Preview: Due March 28 - U.S. February Personal Income and Spending - Core PCE Prices to outperform Core CPI

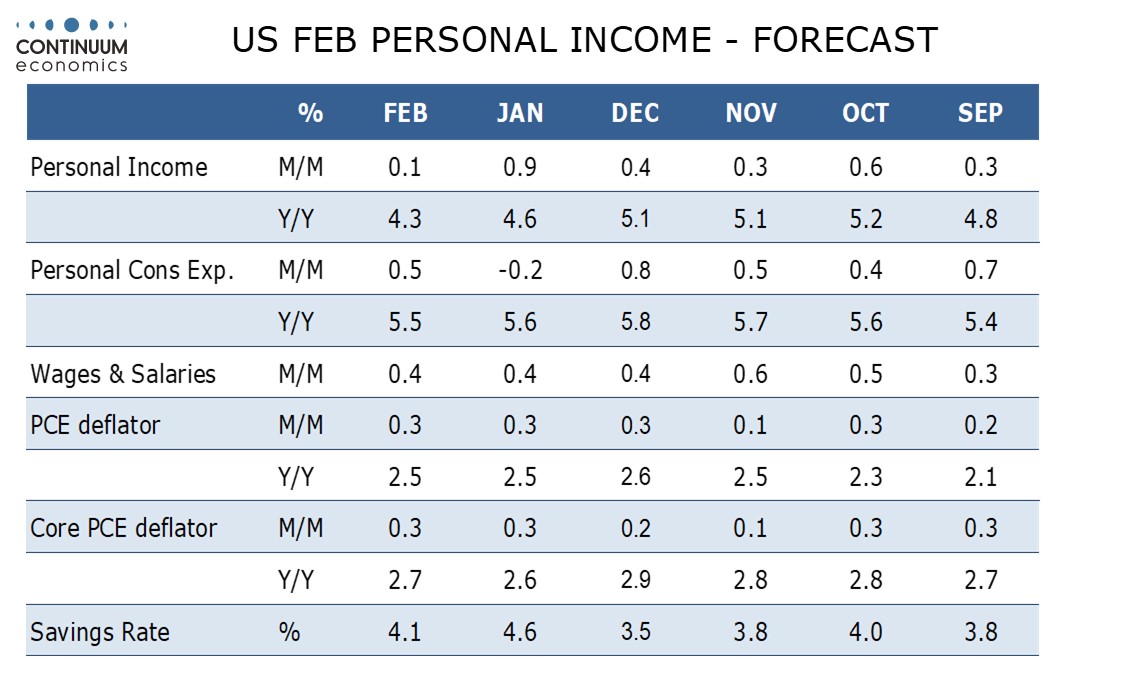

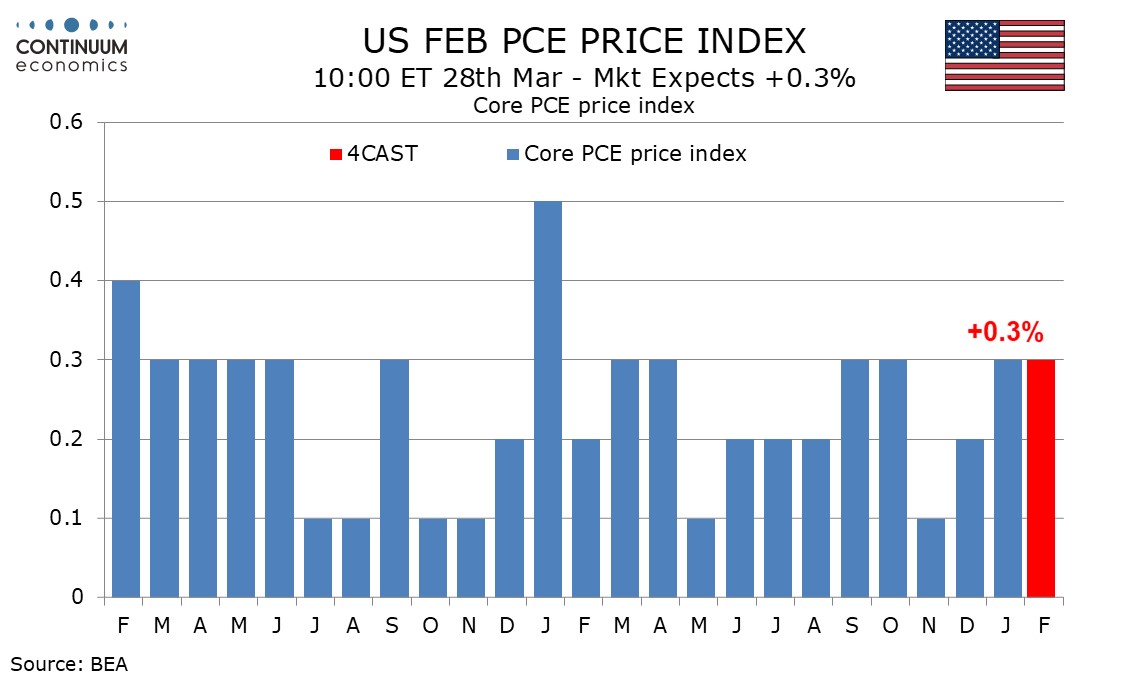

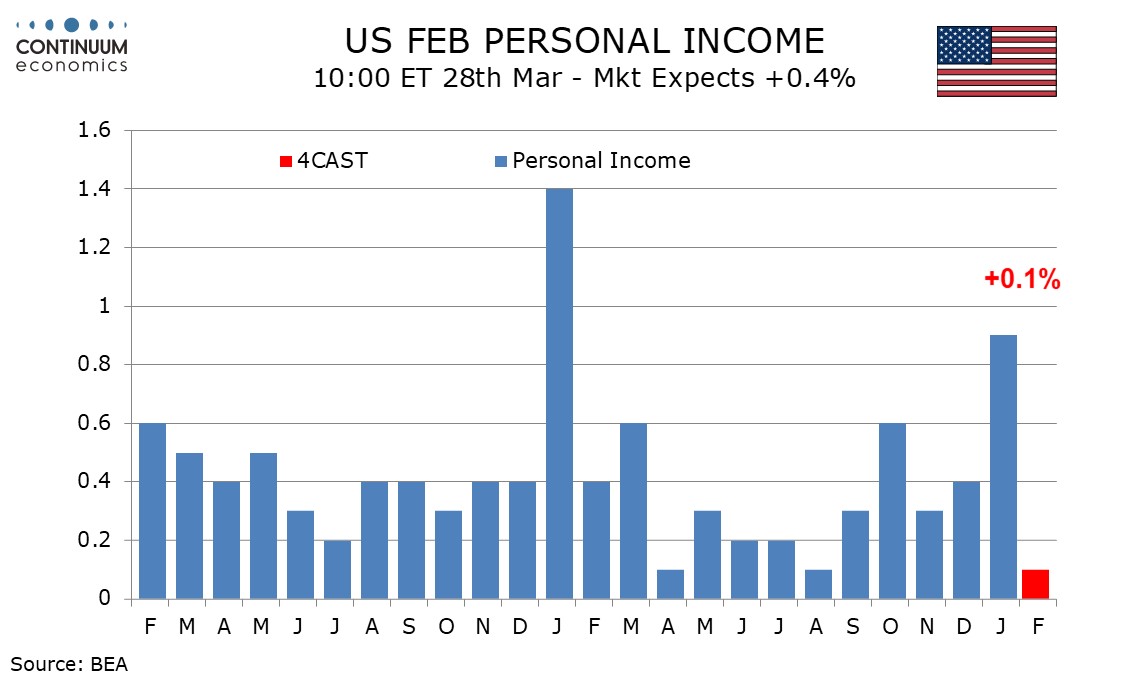

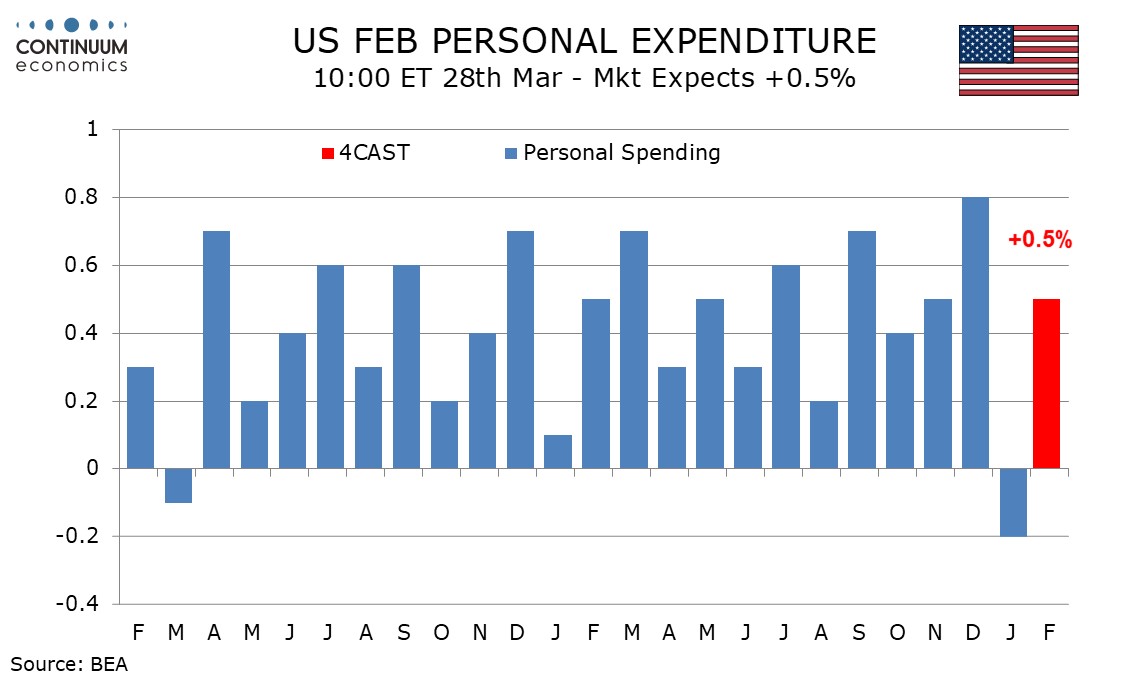

We expect a 0.3% rise in February’s core PCE price index, ahead of a 0.2% core CPI to partially offset a January underperformance when core PCE prices rose by 0.3% while core CPI surged by 0.5%. We also expect a subdued 0.1% rise in personal income to follow a strong 0.9% increase in January but personal spending to bounce by 0.5% after falling by 0.2% in January.

Core PCE prices look set to be a little stronger the the core CPI with a sharp fall in CPI air fares unlikely to be reflected in core PCE prices, while PPI showed an acceleration in core goods prices despite a subdued outcome overall. We expect overall PCE prices to also rise by 0.3% in February, also matching January’s gain.

On a yr/yr basis core PCE prices would then edge up to 2.7% from 2.6% after slipping in January from 2.9% in December. Fed's Powell has predicted 2.8%, suggesting upsode risk. Overall PCE prices however would be unchanged at 2.5% yr/yr, and that is consistent with Powell's expectations.

While non-farm payroll details imply a third straight 0.4% rise in wages and salaries, we expect personal income to ruse by only 0.1% after a 0.9% bounce in January. January’s data was inflated by strong gains in Social Security payments, on the annual cost of living adjustment, and dividends, both of which are likely to correct lower in February.

Consumer spending is likely to look stronger than the 0.2% rise in February retail sales with industry data suggesting a bounce in autos which surprisingly slipped in the retail breakdown. Retail sales were also restrained by a sharp fall in eating and drinking places which are included in services. This will restrain service spending, which we expect to rise by 0.4%, but only 0.1% in real terms.