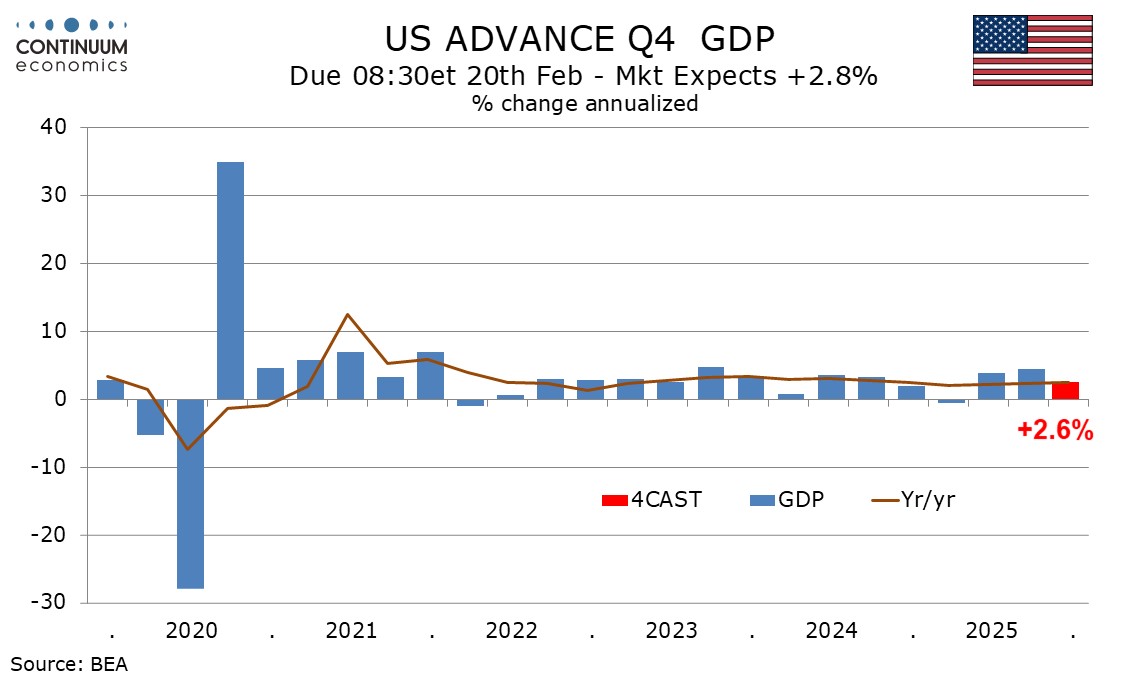

Preview: Due February 20 - U.S. Q4 GDP - GDP and Core PCE Prices both seen at 2.6%

