Bank of Canada Preview for October 23: Close call for 25bps rather than 50bps

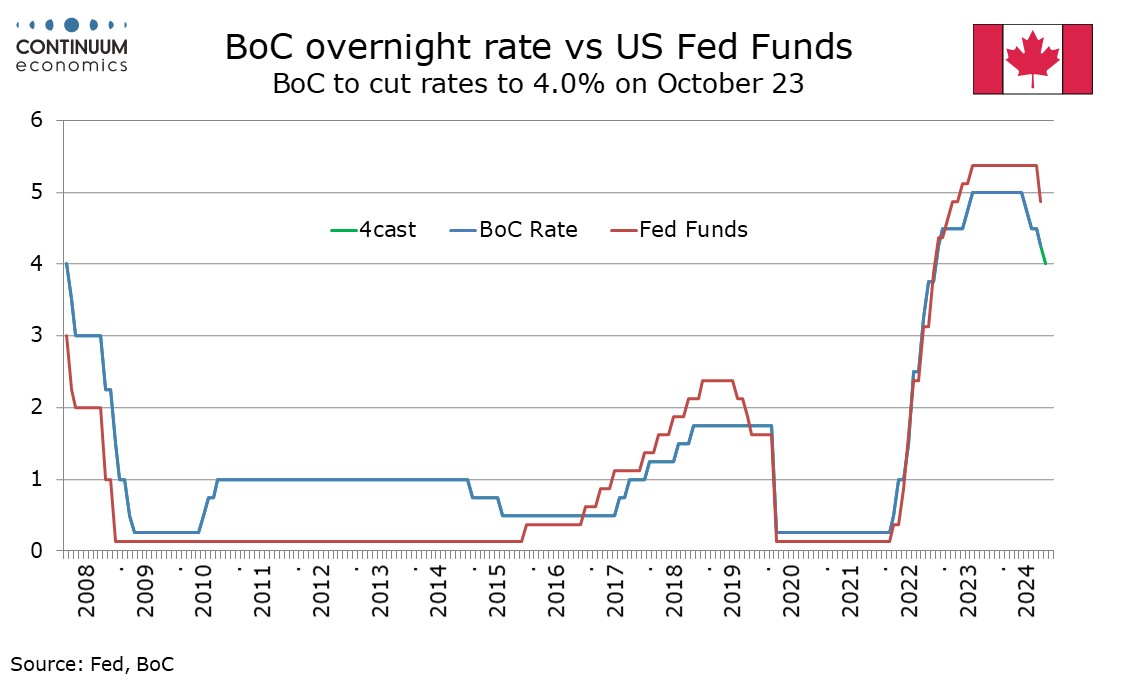

The Bank of Canada’s October 23 decision looks a close call between a fourth straight 25bps easing to 4.0%, which is our expectation, or a 50bps move to 3.75%. The BoC can feel increasingly confident of core inflation returning to the 2.0% target in 2025, though tentative signs of growth regaining momentum may persuade them to wait for the Q3 GDP release on November 29 before deciding whether a more aggressive pace of easing is justified.

