ECB Preview (Mar 6): Gauging Restrictiveness as Policy to be Eased Further

As has been the case at most recent Council meetings, the ECB verdict is less important that the rhetoric. A sixth 25 bp discount rate is widely expected, to 2.5%, but how wide the door is left open for further cuts may be gleaned from any clear change in regard to how near(er) neutral policy the Council feels they are. Last time around, the ECB stressed monetary policy remained restrictive albeit with differences on the degree and the likely the debate on this issue may more intense next time around. It is unclear also how vocal the Council wishes to advertise any shift as it may wish to keep options for further easing in April should US tariffs materialise as has been flagged. As for growth risks, little was made of the weaker real economy last time, but some downward revision regarding growth seems likely, partly due to higher interest rates and this coming alongside a continued below-target inflation outlook but where the near-term picture is raised on account of energy costs.

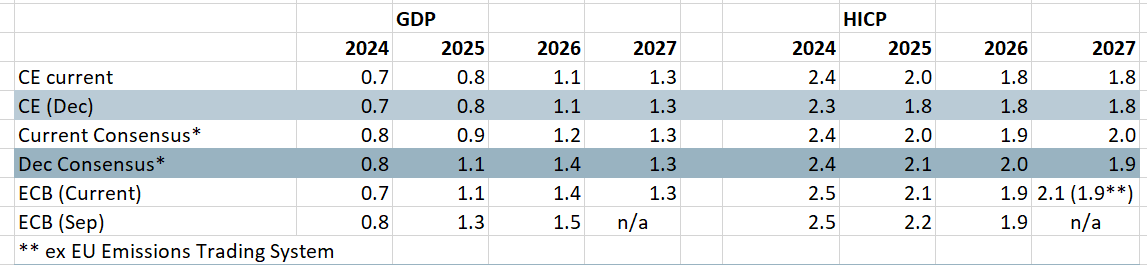

Figure 1: ECB Likely to Remain Above Consensus?

Source: ECB, Bloomberg, CE

As for assessing the economy, we thought it notable that the ECB in January did not acknowledge that an inflation backdrop that was in line with expectations had actually come about amid a much weaker growth backdrop in the last few months. That latter weakness should mean the ECB pares back its growth forecast at least for this year by around a notch, albeit this also a result of the higher interest profile that has developed since the December forecast – the yield curve is higher at all rates over three years out and where the policy rate discounted by markets is some 20 bp higher. But it is possible that the 2026-27 above consensus GDP forecasts (Figure 1) may be pared back. But the ECB may be reluctant to this at this juncture both because it leads to a larger inflation target undershoot and because it is wary that confirmation of US tariffs may warrant a more comprehensive reassessment. Notably the account of the January meeting (published today) did suggest ‘that there was a risk of undershooting the inflation target in 2026 and 2027. It was remarked that further downside revisions to the economic outlook would tend to imply a negative impact on the inflation outlook and an undershooting of inflation could not be ruled out. Regardless of any actual change in forecasts, the ECB is likely to stick to the outlook having downside risks, repeating the concern that ‘Greater friction in global trade could weigh on euro area growth by dampening exports and weakening the global economy’.

Considerations Beyond Next ECB Meeting

Notably, given the likelihood that a slightly below target 2026-27 inflation picture will be retained, this should effectively mean the ECB will validate current market rate thinking which sees a discount rate troughing at around 2% in 2026 – NB we see the rate hitting 2% by mid-2025, with an ensuing alleged around-neutral 2% policy rate resulting and with the risks of further easing into next year. But at the March press conference, the ECB is unlikely to offer signs that further easing will continue at consecutive meetings as has occurred of late, suggesting the policy stance is (much or somewhat) less restrictive. It may then suggest additional rate cuts will arrive either at slower pace and/or have to be more data driven. But as the account of the January meeting highlighted It is clear that the existing debate about how restrictive policy will be may only intensify. Indeed, the debate is already quite vocal, led by the hawks who are trying to argue for a policy pause at least after an assumed move next week. Regardless we do see a further cut at the April 16 meeting. And while the ECB may not implicitly commit to such a move next week especially given trade related uncertainties, it may feel a need to cut again as the Council will want to react to the hefty (ie 25%) and broad-based tariffs on the EU that President Trump has flagged will be detailed on April 2.