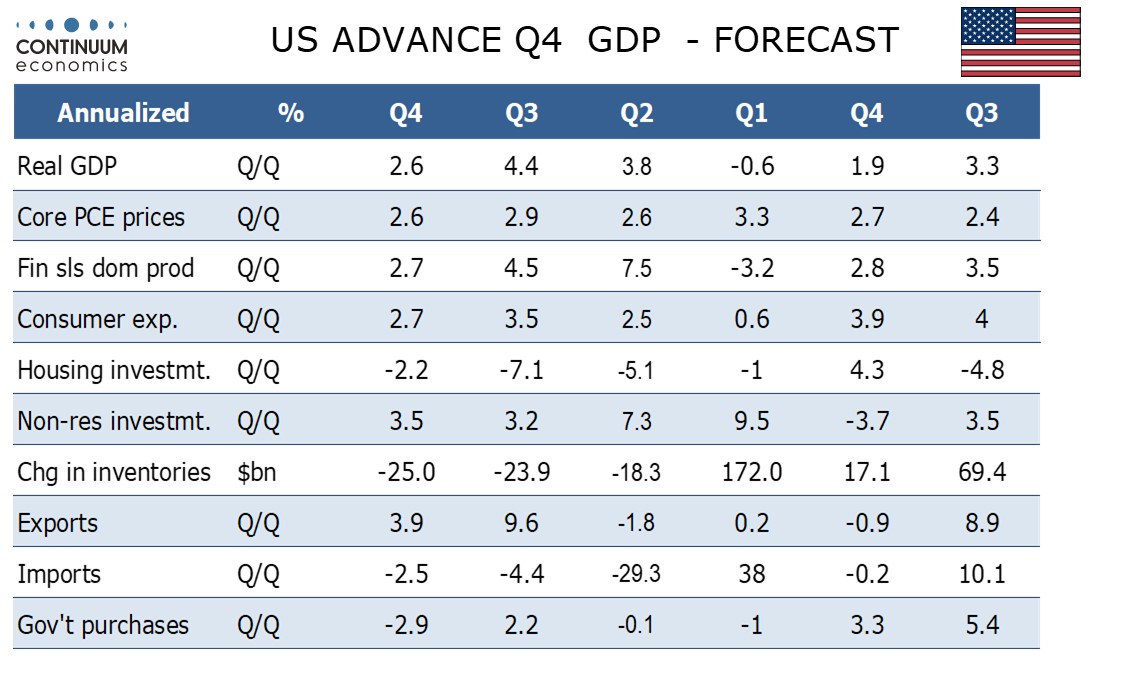

We expect a 2.6% annualized increase in Q4 GDP, well above a flat forecast we had entering the quarter, but off a peak estimate of 3.6%, with weaker November trade and December retail sales data having trimmed the forecast. December trade data, due on February 19, remains a significant source of uncertainty. We also expect core PCE prices to ruse by 2.6% in Q4.

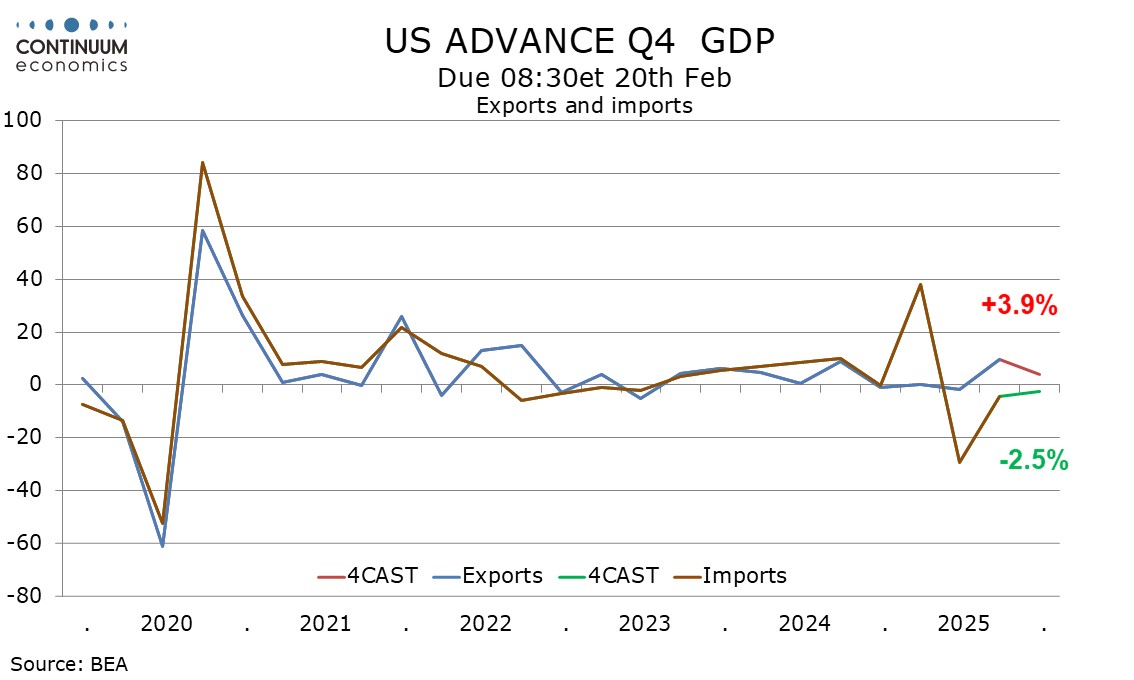

We are assuming a slight increase in December’s trade deficit, though Q4 is still likely to see a positive contribution from net exports due to a sharply narrower deficit in October. We expect exports to increase by 4.1% and imports to fall by 2.5%, with net exports adding 0.9% to Q4 GDP.

As a consequence of trade policy shifts, net exports have been a major source of volatility within recent GDP data. However under our forecasts, for 2025 as a whole, exports would be up a modest 2.1% and imports up by a similar 2.0%.

