U.S. June Employment - Consistent with an economy growing below potential

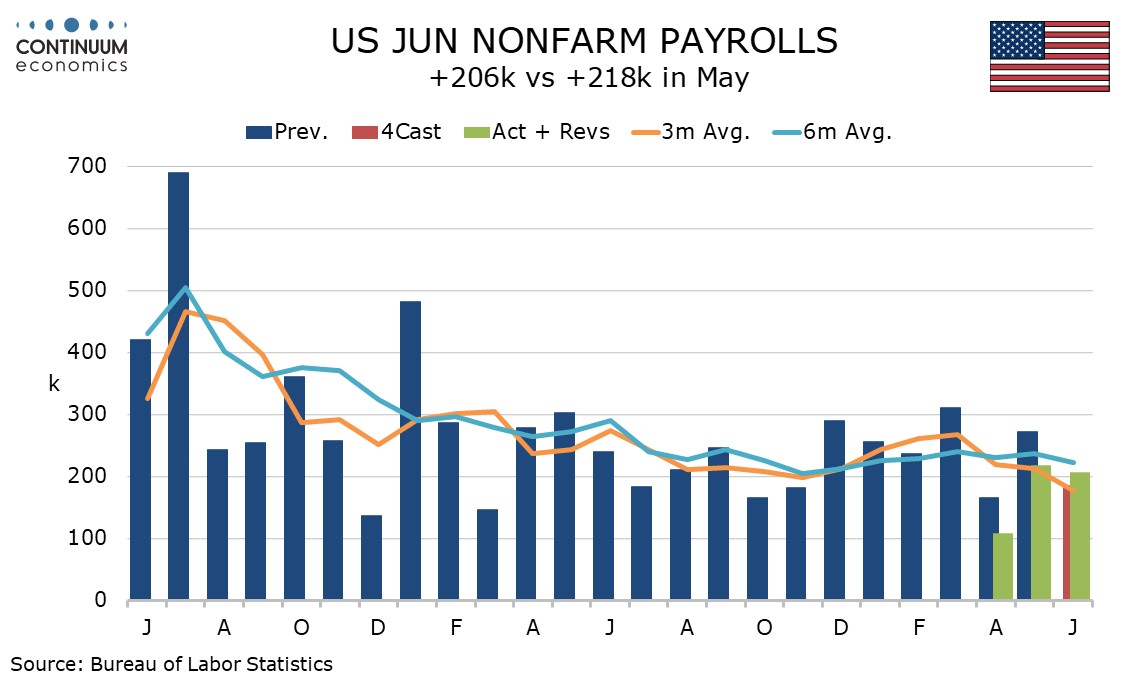

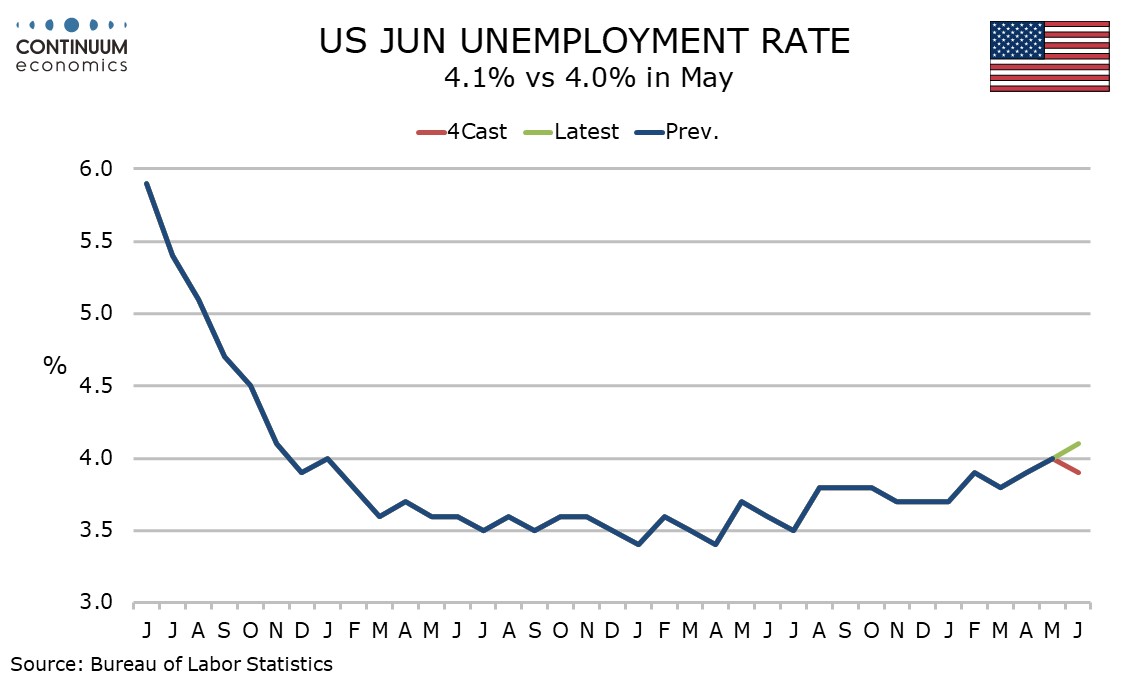

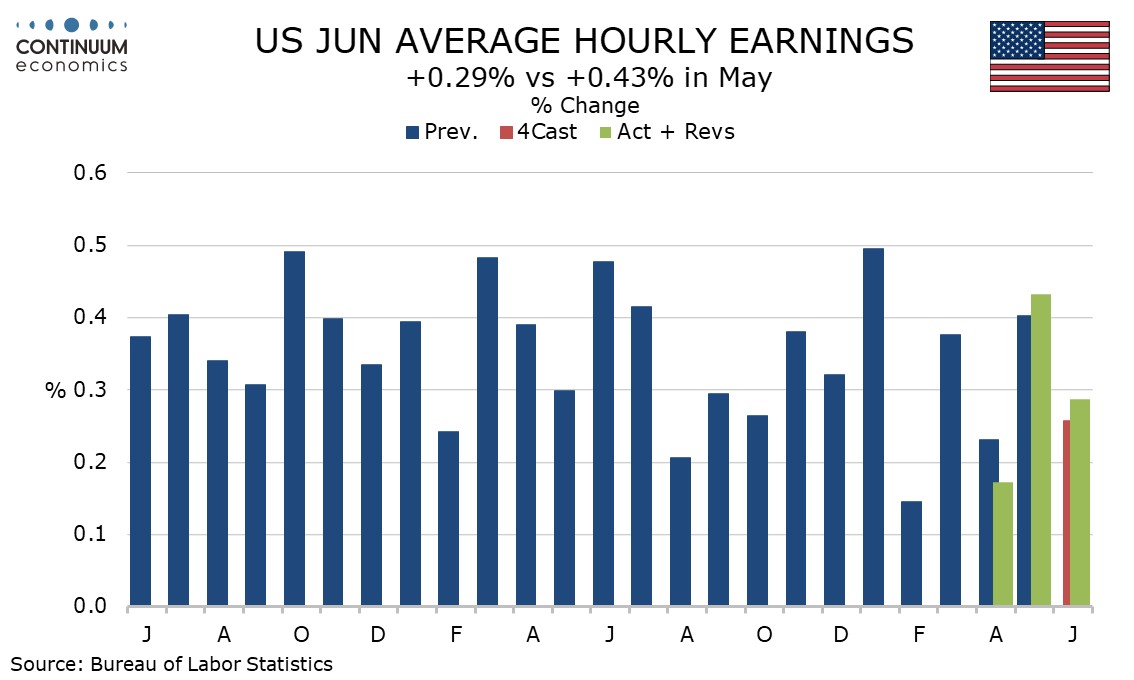

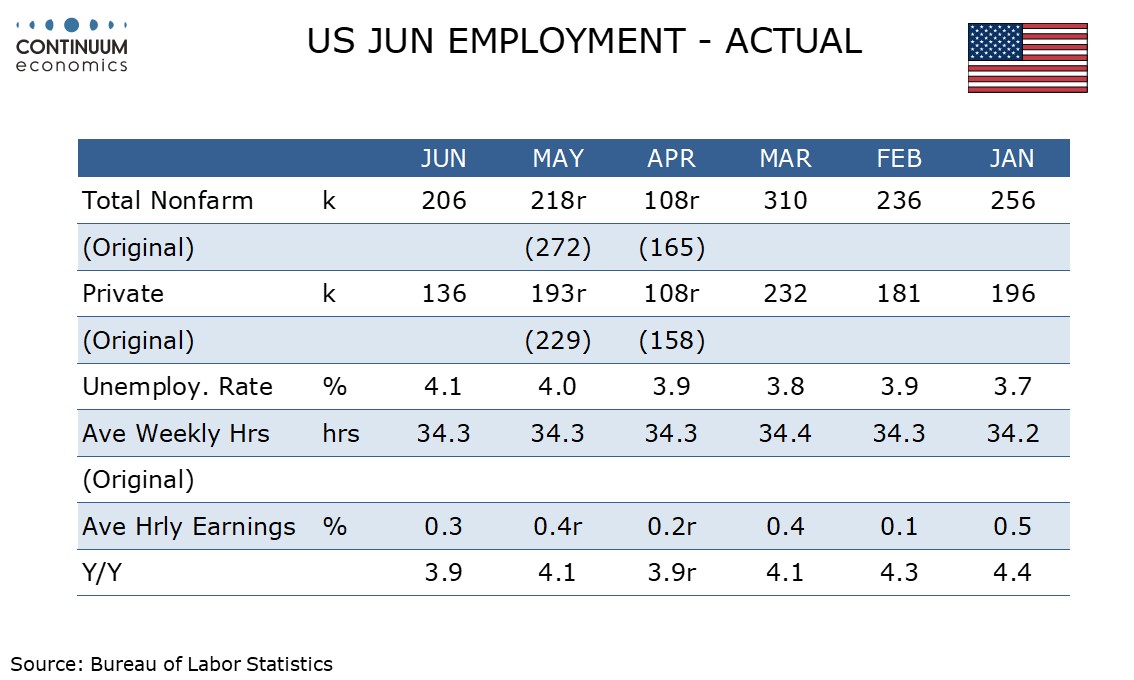

June’s non-farm payroll is slightly stronger than expected in the overall gain of 206k, but with significant negative back month revisions of 111k, while private sector payrolls rose by a weaker than expected 136k. With average hourly earnings up a moderate on consensus 0.3% and unemployment up to 4.1% from 4.0% the report is consistent with some loss of labor market momentum.

May’s payroll was revised to 218k from 272k with April revised to 108k from 165k. Private payrolls saw May revised to 193k from 229k and April to 108k from 158k, meaning a net of 86k in negative private payroll revisions. The 3-month average for overall payrolls of 177k is the lowest since January 2021.

