be, widely expected will be more arms for Ukraine.