USD, JPY flows: USD lower, JPY gains on weak US employment report

Weaker than expected employment growth, a higher unemployment rate and weaker than expected average earnings mean the employent report is unambiguously weak. USD weakness mainly against the JPY as high yielders are suffering from weaker risk sentiment

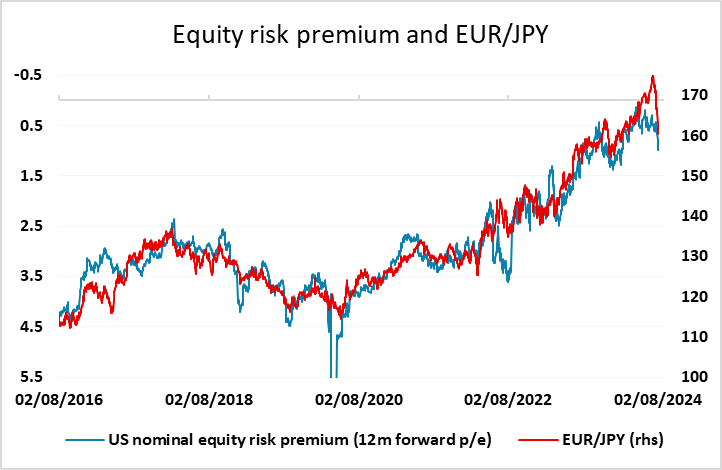

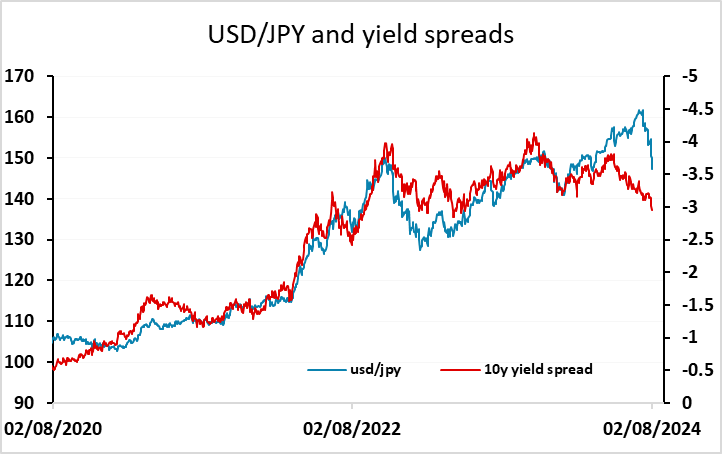

A generally weaker US employment report has put the USD under pressure against the JPY, but it is not much changed against the riskier currencies, while EUR/USD is only modest higher. A smaller than expected rise in non-farm payrolls, a rise in the unemployment rate and weaker than expected average earnings growth mean the report is straightforwardly weak. US yields have dropped sharply, and equities are also weak, implying a sharp rise in equity risk premia. All of this is extremely positive for the JPY, with JPY crosses highly correlated with equity risk premia, and USD/JPY sensitive to yield spreads. There is scope for even more substantial JPY gains, with yield spreads pointing sub-140. The weakness of the higher yielders is less likely to be sustained, with equities likely to find some support from increased expectations of Fed easing.