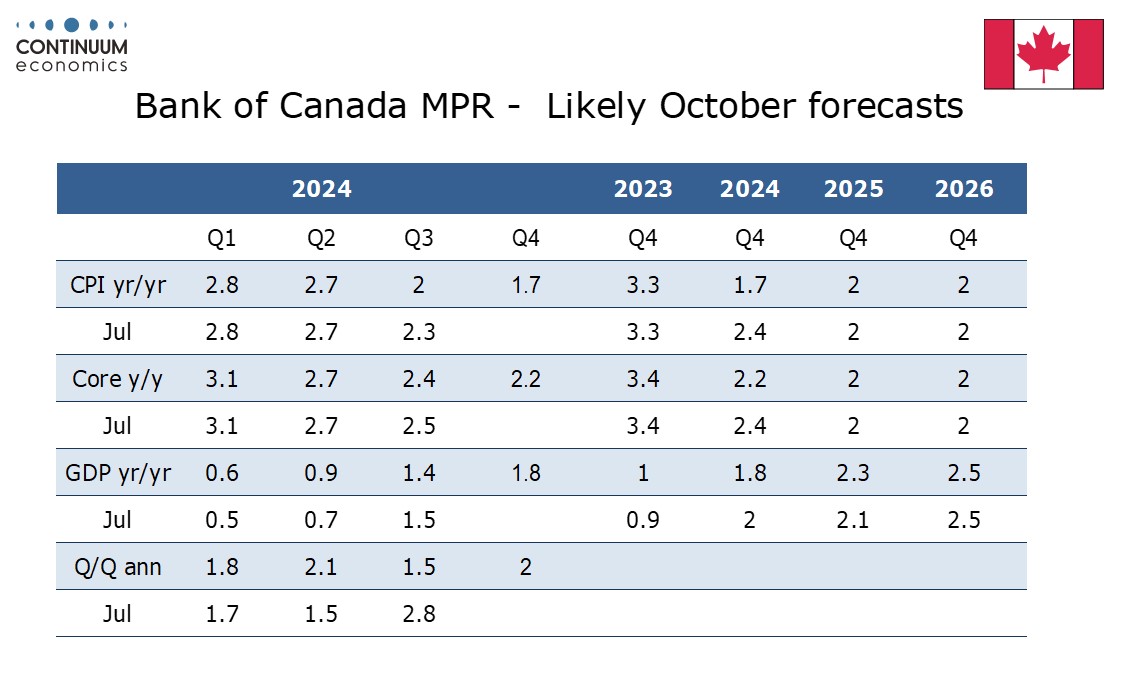

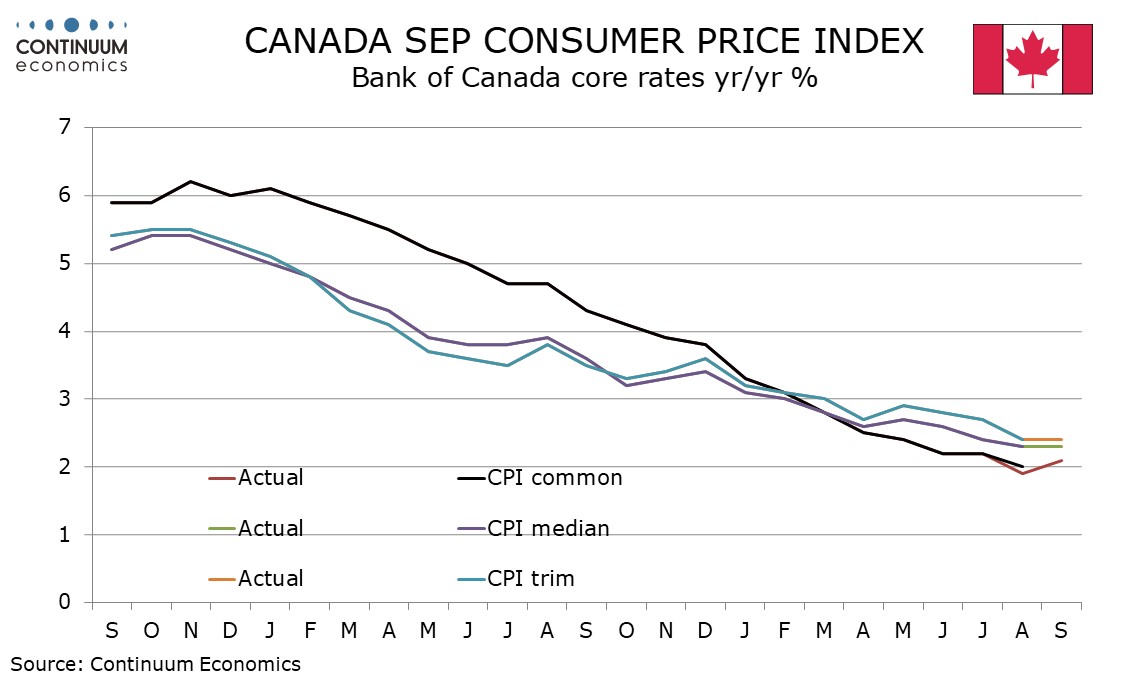

This meeting will contain a quarterly Monetary Policy Report, and economic forecasts will be updated from those made in July. Headline inflation has averaged 2.0% yr/yr in Q3, below July’s 2.3% forecast and a 1.6% September pace suggests Q4 is likely to fall further, well below the 2.4% seen in July for Q4 2024. Progress on the core rates has been less impressive, defined by the average of CPI-Median and CPI-Trim for the purpose of these BoC forecasts, but Q3 at 2.4% is below the BoC’s July view of 2.5% and Q4 is likely to be softer still. The 2.0% target is likely to be reached in 2025, with risk of a move below if stronger growth does not start to absorb excess capacity.

