USD flows: USD gains strongly on PPI

PPI well above expectations pushing US yields and the USD higher. Negative equity response so far quite modest, suggesting the JPY will remain under pressure.

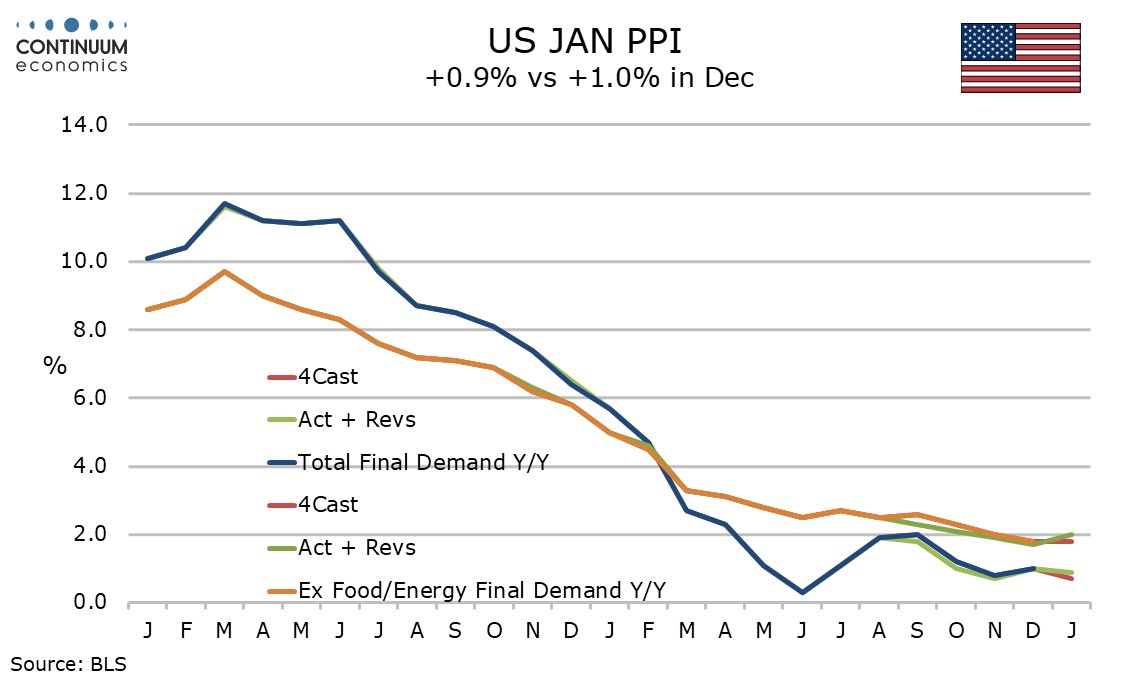

The USD has risen across the board after the stronger than expected PPI data for January, with the reaction likely exacerbated by the stronger than expected CPI data seen earlier this week. PPI was considerably stronger than expected at 0.5% m/m core, and the US money market has further reduced expectations of Fed easing to just three cuts this year with the first not fully priced in until July. However, since three cuts were indicated by the Fed dots in December, there is still scope for further rises in US yields if the Fed sees the latest inflation data as indicated unexpectedly high and persistent inflation pressures.

Initially, the USD has seen the largest gains against the EUR and AUD, but for the moment EUR/USD remains in the 1.07-1.08 range that has held since the employment report. However, the data does suggests the risks are weighted towards a downside break. The EUR is suffering partly from higher US yields, but with EUR yields also rising the impact on spreads has been minor, and partly from the negative equity market reaction to higher yields, which is also weighing on the AUD. But the equity market reaction has been quite modest thus far, and as long as that is the case, the 1.07 level may hold.

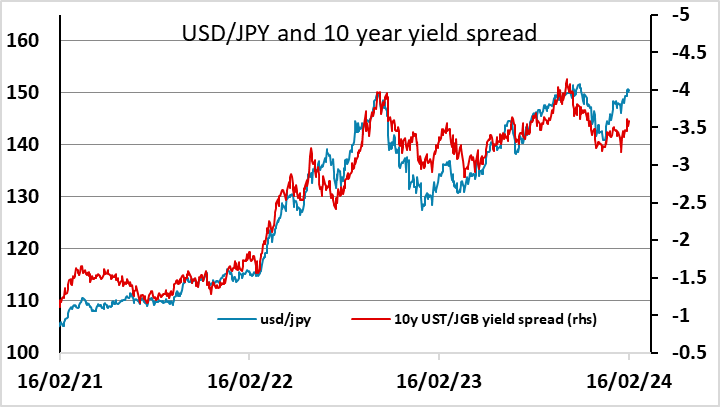

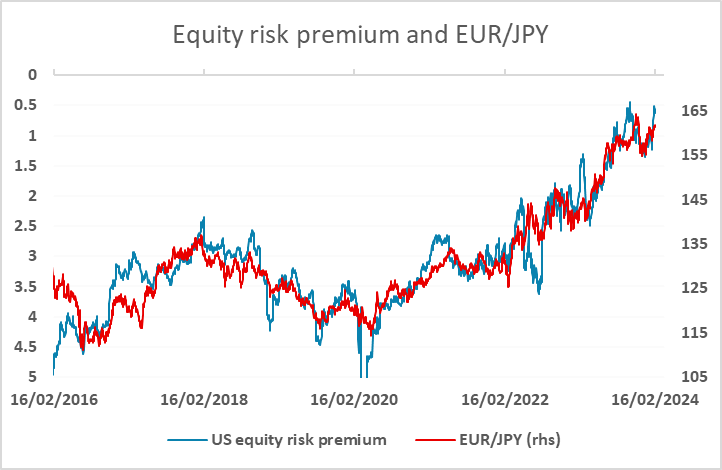

The rise in yields also implies a further decline in the equity risk premium. This suggests upside pressure on EUR/JPY and other JPY crosses will continue. While USD/JPY still looks stretched relative to yield spreads, the equity trend looks to be dominant. The uptrend in the USD is still clearest in USD/JPY, which is pressing towards the year’s high at 150.88 seen on Tuesday, but we are wary of a bigger negative equity market reaction which could trigger a sharp reversal.