Preview: Due September 5 - U.S. August Employment (Non-Farm Payrolls) - Similar to July's, still not recessionary

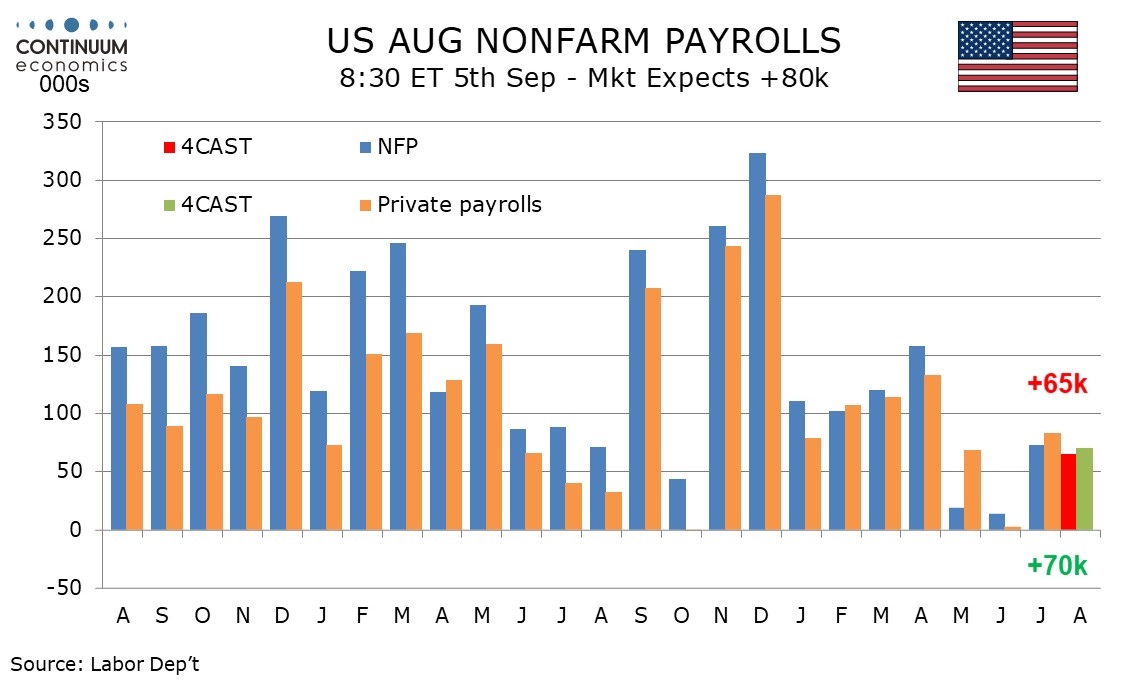

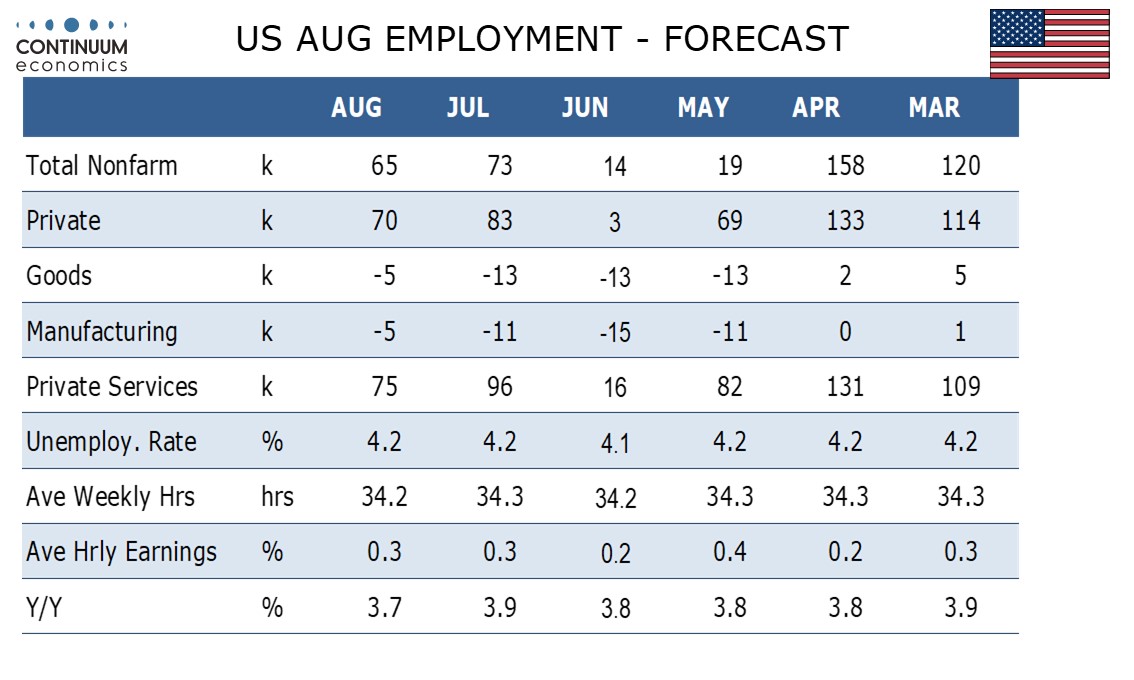

We expect August’s non-farm payroll to look similar to July’s, with a rise of 65k versus 73k in July, above the 14k rise of June and the 19k rise of May but well below the trend that was running above 100k through April. We also expect unemployment to remain at July’s 4.2% rate and a second straight 0.3% increase in average hourly earnings.

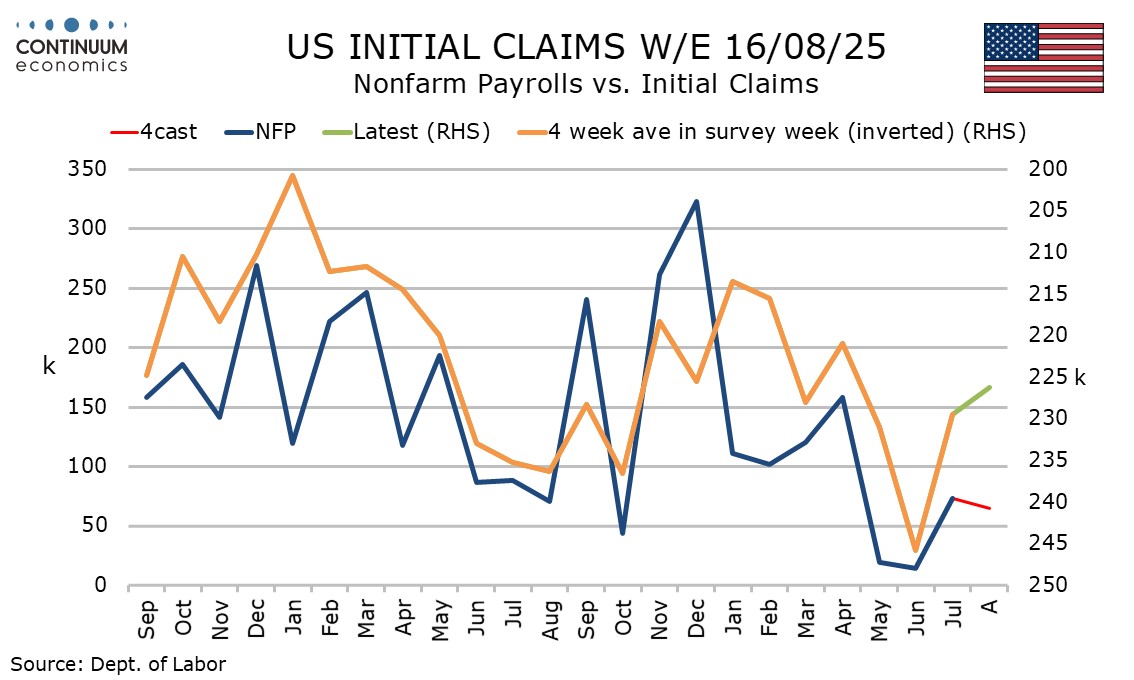

July’s data was most notable for the dramatic downward revisions to May and June. We are assuming limited revisions this time with the recent payroll data looking fairly consistent with initial claims. The 4-week average for initial claims slipped in July and further into August’s survey week, though the weekly number did increase in August’s survey week.

This suggests an August outcome similar to July’s and stronger than those of May and June. Tariff fears have eased somewhat since the initial shock that followed April’s announcement, while seasonal adjustments assume less hiring in July and August than is the case in May and June. This gives payrolls a smaller hurdle to clear, significant when labor supply is limited by immigration policy.

Some may fear pressure from the Trump administration could make the Labor Department unwilling to report any bad news. However, manipulation of the data would require a large effort from many people, and would be difficult enough to make it unlikely. The preliminary estimate for the revision to the March 2025 payroll benchmark is due on September 9, and that could be significant.