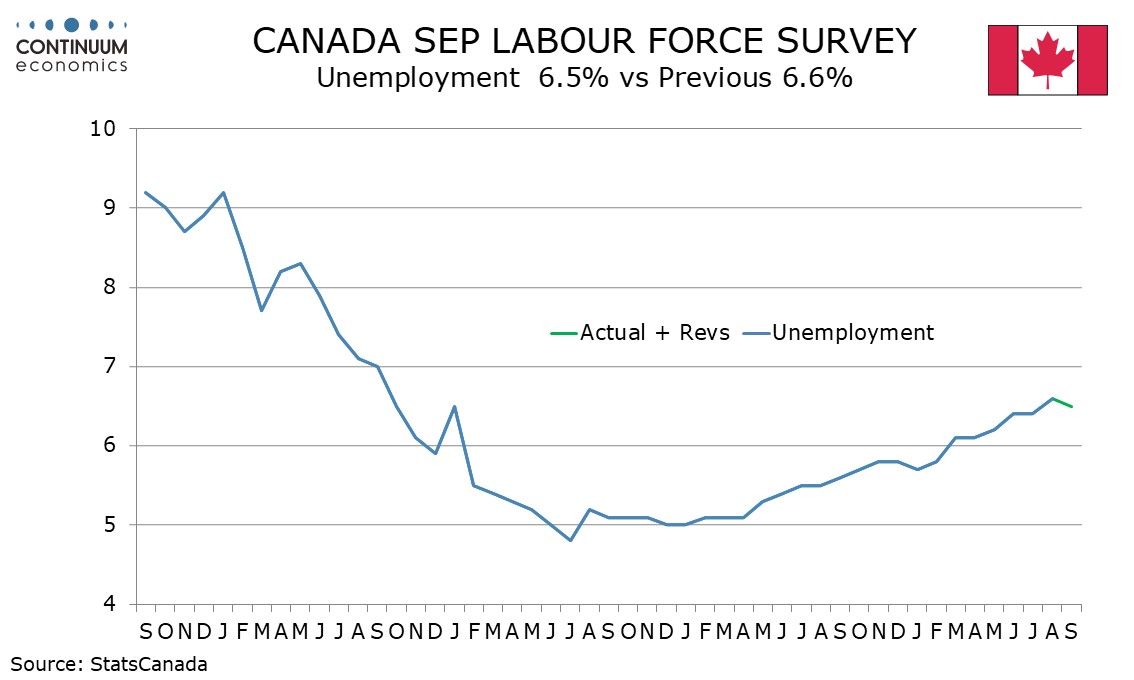

Q2 GDP at 2.1% annualized exceeded the BoC’s 1.5% July projection but the details did not impress, with the upside surprise coming largely from government. Q3 looks sure to come in well below the BoC’s 2.8% July projection, probably about 1.5%. However a stronger September employment report raises hopes that momentum is starting to pick up entering Q4 and retail sales have made a stronger start to Q3 after a weak Q2. We expect GDP for 2024 to see only a modest downward revision, which could be offset by an upward revision to 2025.

The Bank of Canada did sound more dovish at its September 4 meeting, which delivered a third straight 25bps easing. Minutes for the meeting saw some seeing risks to inflation as balanced, but some had become more concerned with the downside risks. Two scenarios were discussed. The first saw lower rates bringing a stronger than expected rebound in the economy and a slower pace of rate cuts becoming appropriate, and the second saw the economy and labor market not picking up as anticipated, requiring a more rapid pace of easing.

These two economic scenarios still look plausible, and that may encourage the BoC to wait for more data on activity before deciding whether a more aggressive pace is necessary. Increased progress on inflation is however likely to lead to a dovish tone, and should growth disappoint there would be few barriers to accelerating the pace of easing. While September’s CPI saw downward progress on the core rates stall, and September’s employment report picked up impressively, at the time of the September 4 BoC meeting softer core CPI and employment data for August had not yet been seen, meaning that on balance data seen since the last meeting may be seen as dovish. Stronger US data making further 50bps easings from the FOMC unlikely near term will not be a major factor for the BoC, given persistent recent Canadian underperformance of the US economy. The BoC decision is a close call.