EUR flows: EUR softer after ECB acknoweldges progress on inflation

EUR lower as EUR front end yields fall follwoing ECB statement.

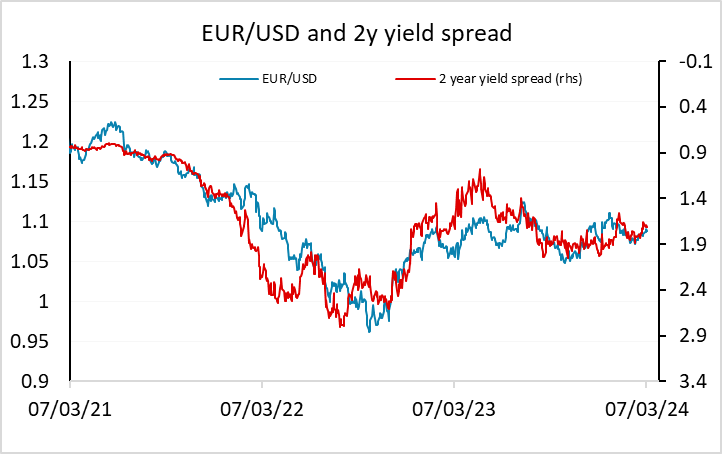

The market is treating the ECB statement as slightly dovish, although the statement could be seen either way. They note that “although most measures of underlying inflation pressures have eased further, domestic price pressures remain high, in part owing to strong growth in wages'. We would interpret this a little more hawkishly than the market, but the market may also be swayed by the (expected) reduction in staff projections, including core inflation back to 2% by 2026. There has been little change in market expectations of an April cut, which is still priced at around a 20% chance, but some increase in the expectations of cuts further out, with another 10bps of easing now seen by year end (4 cuts) and a June rate cut now more than fully priced. The decline in EUR yields has triggered a modest correction of the recent EUR rally, sending EUR/USD back into the 1.08-1.09 range.

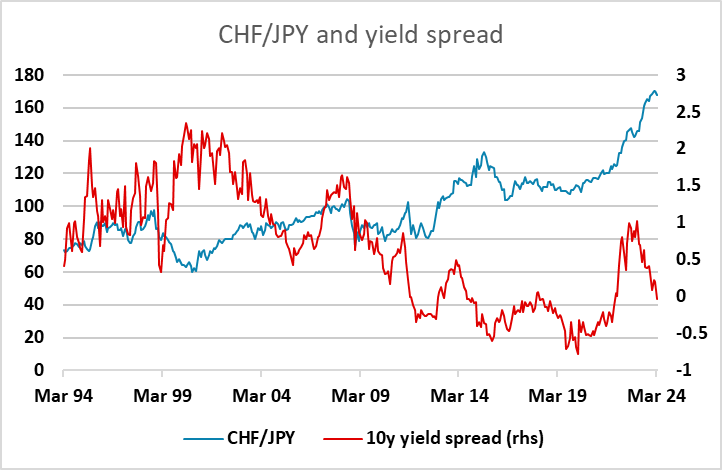

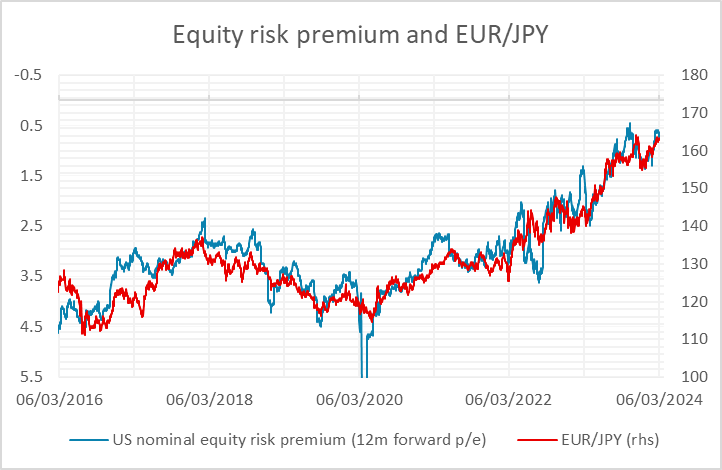

While we would see the ECB statement a little less dovishly than the market, we would say the same about the market reaction to the Powell testimony yesterday, so it makes sense to us that EUR/USD is back in the range. But the softer tone to yields in both the US and Eurozon and the former tone to Japanese yields as evidence of rising wage settlements emerges suggests more downside scope for both USD/JPY and EUR/JPY. In truth, EUR/JPY has been trading well above levels consistent with yield spreads for some time, and we still expect some significant weakening in risk sentiment will be necessary to trigger a big move up in the JPY. But the JPY nevertheless looks the most obvious beneficiary of this week’s developments. We continue to like CHF/JPY as the purest value play given the lack of any significant nominal yield spread advantage for the CHF.