FX Daily Strategy: N America, August 5th

ISM services may provide some USD support

JPY remains the most likely beneficiary of any risk or USD weakness

EUR/USD may remain broadly steady

CHF can fall further

ISM services may provide some USD support

JPY remains the most likely beneficiary of any risk or USD weakness

EUR/USD may remain broadly steady

CHF can fall further

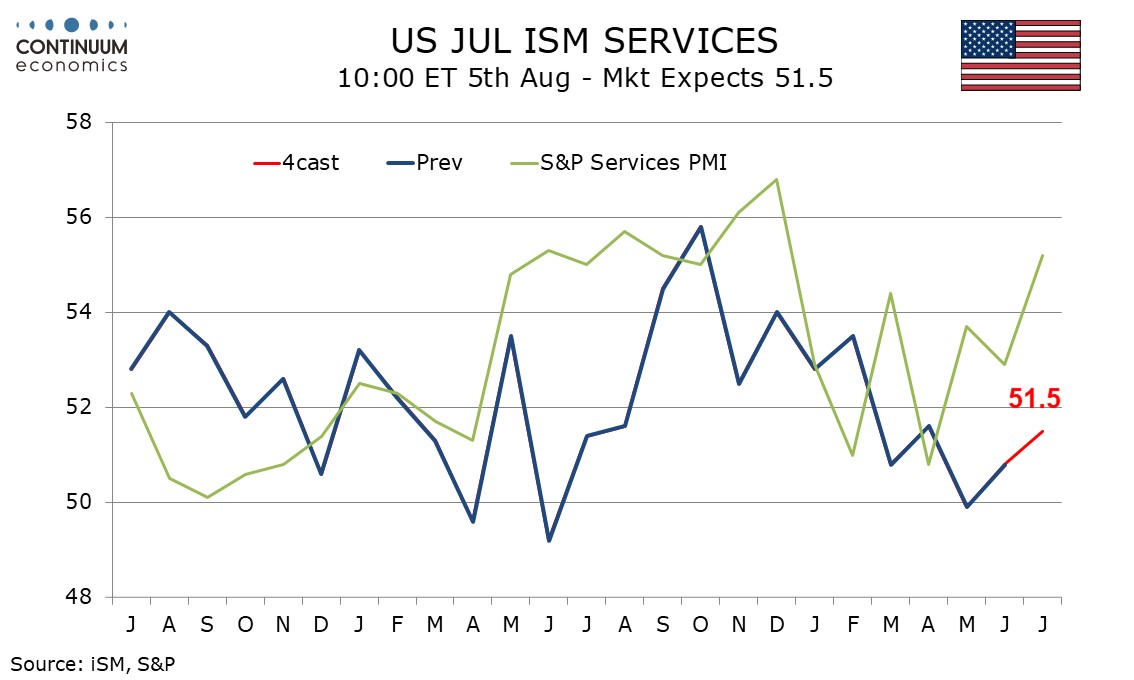

The ISM services survey will be the main data focus on Tuesday. We expect a July ISM services index of 51.5, up from 50.8 in June but a less impressive bounce than seen from the S and P services PMI, which increased to 55.2 in July from 52.9 in June. After the weak employment report last week, the market will be more sensitive to any data that provides evidence of further weakness, but if the ISM services PMI improves, it may lead to some modest USD recovery following the losses of the last couple of days. We don’t expect the ISM to be as strong as the S&P services PMI already released, but a rise on the month will be a reminder of that strong S&P number, and may mean there is less concern about the downward revisions to the employment data.

