India’s FY26 Budget: Balancing Growth, Fiscal Prudence, and Political Realities

India's FY26 budget is a strategic attempt to sustain economic expansion while maintaining fiscal consolidation, with the government targeting a nominal GDP growth of 10.1% and a real GDP expansion of 6.3%-6.8%. The budget continues its capex-led growth approach, increasing infrastructure investment, rationalizing trade and customs duties, and providing tax relief to boost consumption. However, it also highlights political considerations, particularly with the BJP facing a reduced parliamentary majority in 2024 and upcoming state elections in 2025. The fiscal deficit target has been set at 4.4% of GDP, reflecting the government’s commitment to deficit reduction, yet there are concerns over revenue collection and the sustainability of tax cuts.

The Union Budget 2025-26 is a carefully calibrated exercise in balancing economic expansion, fiscal consolidation, and political pragmatism. With nominal GDP expected to grow by 10.1% and real GDP growth projected at 6.3%-6.8%, the budget underscores the government’s intent to sustain economic momentum amid global uncertainties. However, underlying shifts in fiscal priorities, taxation policies, and trade measures reflect both structural and political compulsions, especially in light of the BJP’s reduced parliamentary majority in the 2024 elections and upcoming state elections in 2025.

At its core, the budget signals three major themes: a pivot toward rural development, continued focus on capital expenditure, and a shift in trade and customs policies to enhance global competitiveness. While these measures support economic resilience, challenges in revenue generation, fiscal consolidation, and inflation management remain significant.

Shifting Priorities: Rural Focus and Consumption-Led Growth

The budget’s focus on rural development reflects a clear political and economic recalibration. The government has introduced several rural-focused schemes, including the PM Dhan-Dhaanya Krishi Yojana, aimed at revitalizing low-productivity agricultural districts. A new six-year mission for self-reliance in pulses (Aatmanirbharta in Pulses) and a five-year mission for cotton productivity further underline the shift towards strengthening agricultural output and rural incomes.

The government has also increased allocations for MSMEs, enhanced credit access, and raised investment and turnover limits by 2.5 times, aiming to stimulate rural entrepreneurship. However, this shift comes at the cost of urban development, with the Ministry of Housing and Urban Affairs’ budget allocation reduced. While the Urban Challenge Fund of INR 1tn has been set up to promote “Cities as Growth Hubs”, the government’s decision to prioritize rural infrastructure and social spending raises questions about the long-term sustainability of India’s urban expansion.

Fiscal Consolidation vs. Tax Relief: A Delicate Balancing Act

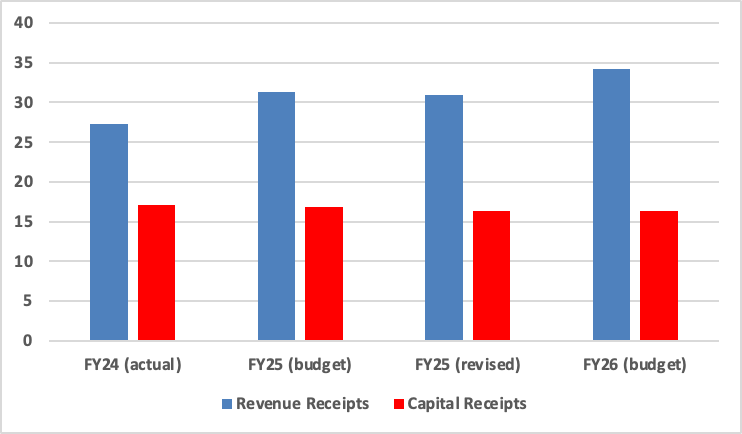

The central government anticipates revenue receipts of INR 34.96tn in FY26, reflecting an 11.1% yr/yr. The majority of this growth will stem from tax revenues, projected to rise by 12.5% yr/yr to INR 28.37tn, supported by robust corporate tax, income tax, and GST collections. Additionally, non-tax revenue is expected to reach INR 5.83tn, up 9.8% yr/yr, largely driven by dividends from state-owned enterprises and surplus transfers from the Reserve Bank of India (RBI).

Figure 1: Government Revenue Trends (INR tn)

Source: Finance Ministry, Continuum Economics

On the expenditure side, total spending is forecasted to grow 7.6% yr/yr to INR 50.65tn, primarily driven by a 9.8% increase in capital expenditure, which is set to reach INR 11.21tn, accounting for 3.1% of GDP. The government continues to emphasize infrastructure development, with grants to states and autonomous bodies for capital investments rising sharply by 42% yr/yr. Revenue expenditure is projected to grow 6.4% yr/yr to INR 39.44tn, with nearly 30% allocated to interest payments, which are expected to rise 11.2% yr/yr, reflecting sustained borrowing commitments. Subsidy rationalization efforts continue, with petroleum subsidies being reduced, while food and fertilizer subsidies remain intact to ensure rural welfare and food security. Defence spending has also been raised to INR 6.81tn, reinforcing national security and procurement of advanced technology.

