Preview: Due April 10 - U.S. March CPI - Gasoline softer, but upside risk on core rate

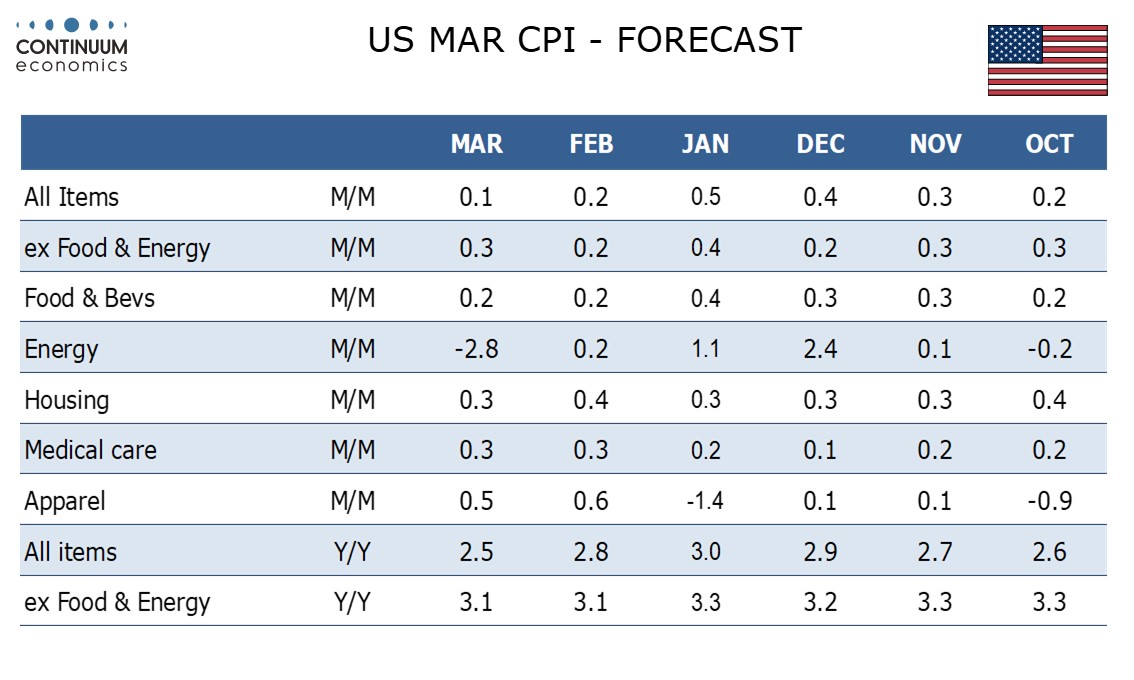

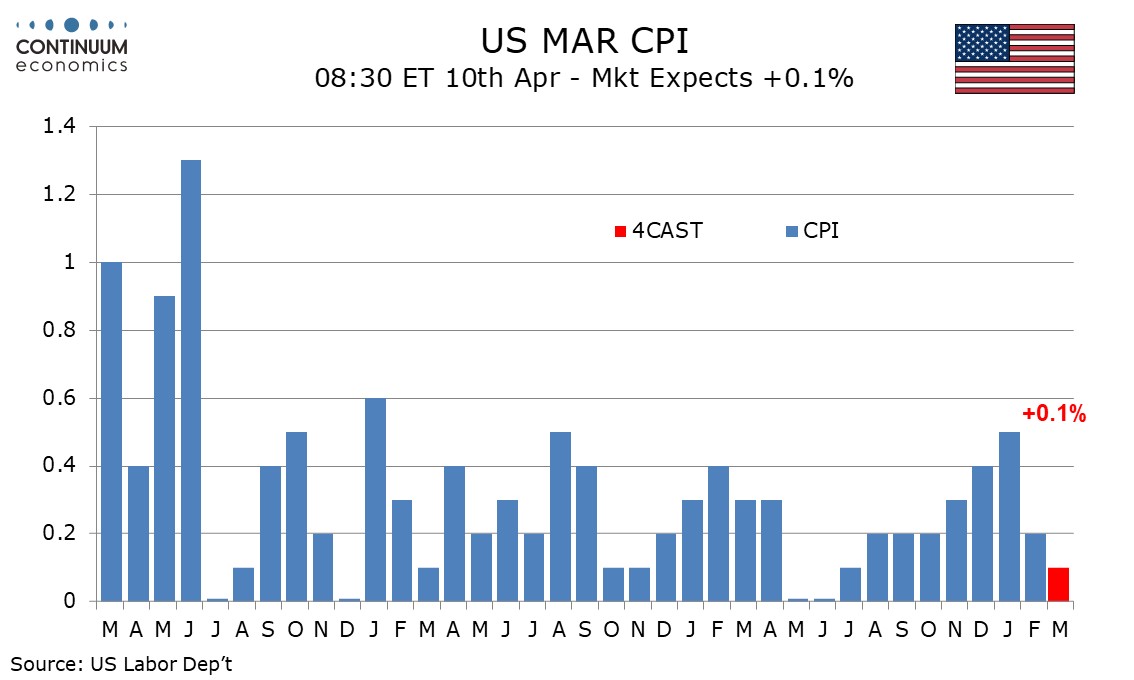

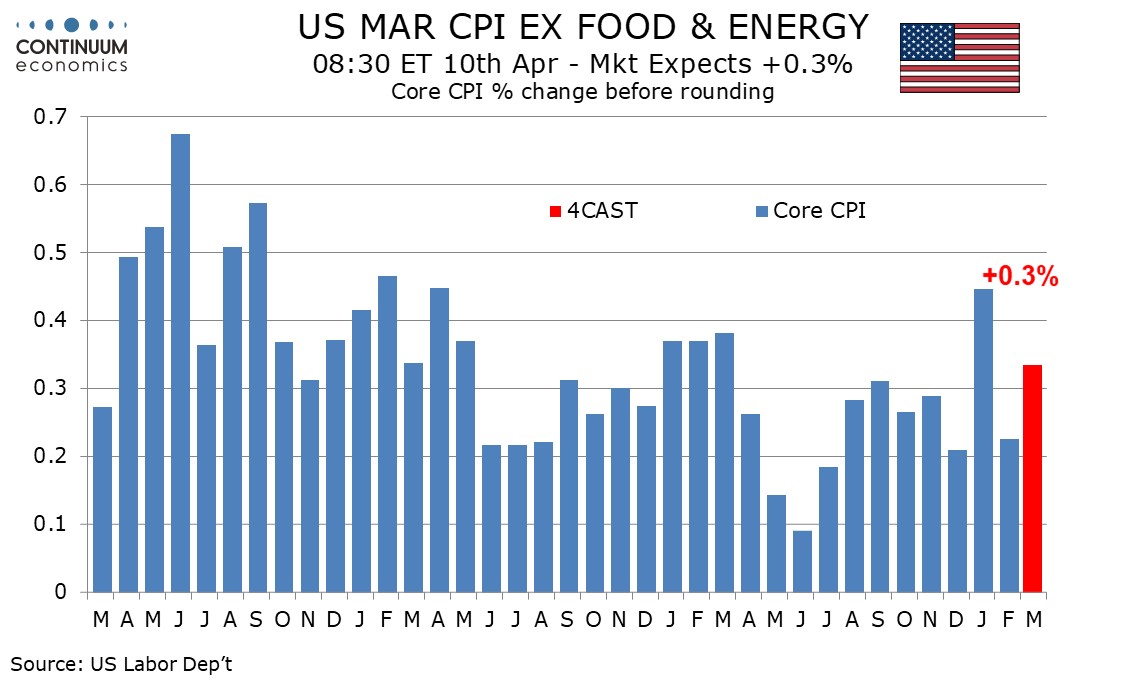

We expect March to increase by a subdued 0.1% overall but by 0.3% ex food and energy, with the core rate likely to be on the firm side at 0.335% before rounding. This will follow core rates of 0.2% in February and 0.4% in January, both of which were rounded down. Tariffs will hit the CPI with force in April.

Gasoline prices saw only a moderate decline unadjusted but after seasonal adjustment are likely to show a substantial 6.0% decline, leading a 2.8% drop in energy. We expect a modest 0.2% rise in food as recent surges in eggs start to stabilize.

Services less energy have risen by 0.3% in four of the last five months, the exception being a 0.5% rise in January, but risks are on the upside of 0.3% given that February’s gain was restrained by a sharp fall in air fares which is unlikely to be repeated. Goods less food and energy with a 0.2% rise in February and a 0.4% rise in January are showing hints of a pick-up in trend, with tariffs on China an upside risk, though with used auto prices looking softer in March we expect core goods to rise by a little less than core services.

We expect yr/yr CPI to slip to 2.5% from 2.8%, though the pace is likely to be slightly above 2.5% before rising. We expect the ex food and energy rate to be unchanged at 3.1%, though we expect March to be slightly below 3.1% before rounding while February was slightly above.