We expect inventories to take off a marginal 0.1% from GDP for a second straight quarter, declining at a similar pace to Q3 in a continued correction from a surge in Q1 ahead of April’s tariff announcement.

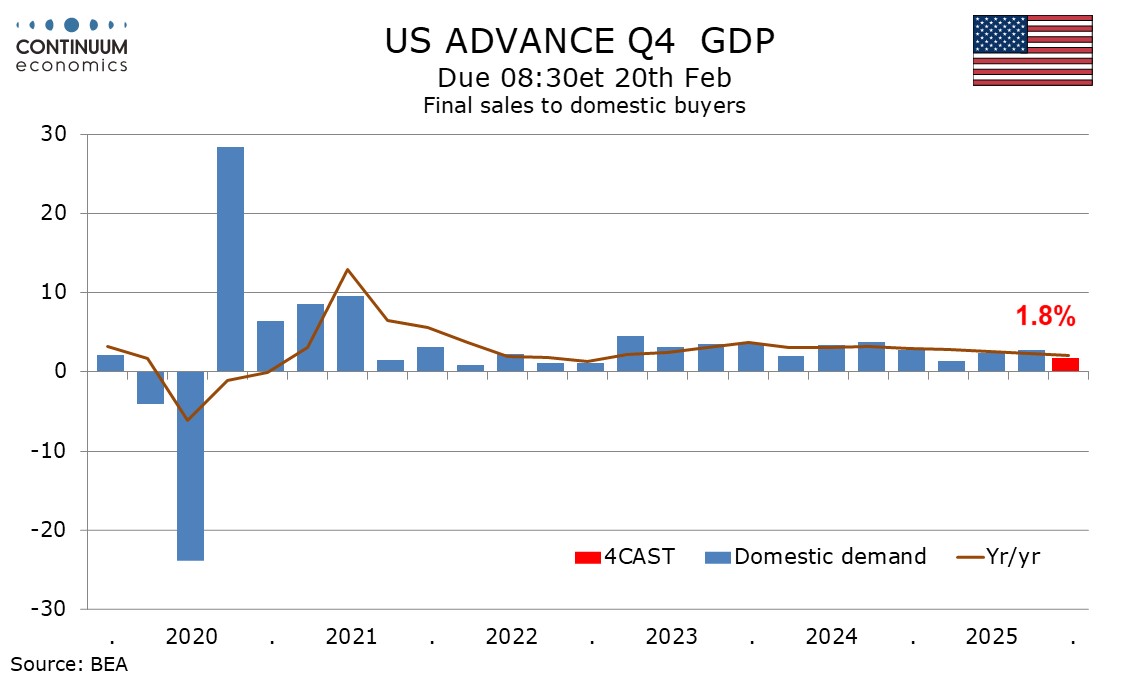

We expect final sales (GDP less inventories) to rise by 2.7% and final sales to domestic buyers (GDP less inventories and net exports) to rise by 1.8%.

