Preview: Due April 16 - U.S. March Retail Sales - Strong end to a subdued quarter

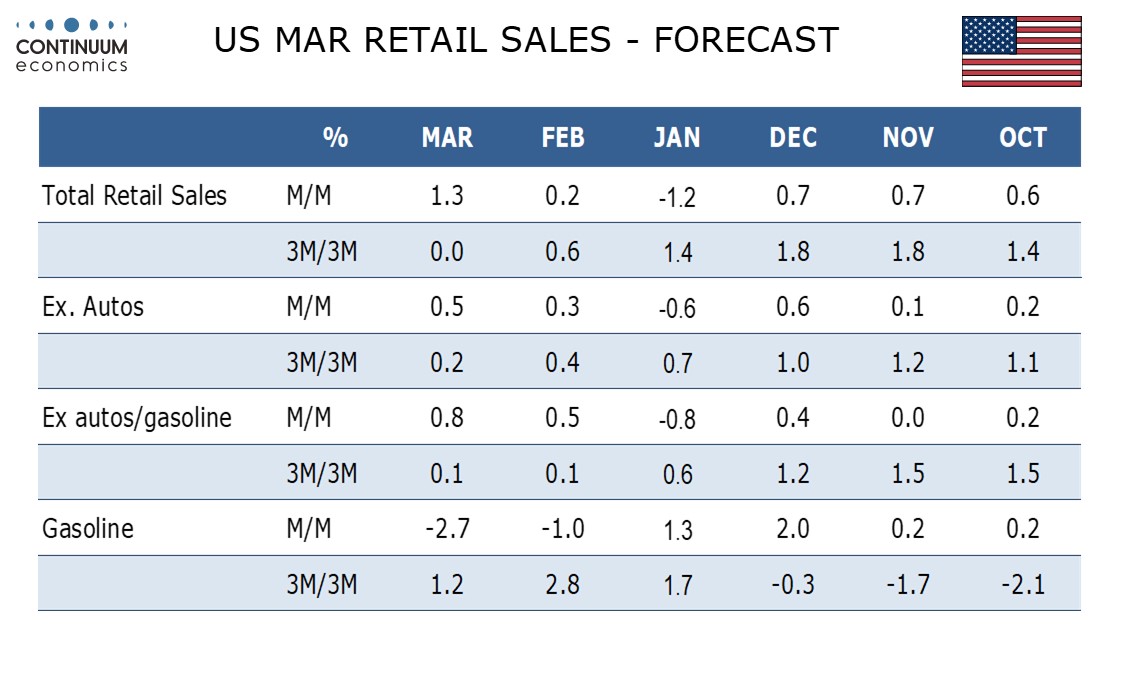

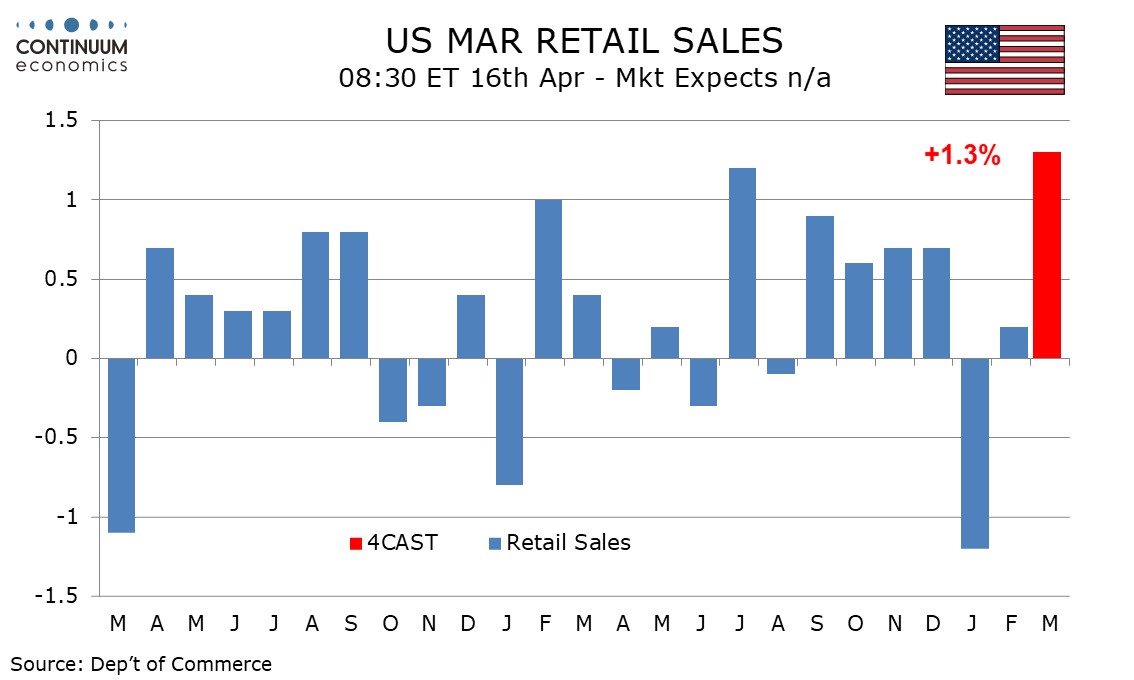

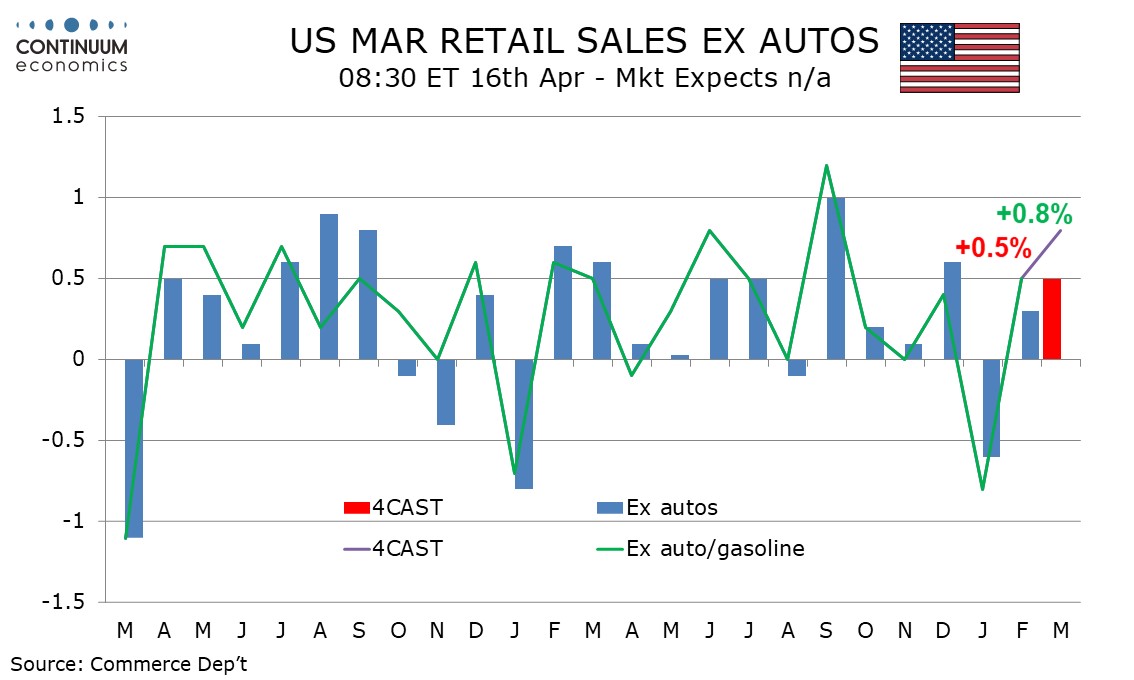

We expect US retail sales to rise by 1.3%, led by autos, in what will be a strong end to a subdued quarter. Ex autos we expect a moderate rise of 0.5% but ex autos and gasoline the rise we expect sales to rise by 0.8%.

