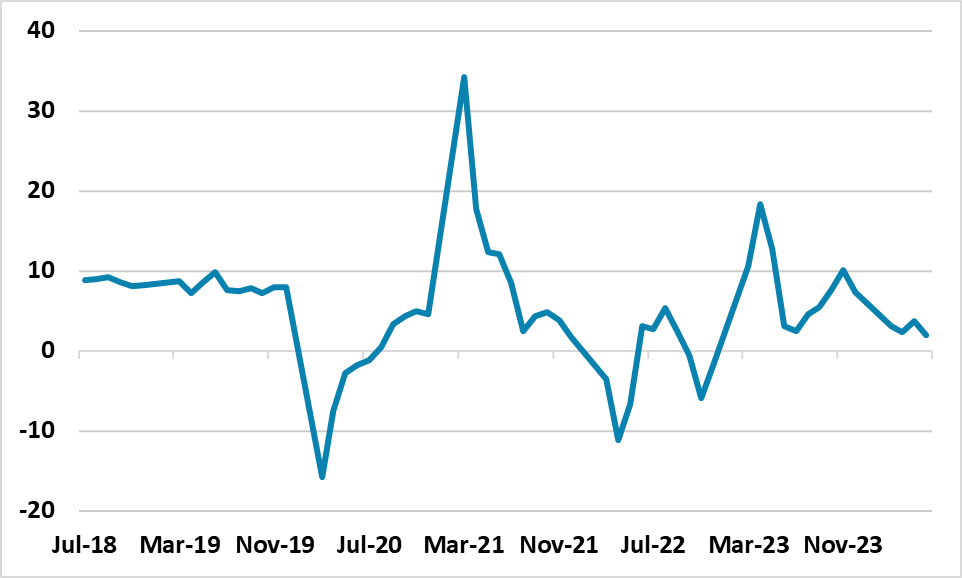

China: Retail Sales Drags Q2 GDP

We are revising down our 2024 GDP forecast from 4.9% to 4.7%, both due to the weaker than expected Q2 GDP figure but also the weak underlying momentum of consumption. Some further targeted policy measures are likely in the coming months, but will struggle to lift economic momentum.

Figure 1: China Retail Sales (Yr/Yr %)

Source Datastream/Continuum Economics

Q2 China GDP came in at 4.7% versus 5.1% expected Yr/Yr. Two factors look to be behind the miss. Firstly, the Yuan 1trn central government stimulus program has yet to come through forcefully, but will likely in H2 GDP. Secondly, consumption is disappointing, with June retail sales down to 2.0% Yr/Yr compared to 3.4% expected. The breakdown of the June retail sales data makes disappointing reading, with consumer goods slowing to +1.5% Yr/Yr, autos -6.2% and home appliances -7.6% Yr/Yr. The 618 shopping festival failed to boost spending. The only comfort was that restaurant spending was +5.4% Yr/Yr versus +5.0% in May. Poor consumer confidence, plus weak employment and wage growth, are hurting consumer purchases. This is beyond the well appreciated dampening effect from the ongoing residential property slump.

Though June industrial production came in higher than expected at 5.3% Yr/Yr and exports are doing well, weak consumption is key. This is not only a drag on Q2 GDP, but also likely on H2 GDP. The May measures to boost the housing market has not succeeded with private residential investment remaining a negative drag on GDP. The Yuan300bln finance for purchases of unsold apartments would likely have to be increased 10 fold to be effective, but that is too large a policy measure for China authorities at this point. The 3 plenum this week will likely set the stage for further targeted fiscal policy later in the year to try to reach the 5% growth target. However, radical or aggressive policy change remains unlikely (here).

We are revising down our 2024 GDP forecast from 4.9% to 4.7% given today data and weakness of consumption momentum and still stick with +4.0% in 2025. The actual 2024 outcome could still be 5.0% given estimation errors in the GDP data that comes out very quickly after the end of the quarter. Some monetary policy stimulus is also likely, with a 25bps August RRR cut and a 10bps MLF rate cut in October after the 1 Fed cut – Yuan concerns stop an earlier move.