Figure 2: Major Budgetary Outlay (INR bn)

| Major Expenditure | INR bn |

| Defence | 4917.32 |

| Rural Development | 2668.17 |

| Home Affairs | 2332.11 |

| Agriculture and allied activites | 1714.37 |

| Education | 1286.5 |

| Health | 983.11 |

| Urban Development | 967.77 |

| IT and Telecom | 952.98 |

| Energy | 811.74 |

| Commerce and Industry | 655.53 |

| Social welfare | 600.52 |

| Scientific departments | 556.79 |

Source: Finance Ministry, Continuum Economics

Among major ministry allocations, the Ministry of Finance remains the largest recipient, with INR 19.39tn (38.28% of total government expenditure), covering debt servicing, subsidies, and financial sector reforms. The Ministry of Defence is allocated INR 6.81tn (13.45% of total spending), focusing on modernizing defence infrastructure and strengthening border security. The Ministry of Road Transport and Highways will receive INR 2.87tn, prioritizing expressway development and logistics enhancement, while the Ministry of Railways has been earmarked INR 2.55tn to support network modernization, metro expansion, and high-speed rail projects. Notably, the Ministry of Housing and Urban Affairs has seen its allocation reduced to INR 967.7bn, signaling a shift toward rural development priorities.

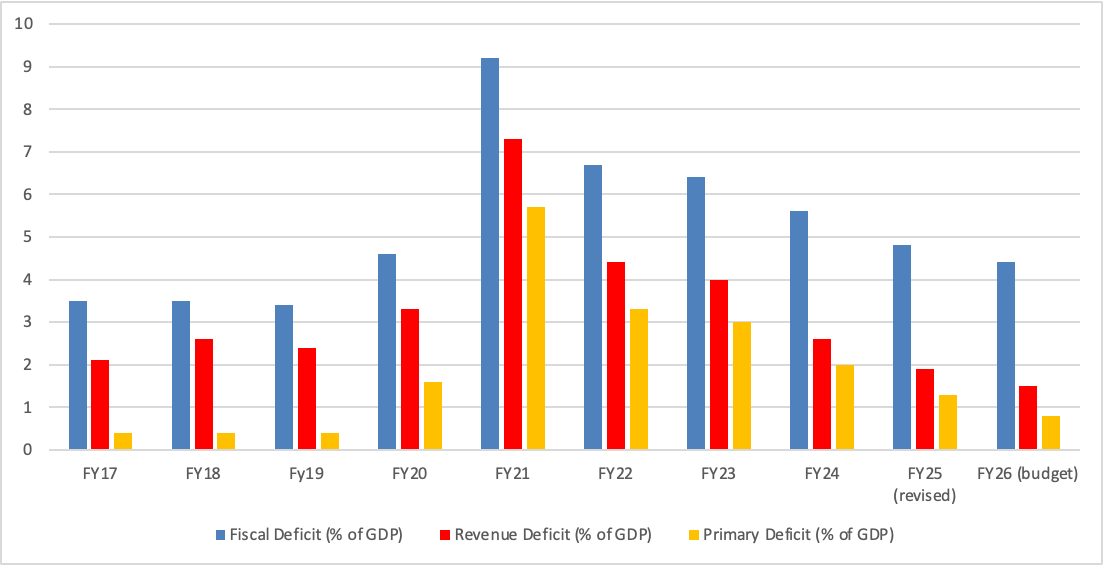

Figure 3: Government Deficit Metrics (% of GDP)

Source: Finance Ministry, Continuum Economics

The fiscal deficit for FY26 is targeted at 4.4% of GDP, maintaining the government’s trajectory of gradual fiscal consolidation. This is in line with the medium-term goal of bringing the fiscal deficit below 4.5% by FY27. The revised roadmap also aims to gradually lower the central government’s debt-to-GDP ratio to 50% by FY31, with a projected decline to 56.1% in FY26 from 57.1% in FY25. However, long-term fiscal stability will depend on sustained revenue growth and prudent subsidy management, particularly in sectors such as food and fertilizers, which have historically posed fiscal pressures.

