Eurozone: Measuring Monthly GDP Highlights Growing Weakness

Getting a reliable coincident assessment of the EZ real economy, let alone any insight into the likely near-term outlook, is difficult. EZ GDP data are prone to rapid revision, arrive only quarterly and only with a long lag offer detail from either the spending or output side that would allow a better understanding of how underlying momentum may be faring. But monthly output data for the three main sectors is now available, allowing the construction of a proxy monthly EZ GDP indicator which chimes with an aggregation of the various PMI numbers – not surprising as they both cover most of the private sector (Figure 1). While GDP growth in Q3 looked solid at 0.4%, we think a) it will be revised lower and b) ended the quarter on a weak note that has created an adverse base effect from the current quarter. And with the PMI data now in seeming freefall and given the correlation with monthly GDP, Q4 could very well be negative with enough of a risk that we have revised down our below-consensus forecasts and think that the ECB’s already fading optimism will have to be reined in further when it updates its projections on Dec 12.

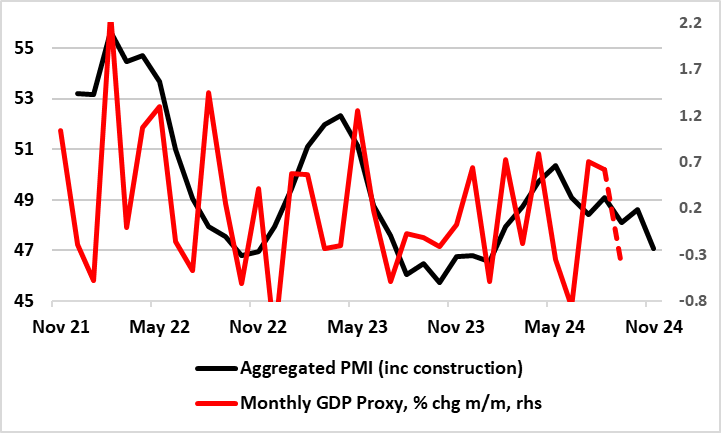

Figure 1: Survey Data Suggest Downside GDP Growth Risks Materialising

Source: Markit, Eurostat, CE, dashed line is September GDP projection

ECB Focus Shifting to Growth?

While not speaking for the whole ECB Council, Vice-President Luis de Guindos, in a recent interview, noted that developments point to growth remaining fragile and to a degree that concerns about high inflation have shifted to economic growth. This is seemingly even more so as geopolitical risks are increasing and uncertainty about US policy could affect trade and fiscal policy, with broader implications for the EZ economy. Admittedly, the more hawkish camp, including, Isabel Schnabel, acknowledge that the EZ economy is still stagnating, but with some better consumer signs. Even so, even they admit it is facing a combination of cyclical and structural headwinds, and that the latter could mean that investment remains sluggish even as interest rates decline.

However, assessing the demand and output backdrop and particularly how consumer and investment spending are performing is difficult given the lack of topical data. It will not be until Dec 6 that any break-down of Q3 GDP will be available, making an authoritative re-assessment of the immediate outlook that the ECB’s updated economic projections due only a few days later difficult – back in September the updated projections then produced did not encompass the GDP revisions made a few days earlier!

Flash GDP in Perspective

Amid this paucity of reliable data, it is important to recognize that there are clear shortcomings to the initial (ie flash) estimate for EZ GDP. No details come with these flashes and they are prone to clear revisions, where even a 0.1 ppt change can be very meaningful when the economy is hardly growing. They are based on incomplete activity numbers with usually on one monthly vale for services and two for construction and manufacturing. This may be why the ECB is openly more focused on survey data, especially as it is more timely. Time will tell whether the Q3 flash numbers will tell any more authoritative a story, but we envisage they too will be revised down to somewhere between 0.2-0.3%!

A Monthly GDP Proxy?

But monthly output data for the three main sectors (ie construction, industry and private non-financial services) is now available, allowing the creation of a proxy monthly EZ GDP indicator. As for Q3 there is still a gap regarding September services. However, surveys are clearly suggesting that the hitherto solid performance of services has dissipated, the question is whether it has gone into reverse or not. But even on the assumption of a stable m/m September services reading, the last quarter may have ended on a very weak note with monthly GDP falling some 0.5% m/m, enough to erase the gains of the previous two months but also create a very adverse base effect for the current quarter.

Notably, this GDP proxy chimes with an aggregation of the three PMI numbers – not surprising as they too cover construction, industry and private non-financial services (Figure 1). This correlation makes the insight into current quarter activity offered by the PMIs somewhat more authoritative. Indeed, with the PMI data now in seeming freefall, Q4 GDP could very well be negative in q/q terms with enough of a risk that we have revised down our below-consensus forecasts. In fact, with the possible Q3 downward revision and a flattish Q4, GDP growth this year may be as low as 0.6%, ie some 0.2 ppt below ECB thinking.

ECB Needs to Reassess

But the lack of momentum implied into 2025 is the more important issue as we have pared back the GDP outlook for next year to 0.8% (from an already below-consensus 1.0%), something that the ECB will have to follow suit to some degree by revising down its (to us optimistic) 1.3%. While the focus of the updated projections due from the ECB next month may its first insight into 2027, the fact the ECB could be forced into a cumulative 0.5 ppt downgrade just for the coming year will only intensify what seems to be a growing concern among some Council members that even the tacit downward revision to the 2025 HICP outlook made in October needs to adjusted down further. This is seemingly being flagged even before the updated projections are agreed; Schnabel saying today that she expects that inflation is going to return sustainably to the 2% target over the course of 2025. And to go back to the PMIs, they also offer a reassuring message on price pressures even amid a small pack-up in the last month. In October, the PMIs suggested that Eurozone companies raised their prices only modestly, ie by the second-slowest extent since February 2021.