For August’s report, we expect only a modest decline in government of 5k meaning private payrolls at 70k would slow from 83k in July. We expect goods to be less negative at -5k from -13k with a few positive signals in manufacturing, but private services to slow to 75k from 96k in July, still above June’s meager 16k.

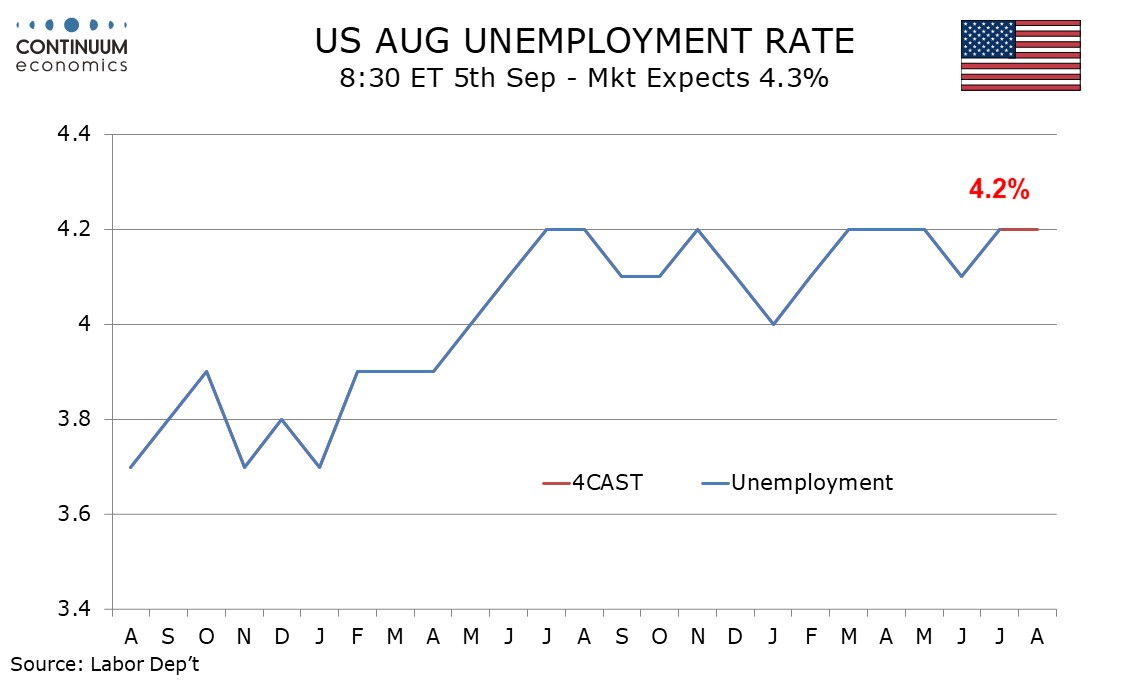

July’s unemployment rate was 4.248% before rounding so a rise to 4.3% is more likely than a fall to 4.1%. However, we expect a marginal decline in July’s labor force on reduced immigration to contrast a marginal increase in employment, leaving the unemployment rate slightly lower, though still rounding to 4.2%.

