Canada August Employment - Detail mostly weak

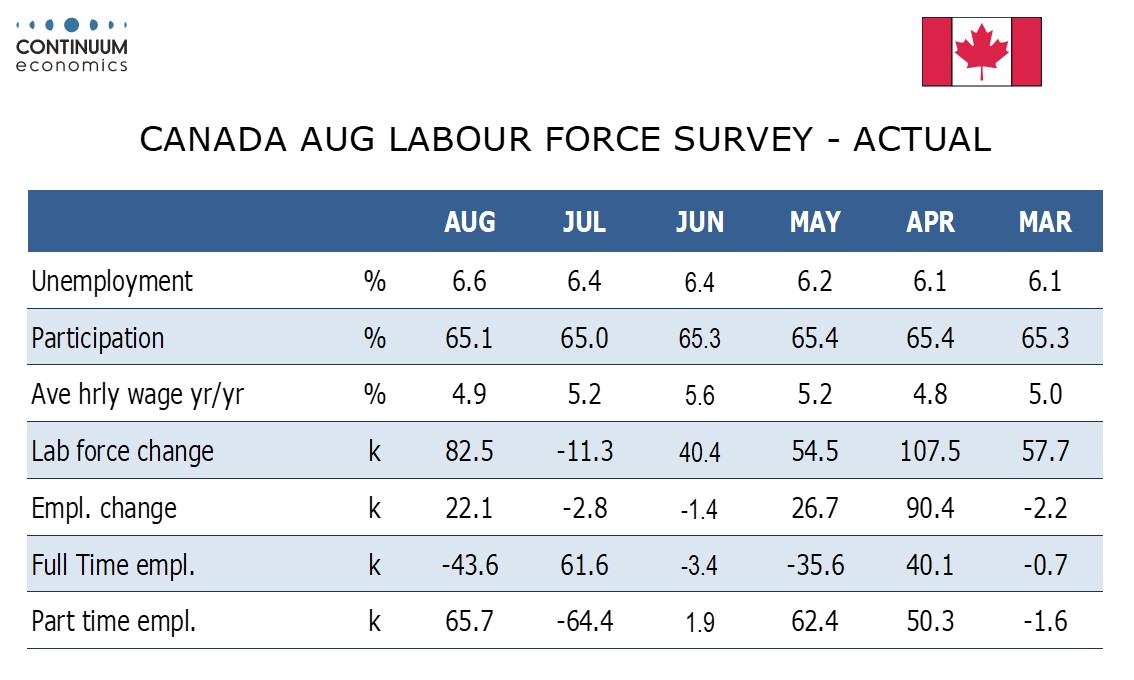

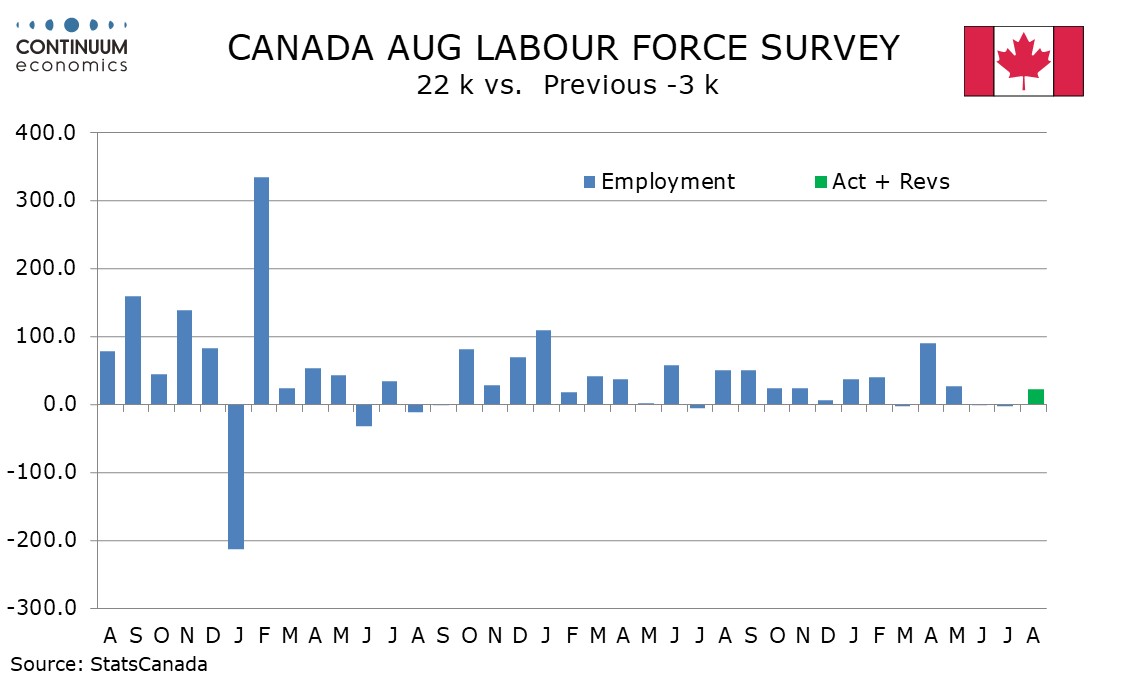

Canada’s August employment report with a 22.1k increase is in line with expectations on the headline and an improvement from two straight near flat moths, but weak in the detail. The employment gain came fully on a 65.7k rise in part time employment with full time work falling by 43.6k, while unemployment rose to 6.6% from 6.4% and wage growth slowed to 4.9% from 5.2%.

The underperformance of full time work needs to be seen alongside the July data when full time work saw a strong 61.6k increase while part time work fell by 64.4k, though trend looks fairly subdued in both series. Slightly more positive in the detail was a 38.2k rise in private sector employment, with the