The household survey which calculates the unemployment rate continues to underperform the payroll with a rise of 116k in employment, falling short of a 277k increase in the labor force and lilting unemployment to 4.1%, the highest since November 2021, from 4.0%. A rising unemployment rate suggests that the economy is now growing below potential as restrictive monetary policy has an impact.

Average hourly earnings rose by 0.287% before rounding and while May was revised up to 0.432% from 0.403% this is outweighed by a downward revision to April to 0.173% from 0.231%. Yr/yr growth fell to 3.9% from 4.1%. The yr/yr rate is still consistent with trend slightly above 0.3% per month but recent data suggest trend is slipping slightly below.

In the in-farm payroll detail government was strong at 70k led by state and local while health care and social assistance remains the strongest sector, rising by 82.4k and explaining over half of the private sector job gain. The main negative was temporary help, falling sharply by 48.9k and this is significant as this is often seen as a leading indicator. Manufacturing was soft at -8k but construction saw a solid 27k increase.

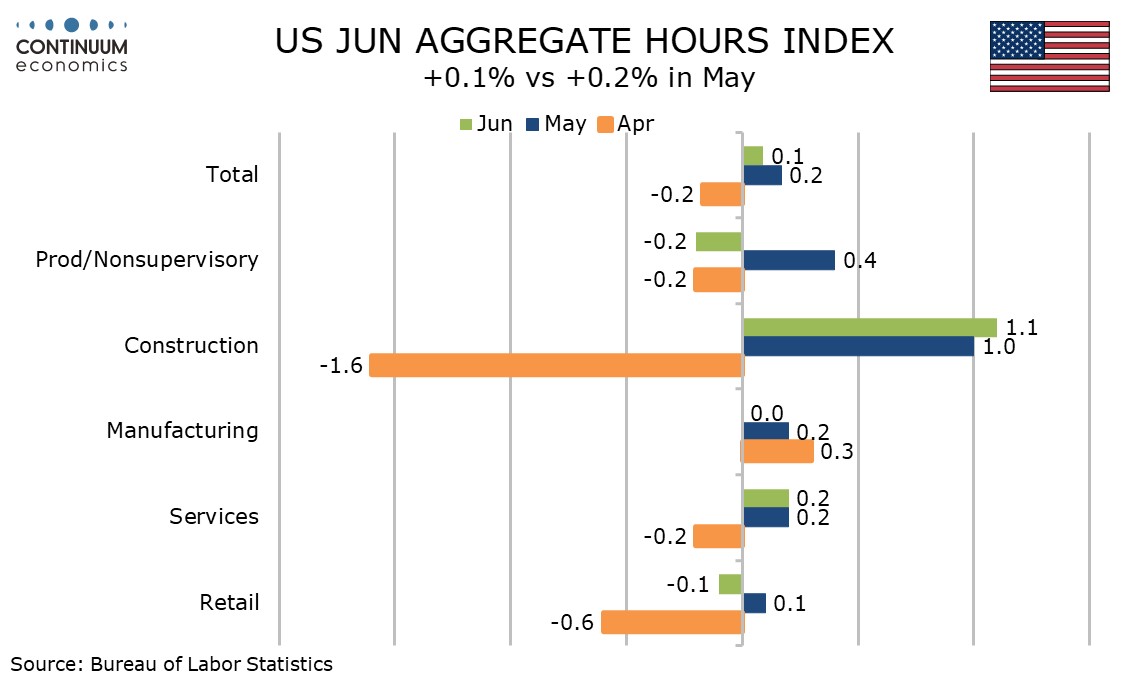

The workweek was unchanged at 34.3 hours as expected meaning that aggregate hours worked increased by 0.1% on the month and 1.6% annualized in Q2. This is up from 0.9% in Q1 so there is no warning of recession but the data is consistent with a moderate pace of growth, and keeps hope for Fed easing later in the year alive.