Preview: Due July 17 - U.S. July Retail Sales - Mostly subdued

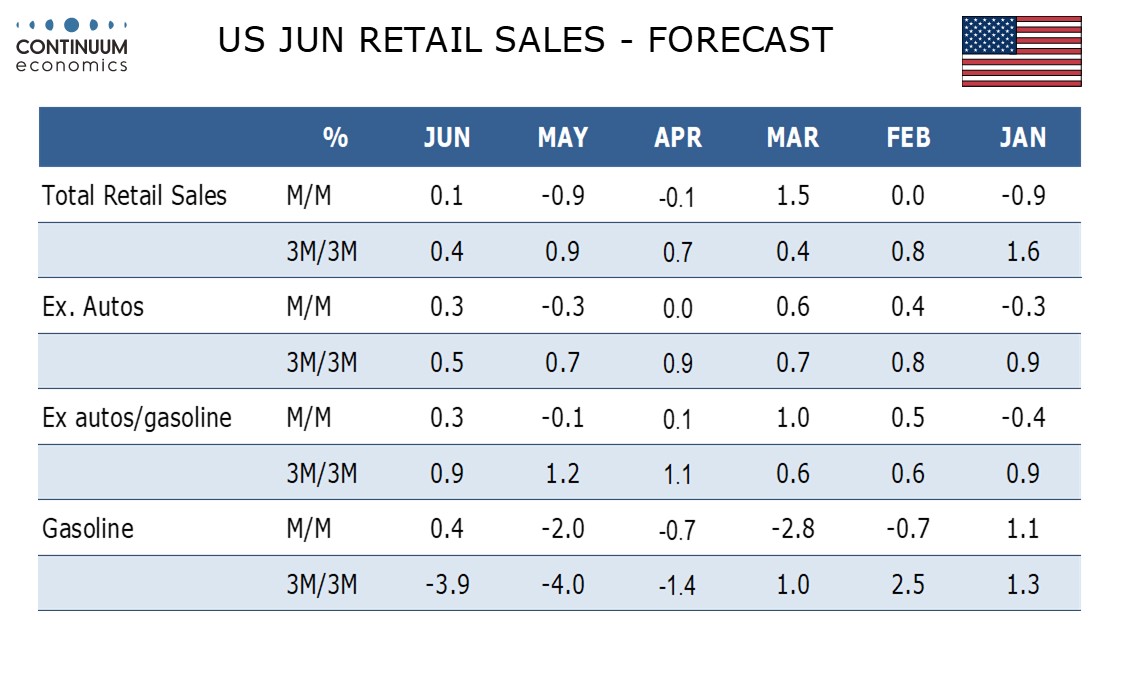

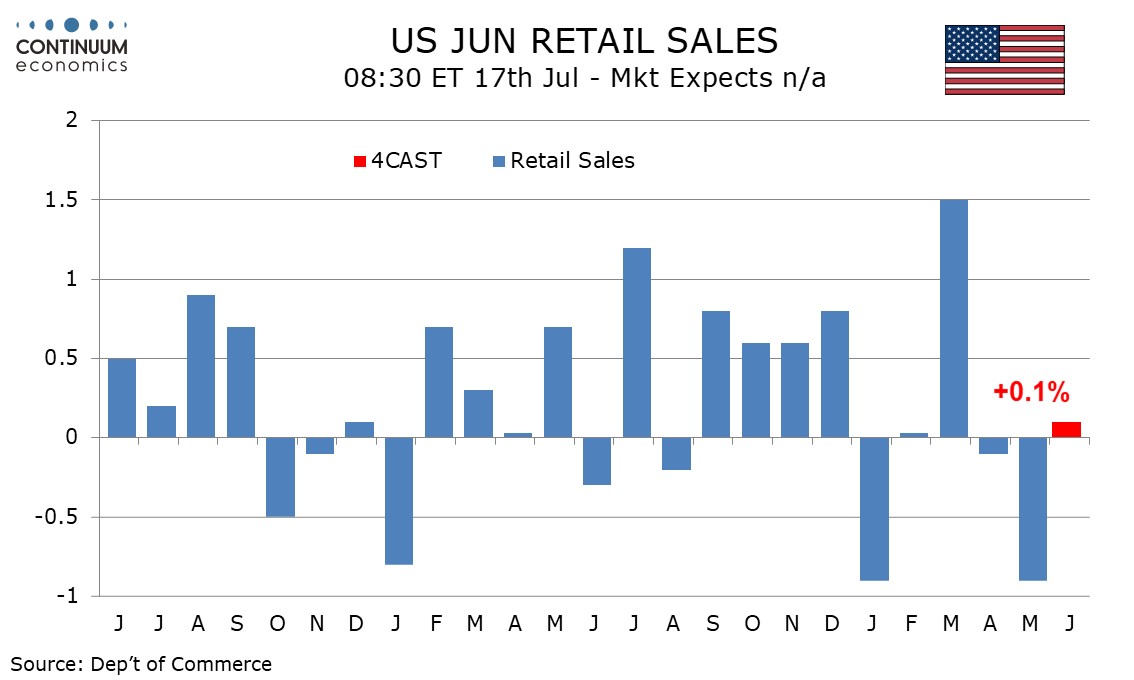

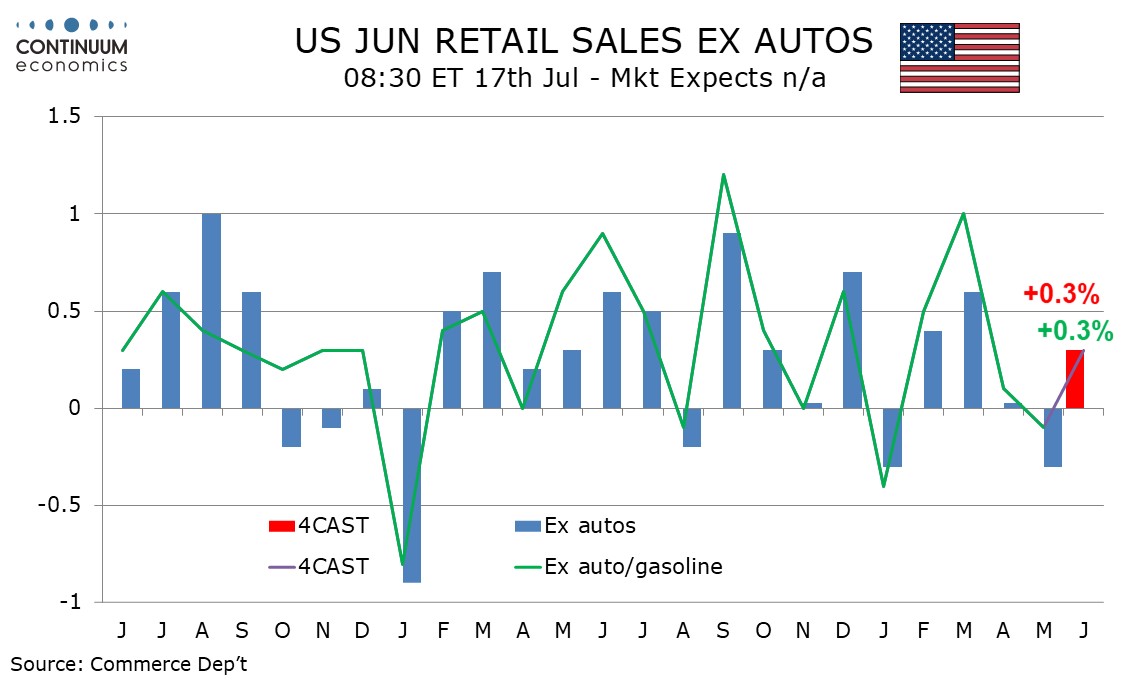

We expect a 0.1% increase in June retail sales to follow two straight declines, with a 0.3% incase ex autos that will reverse a 0.3% May decline. Ex autos and gasoline, we also expect a 0.3% increase, after a 0.1% May decline that followed a 0.1% April increase.

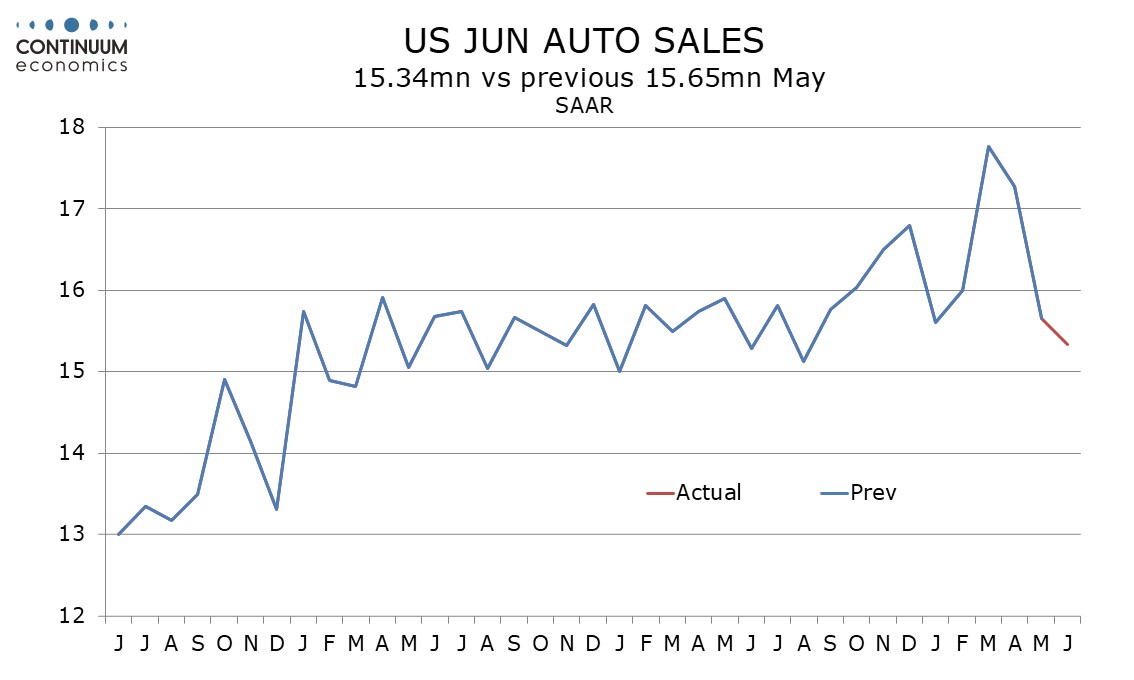

Industry data shows auto sales continued to correct from a strong March increase that came ahead of threatened tariffs. Gasoline prices are unlikely to have much influence in June after four straight negatives.

Ex autos and gasoline we expect some support from upward corrections in food and eating and drinking places, which were both significantly below trend in May. Elsewhere we expect the ex auto and gasoline data to be subdued.

Under our forecast Q2 would show a 0.4% rise (not annualized), matching Q1, while ex auto sales would slow to a 0.5% pace from 0.7%. Ex autos and gasoline however we expect a solid rise of 0.9%, up from 0.6% in Q1.

Consumer spending is being restrained by slippage in confidence, though real disposable income outpaced consumer spending in Q1 and looks likely to do so again in Q2, reducing near term downside risks to spending. Real disposable income has however been supported by some one-time factors in Q1 and April, before slipping in May.