public sector down by 8.6k and self-employment down by 7.4k. There were few stand outs in the detail by industry, with educational services the strongest sector at 26.7k, and health care and social assistance not far behind at 25k.

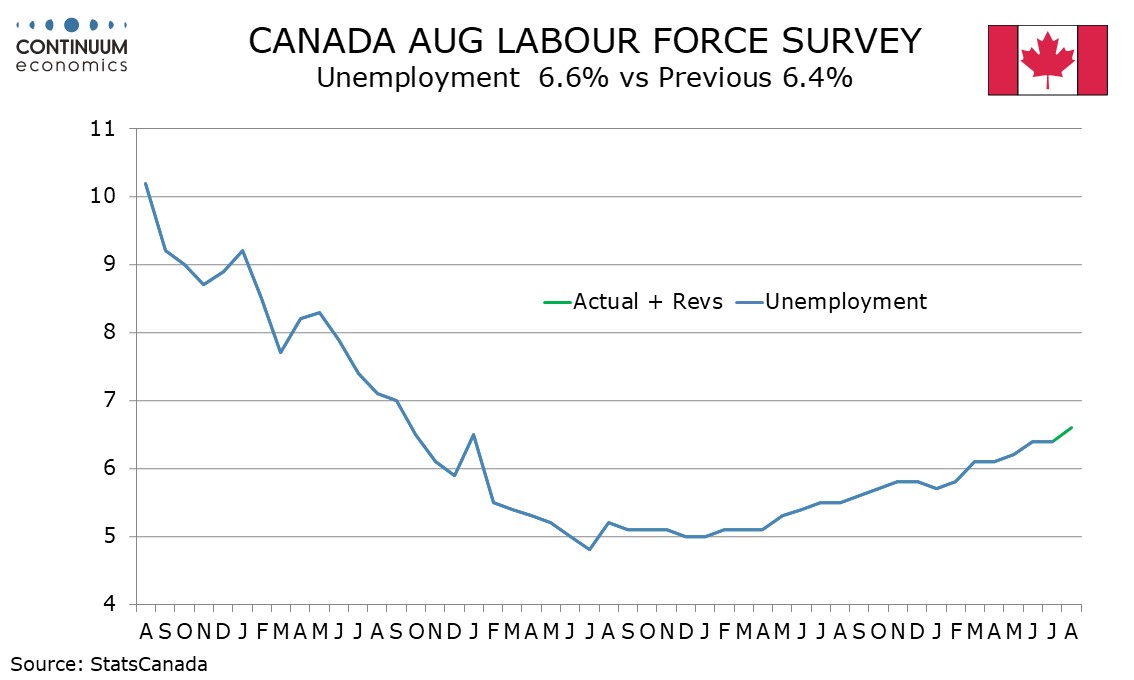

The unemployment rate is the highest since September 2021 and up from 5.0% at the start of 2023. It is well above the pre-pandemic trend that was stable below 6%. The rate increased more sharply than expected due to a strong 82.5k increase in the labor force.

Yr/yr growth in the hourly wage of permanent employees at 4.9% is at a 4-month low but not a clear break in trend and wages still look too strong to be consistent with inflation at the 2% Bank of Canada target. Still, the report is one that justifies continued BoC easing.