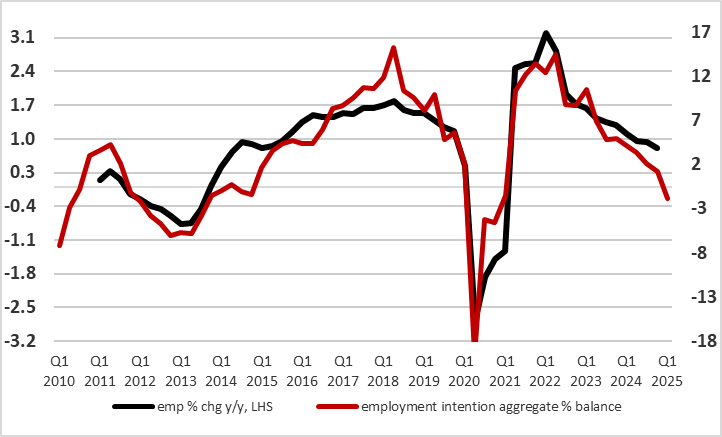

Moreover, the non-hawks on the Council may be more influenced by the data backdrop, still concerned that though surveys are less bad, they still imply little to no growth. In particular, amid an ECB central view that consumer spending should pick-up further helped by real incomes growth, this is being threatened by what may be a clear emerging slump in the labor market. European Commission survey data now echo PMI numbers in suggesting falling employment (Figure 2) including in hitherto solid services. Thereby this questions the ECB projection of circa-0.5% jobs growth and helping to explain recent much softer wage signals.

Figure 2: Business Surveys Increasingly Suggest Falling Job Count

Source: European Commission, aggregate employment intention computed by CE

All of which helps explain why we still think that the economy will undershoot ECB thinking. As for GDP, if the ECB regards the Q4 data as being history and merely short-term stagnation, we suggest that the near-flat quarterly reading reflects actual m/m declines in late Q4, thereby highlighting a clear loss of momentum into the current year that chimes with weak business survey data. Moreover, GDP numbers continue to suggest an EZ economy that is still diverging as Germany and now France stutters while Spain prospers, with EZ survey data suggesting that political uncertainty is now affecting economic prospects and accentuating growth disparities.

Discussion on Policy Neutrality Too Simplistic?

In addition, the inflation picture is showing better underlying conditions, something that flash February HICP data may highlight next Monday. Indeed, we suggest inflation (even for services) is already behaving as it is at target – if not below when assessed on an adjusted shorter term time frame – NB the January Council account very much noted the importance of services inflation once again and also pointed to measures of underlying services inflation (ie PCCI) having neared 2%.

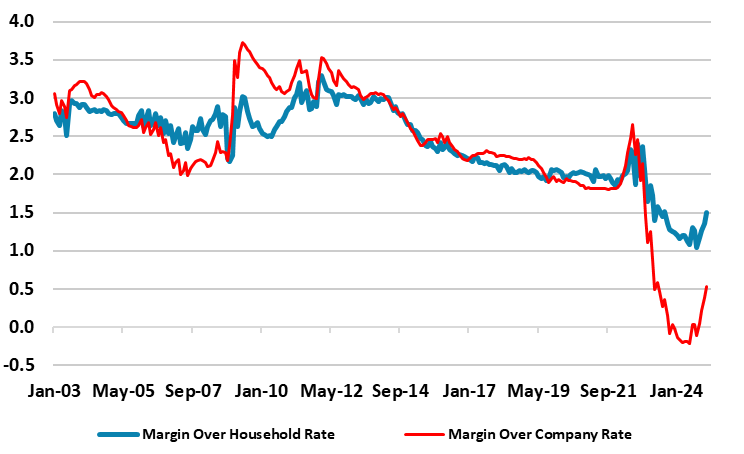

The dovish camp may also highlight that well-advertised recent ECB research that does suggest a neutral rate as being between 1.75% and 2.25%, despite what some Council hawks have suggested. The dovish camp could also underscore (and as we have suggested before) that assessing what may be a neutral rate merely by pointing to particular interest rate (even in a modest range) is both over-simplistic and misleading as it ignores the manner in the transmission mechanism of monetary policy is working, this being argued at the January meeting. The transmission mechanism, after all, determines not just the cost of borrowing but bank’s willingness and ability to supply credit. In this regard, perhaps a key factor is the margin that banks lend relative to any policy rate. This margin has narrowed markedly of late (Figure 3), the question being whether banks will seek to rebuild lending margins back to those seen prior to the pandemic, thereby actually acting not only to slow the impact of policy easing but even to offset it.

Figure 3: Bank Lending Margins Too Low to Last?

Source: ECB, CE (%)

Rates Hitting ECB Profitability

Elsewhere, the ECB May have an-almost personal position for cutting official interest rates – further, although it would be loath to admit so. It has been racking up significant losses. Indeed, its annual last year jumped to a record EUR 7.9 bln last year (from EUR 1.3 bln in 2023), as its interest rate payments on its own financial liabilities rose as a result of its decision to increase borrowing costs even further. In fact, the interest it pays on bank reserves (to set the overnight interest rate) are higher than the yield of the bonds bought under the quantitative easing programme. In its annual accounts, the ECB underlined that the losses had no impact on the bank’s stability or monetary policy and foresaw a return to profits over the coming years. However, as any fresh return to profit will initially be used to repair the balance sheet damage of recent losses, those losses will limit subsequent pay-outs to national central banks as future profits which in the past have been used (partly) to pass on national governments’ budget.

All of which implies around three more 25 bp cuts in H1 this year, with an ensuing around-neutral 2% policy rate. But as suggested above it is possible that amid a continued sub-par growth outlook into 2026, then further easing may be on the cards into 2026, especially if the policy stance remains restrictive as the ECB is forced to continues to review and pare back estimates of policy neutrality.