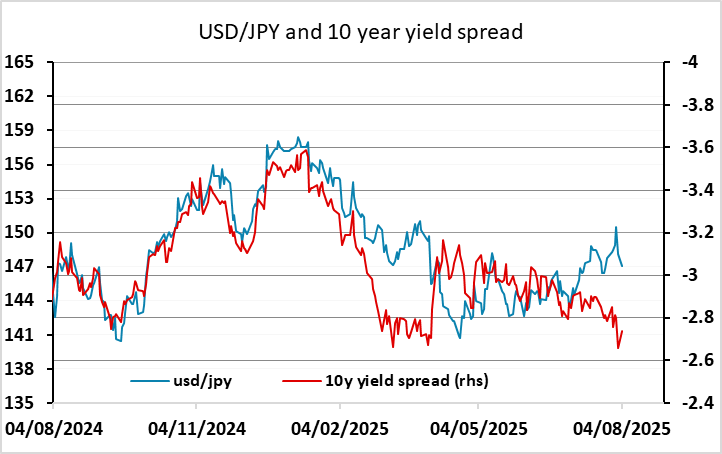

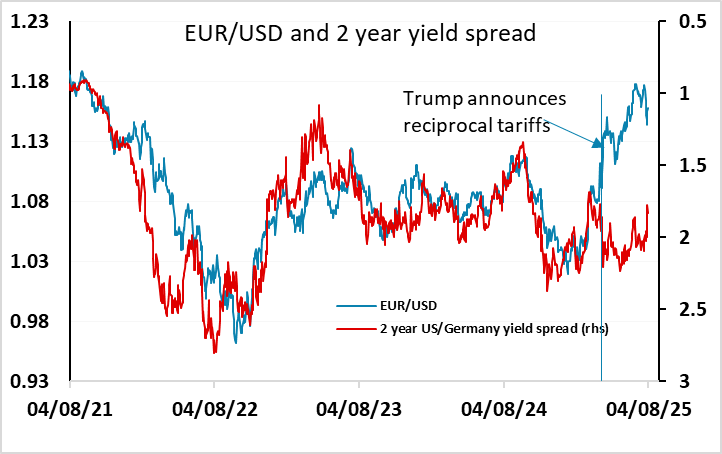

While it is still the case that the decline in US yields and yield spreads are supportive for the JPY, it is less clear that the USD will suffer against the riskier currencies, given the gains in the EUR in particular since April. Weaker equity markets will only tend to be USD negative if US equities are disproportionately weak, and this has not been the case in the last couple of days. While EUR/USD remains likely to remain supported because of the rising uncertainty about the US economy, Trump’s volatile policy agenda and the likely impact of tariffs in the coming months, there has already been a substantial EUR rise since April, well beyond the normal correlation with yields. We would therefore expect EUR/USD to remain broadly steady short term, although if the JPY makes gains the likelihood is that the EUR will rise a little with it unless wee see a significant rise in risk premia.

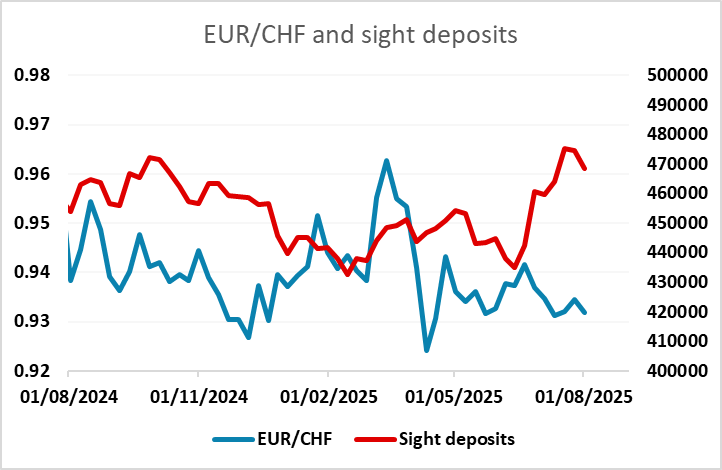

CHF weakness was quite notable on Monday, coming in spite of higher inflation numbers and sight deposits data suggesting the SNB did not intervene to prevent CHF gains in the latest week. The rise in sight deposits in previous weeks might indicate some SNB action, but last week’s tariff news probably mean that there was enough natural flow to weaken the CHF, and that has continued this week. While the CHF has historically been seen as a safe haven, it has not really acted that way this year, gaining in a risk positive environment. From here, CHF/JPY in particular looks ripe for a turn lower.