Q1 started on a weak note with January weakness probably largely due to bad weather. Continued bad weather in February probably helped keep the rebound modest. More normal weather in March is likely to assist a stronger rebound.

Consumer spending underperformed personal income in January and February, and while the personal income strength was led by temporary factors, it still gives consumers scope to spend. Weakness in confidence is likely to reflect political views and the impact on spending is likely to be modest unless fears of higher inflation are realized.

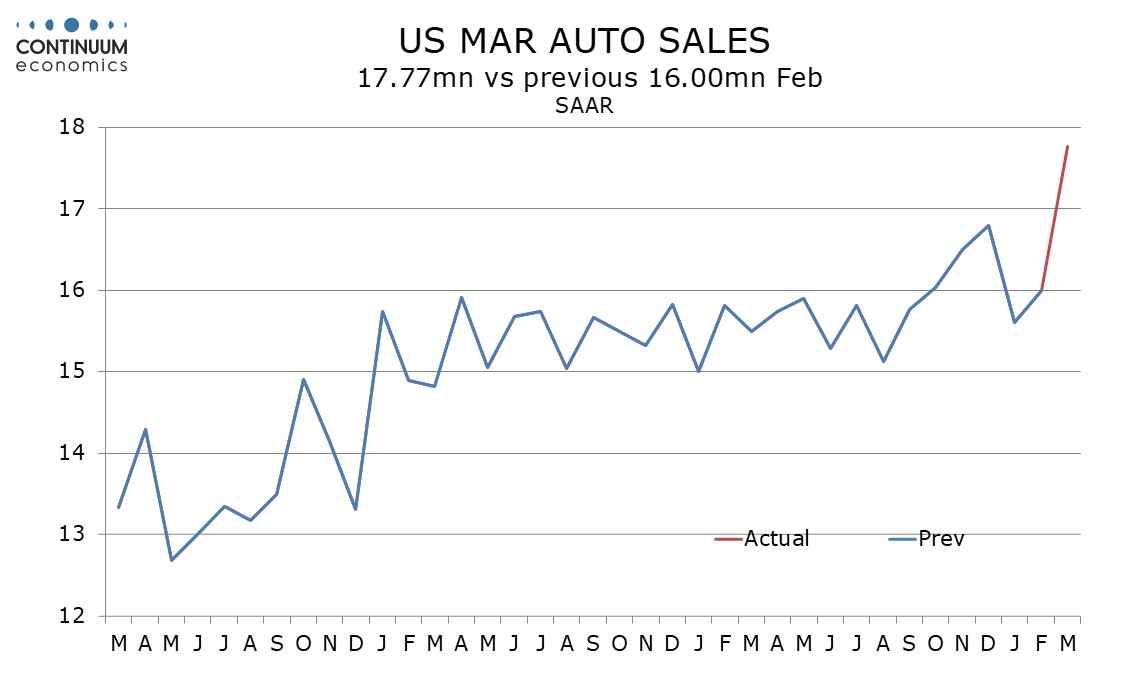

Industry data suggests a sharp rise in auto sales. This may be due to spending being accelerated due to fears of tariff-led price hikes. Gasoline prices slipped in March and will act as a restraint on sales value. Ex autos and gasoline we expect a mostly solid March breakdown, extending February’s partial recovery from a weak January.

Even with a March bounce Q1 is likely to look subdued, with sales unchanged overall, and gains of only 0.2% ex autos and 0.1% ex autos and gasoline (not annualized). This would be the weakest quarter overall and ex autos since Q2 2023, and the weakest quarter ex autos and gasoline since the pandemic in Q2 2020. There is plenty of scope for a bounce in March sales.