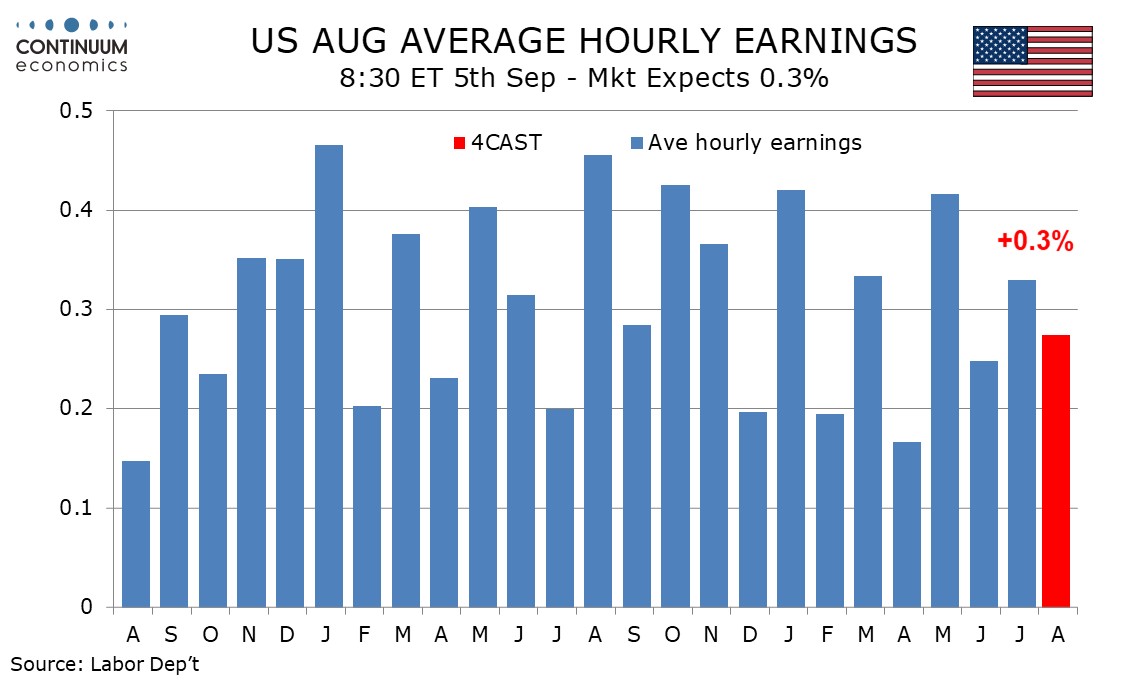

Average hourly earnings are trending at 0.3% per month and we expect that to continue, though we expect August’s increase to come in at 0.27% before rounding, down from 0.33% in July. This would see yr/yr growth slow to a 13-month low of 3.7%, from 3.9% in July.

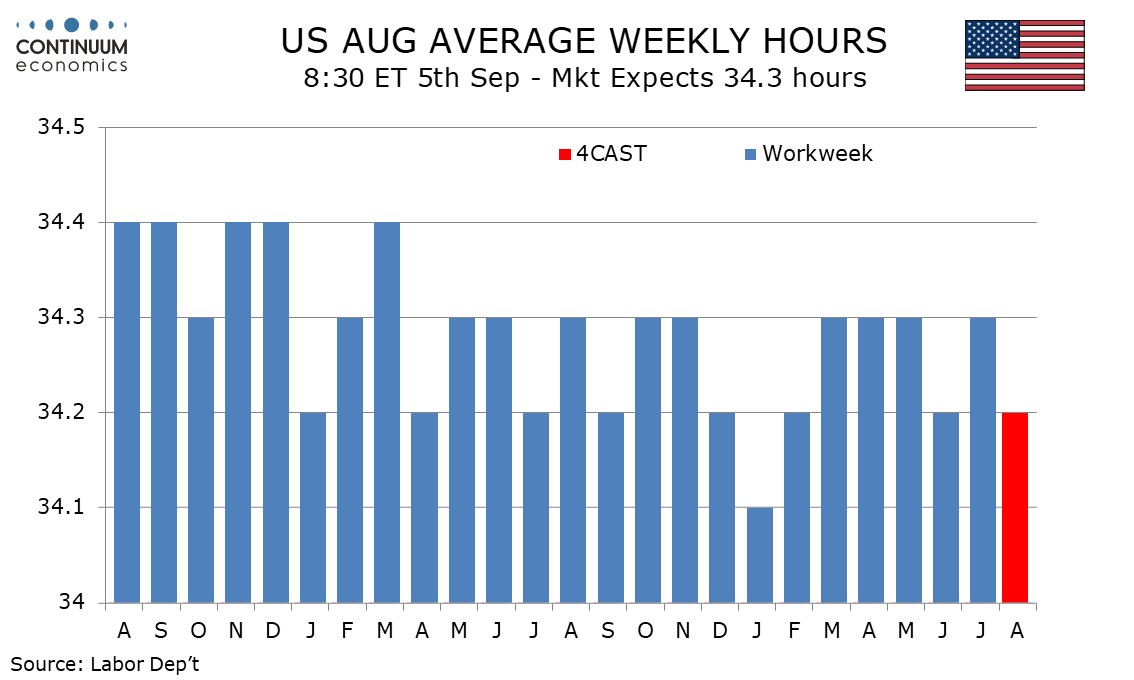

The average workweek is a close call between July’s 34.3 and June’s 34.2, but we lean towards the latter. Given that March, April and May all came in at 34.3 that would leave the workweek as well as non-farm payrolls signaling a slowing in the economy. However only if employment starts to significantly decline would we be seeing clear warning signals for recession. That we do not expect.