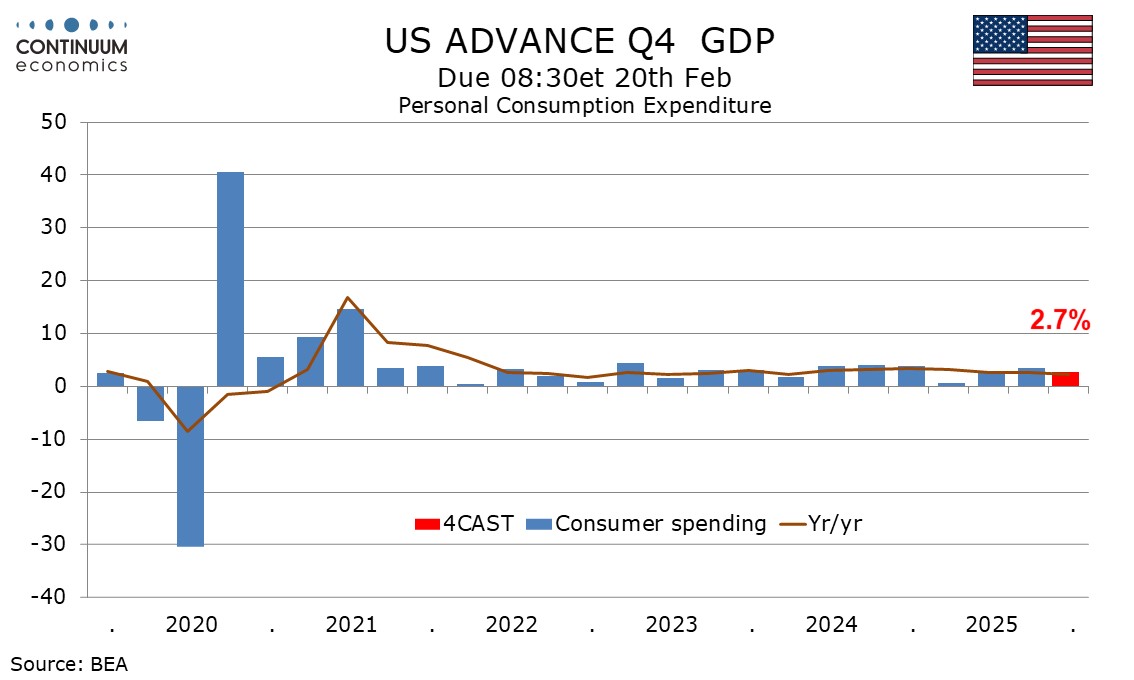

Even with the weak December retail sales outcome, consumer spending looks set for a respectable rise of 2.7%. This is likely to be well ahead of real disposable income, which we expect to fall by 0.3%, following a flat Q3. This suggests consumer spending is vulnerable to a slowdown. December personal income and spending data will be released alongside the GDP report.

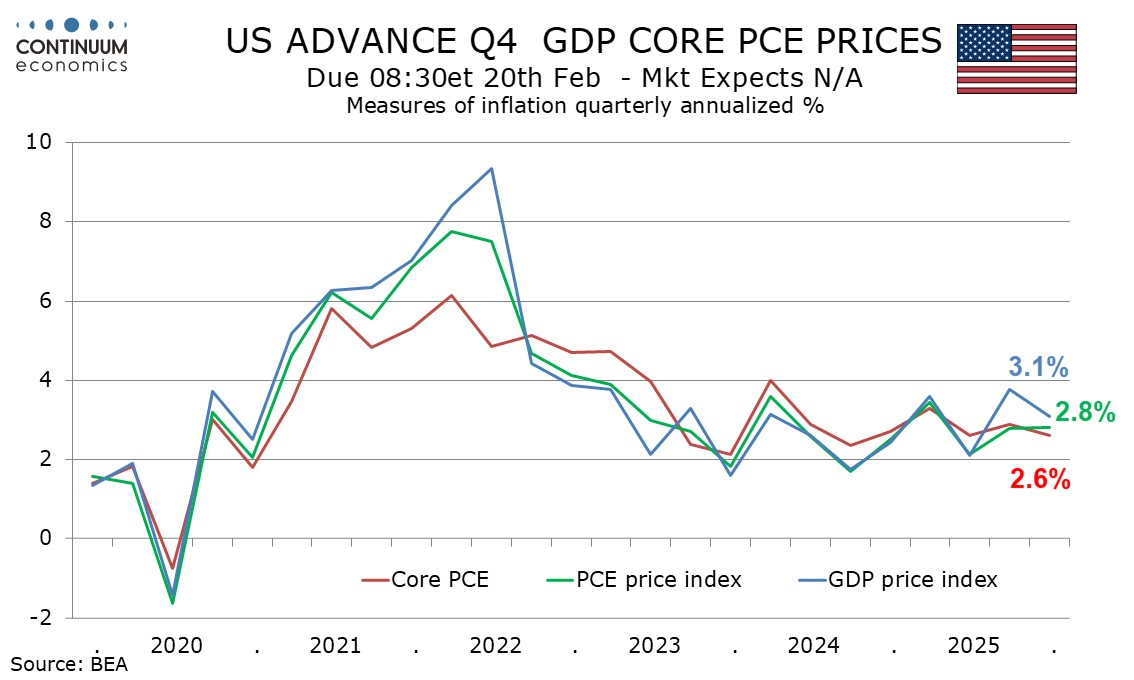

Slowing employment growth is weighing on real disposable income, along with persistent inflation. We expect a stronger 0.4% rise in PCE prices in December, leaving annualized Q4 gains of 2.8% for overall PCE prices and 2.6% in the core rate. We expect a 3.1% increase in overall GDP prices, with export prices rising faster than import prices and risk that Q3 strength in investment prices will persist. If it does, it would argue against assuming AI-fueled investment will be a restraining force on inflation.

