Eurozone Banks Continue to Limit Credit Supply as Demand Still Falters

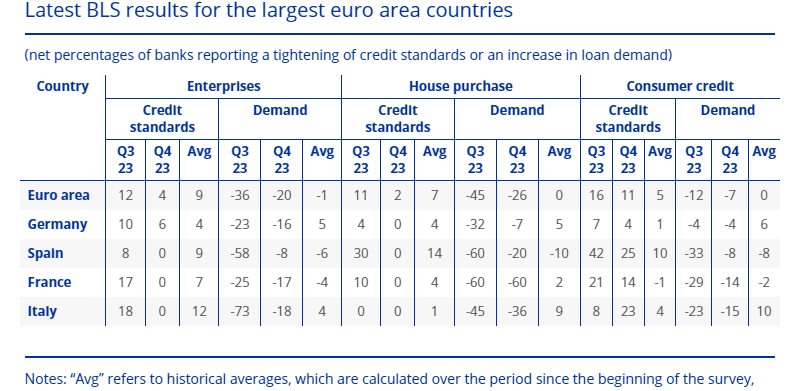

Not unsurprisingly, the January 2024 bank lending survey (BLS), saw EZ banks moderately tighten their credit standards further for loans in the last quarter of 2023. For ECB hawks who have suggested that the fall in market interest rates in the last few months constitutes and easing in financial conditions, the BLS points very much in the opposite direction. Indeed, it adds to the substantial cumulative tightening in credit standards since 2022, which has contributed, together with weak demand, to the strong fall in loan growth to firms and where there has also been a marked cumulative fall in credit demand. Admittedly the tightening was less marked than in the previous quarter and there was little sign that the fall in deposit volumes was having much impact in affecting credit supply. But the BLS very much underscores that the impact of past tightening will continue to dampen loan growth in the coming quarters, not least as more tightening in credit standards (less credit supply) is expected through the current quarter.

Figure 1; Banks Still Seeing Credit Supply Slipping as Demand Drops Further

Source; ECB

The Corporate PictureAs for what banks are thinking in regard to companies, it is clear that risk perceptions related to the economic outlook and the situation of firms continued to have a tightening impact, whereas the impact of banks’ cost of funds and balance sheet situations, competition and risk tolerance was broadly neutral. The impact of past tightening will continue to dampen loan growth in the coming quarters, in line with the leading indicator properties of credit standards (about 5-6 quarters ahead of actual loan growth developments), such that actual lending to firms can be expected to remain weak in 2024. Admittedly, the net percentage of banks reporting a tightening moderated compared with the previous quarter, was lower than banks had expected and lower than the historical average (9%). However, banks expect further net tightening for the first quarter of 2024. Lending conditions for firms tightened moderately further in most economic sectors, ranging from almost no net tightening in services to relatively large net tightening in the commercial real estate, construction and residential real estate sectors. Demand for loans decreased in net terms in all economic sectors, especially in real estate and construction.

Consumer Demand Still FallingAs for the consumer picture, banks reported a further net tightening of credit standards for loans to households, which was small for housing loans but more pronounced for consumer credit. Risk perceptions were a major driver of the tightening of credit standards in both categories, with banks’ lower risk tolerance also driving the tightening of credit standards for consumer credit. For both loan categories, the net tightening was lower compared with the third quarter (11% for housing loans and 16% for consumer credit) but was broadly in line with what had been expected. Banks expect a further net tightening of credit standards in both loan categories.

Firms’ net demand for loans continued to decrease markedly mainly driven by higher interest rates and lower fixed investment, consistent with the net decrease in demand for long-term loans. By contrast, financing needs for inventories and working capital contributed slightly positively to loan demand, the question being whether this implied increase in stock building was involuntary or not. A crumb of comfort is discernible in the fact that, banks expect a small net increase in demand for loans to firms for the first time since the second quarter of 2022.Net demand for housing loans and consumer credit continued to decrease. For both housing loans and consumer credit, the general level of interest rates and consumer confidence were major drivers of the decline in demand, with housing market prospects also exerting substantial downward pressure on housing loan demand. In the first quarter of 2024, banks expect an increase in housing loan demand for the first time since the first quarter of 2022, but a continued decrease in consumer credit demand.

Banks’ overall credit terms and conditions tightened moderately further for firms and consumer credit but eased for housing loans. The net easing in the housing loan category was not accompanied by a corresponding decrease in lending margins and followed seven quarters of tightening (since the first quarter of 2022).