Indonesia CPI Preview: Food Prices to Maintain Pressure

Indonesia’s consumer price inflation is expected to remain broadly stable at the 3% y-o-y mark in May. Supply disruption due to floods in Sumatra region alongside persistent high food prices will keep price pressures elevated.

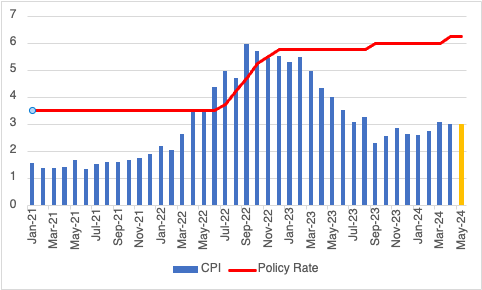

Figure 1: Indonesia Consumer Price Inflation and Main Policy Rate (%)

Source: Continuum Economics

Indonesia experienced a slight easing in consumer price inflation, to 3% yr/yr in April, down from 3.1% yr/yr in March. Looking ahead for May and June, we anticipate prices to remain sticky. A slowdown in prices is only expected in the third quarter of the year, as the recent hike in interest rate trickles down into the economy. As seen in in March and April, food prices will remain the main driving factor of rising inflation. Food inflation eased to 7% yr/yr in April, but remained high driven by elevated price of rice. Further, core inflation inched up to 1.8% yr/yr from 1.7% yr/yr in March.

In addition to the above, the recent volatility in the Indonesia Rupiah has increased the risk of imported inflation. Tje IDR has lost some 3.74% against the USD 9as of May 21), with severe pressure in April, leading to the consequent rate hike, followed by mild gains in May. Additionally, inflation risks remain tilted to the upside given the lingering effects of last year's El Niño and recent floods in Sumatra are exacerbating the domestic rice supply shortage. Elevated geopolitical tensions could prompt an uptick in freight rates and global oil prices, which could weigh on inflation as well. Still, keeping in mind the April rate hike, inflation expectations remain aligned with Bank Indonesia's medium term target of 2.5%. For now, our expectation is that inflation will remain broadly stable at about 3% yr/yr in May. On the monetary policy front, given benign inflation and expectation of a delayed rate cut by the Federal Reserve, Bank Indonesia will also hold rates at least until end-2024. We expect Bank Indonesia to closely follow the Federal Reserve, hence no rate cuts are expected before the Fed makes a move.