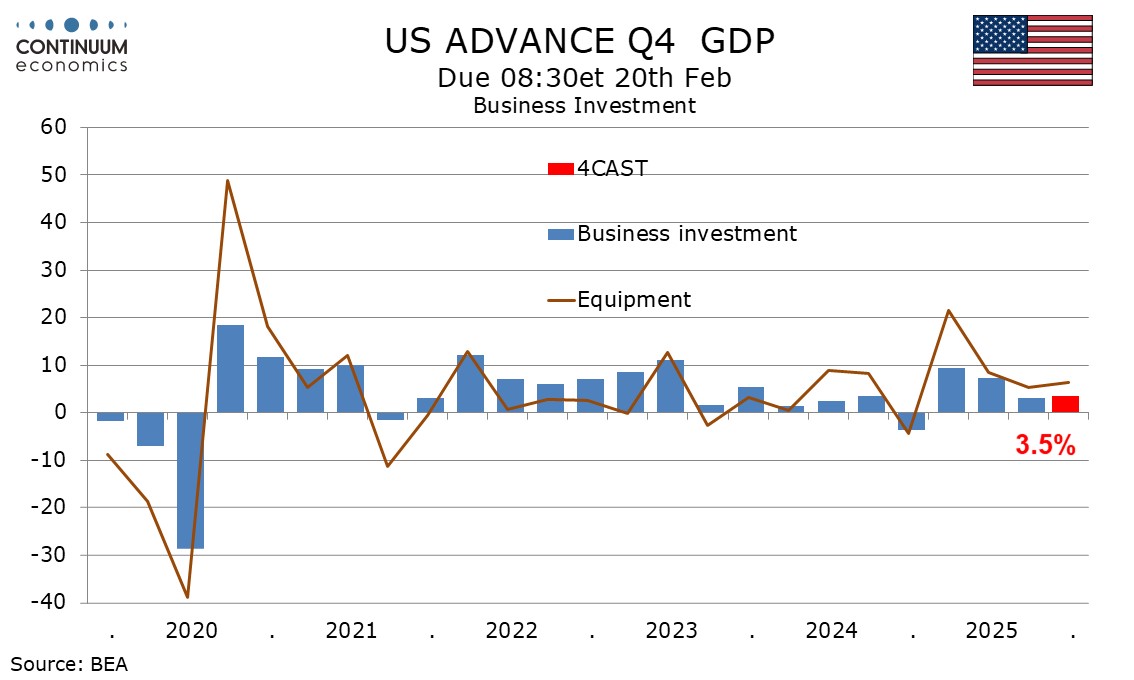

We expect business investment to rise by 3.5%, similar to Q3’s 3.2%, again with positives from equipment and intellectual property and a negative from structures. Signals from durable goods orders, for which December data is due on December 18, and industrial production, for which December data is already visible, have generally been positive for business investment.

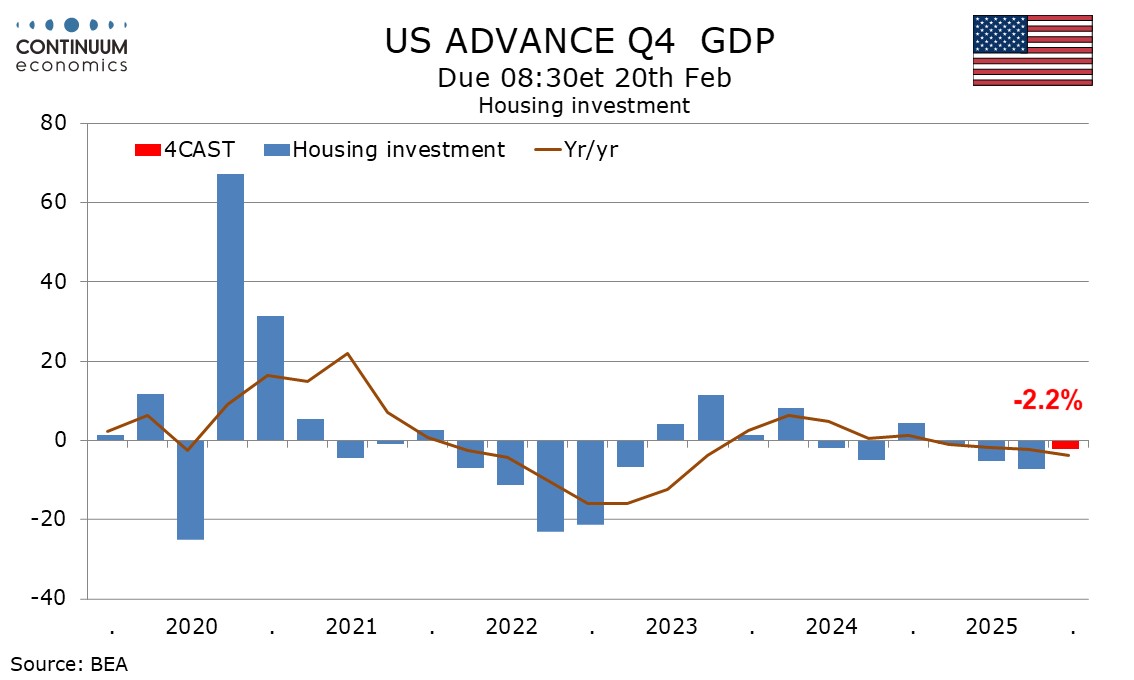

We expect a less negative picture from housing, at -2.2% versus -7.1% in Q3. A positive is possible if data still to be released, for housing starts, new home sales and construction spending for both November and December, picks up.

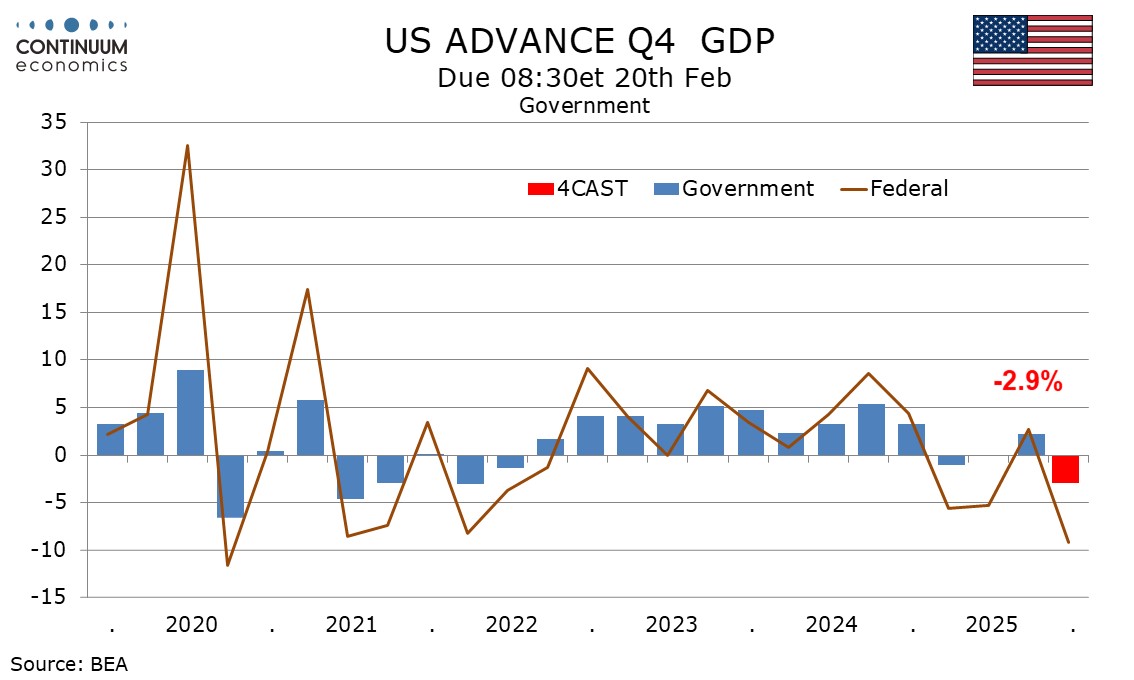

With the Federal government having shut down in October and early November, we expect a weak quarter from government at -2.9%. The decline will be due from Federal spending but we also expect State and Local at 1.2% to slow from 2.0% in Q3.