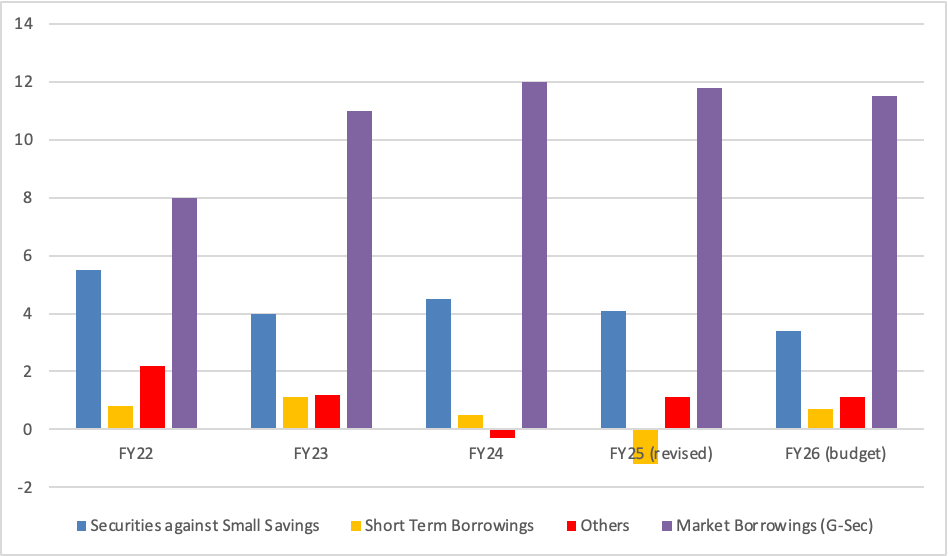

To finance the fiscal deficit, gross market borrowings are budgeted at INR 14.8tn, with net borrowings set at INR 11.5tn, both higher than the INR 10.5tn recorded in the previous budget. The government plans to allocate 99% of borrowed funds toward effective capital expenditure, ensuring that debt is utilized for productive investments. Additionally, a debt switch worth INR 2.5tn is planned to replace older securities with new ones, a move expected to optimize debt servicing without impacting overall fiscal stability. The challenge for the government is delivering on growth-friendly policies without jeopardizing fiscal consolidation goals, particularly with upcoming state elections creating political pressure for populist spending.

Figure 4: Government Budget Financing (INR tn)

Source: Finance Ministry, Continuum Economics

Tax Measures

The government has committed to a fiscal deficit of 4.4% of GDP in FY26, continuing its medium-term deficit reduction roadmap. However, this fiscal prudence is being tested by the introduction of tax cuts aimed at boosting household consumption. The new tax regime (NTR) now provides a tax-free income threshold of INR 1.2mn, along with additional TDS exemptions on rental income and senior citizen savings.

While these measures are intended to stimulate consumer spending, they also pose risks to revenue collection. The possibility of slippages in revenue collection targets, especially with India’s revenue-to-GDP ratio remaining lower than its emerging market peers cannot be ruled out. The government’s dependence on RBI dividends, expected at INR 2.6tn, offers some fiscal breathing room, but this is not a sustainable long-term revenue source. If tax revenues underperform, India’s fiscal consolidation efforts could be at risk. Another major policy shift is the extension of the time limit to file updated income tax returns from two years to four years, which could increase voluntary tax compliance, but also delay tax collection receipts. Moreover, the government has rationalized TDS and TCS provisions, reducing tax compliance burdens but potentially impacting tax inflows. The tax relief, majorly aimed at the large middle income voting population, follows the ruling government's setback in the June 2024 elections, when it lost several seats in parliament. The urban population reportedly disgruntled with persistent inflation eroding disposable income, amid high level of taxes did not vote for the Modi-government as seen in previous elections of 2024 and 2018. These measures also reflect the ruling party's attempt to pacify this voter base and address rising inflation concerns.

Trade and Customs Reforms: Strengthening Global Competitiveness

The budget’s trade policies reflect a strategic shift towards increasing India’s competitiveness in global markets. The government has implemented a significant rationalization of customs duties and tariff slabs, reducing the number of tariff categories to just eight. This comes at a time when India has attracted a lot of criticism from the US President Trump. President Trump has called India "tariff-king" in recent weeks, and these measures also reflect the government of India's proactive measure to shake off some retaliatory tariffs. Key tariff reductions include:

- Motorcycles below 1,600cc: Duty reduced from 50% to 40%.

- Motorcycles above 1,600cc: Duty slashed from 50% to 30%.

- Carrier-grade Ethernet switches: Reduced from 20% to 10%.

- Synthetic flavoring essences: Reduced from 100% to 20%.

- Elimination of tariffs on specific waste and scrap items to support domestic manufacturing.

Additionally, the Basic Customs Duty (BCD) exemptions have been expanded to include 36 new life-saving drugs, lithium-ion battery scrap, cobalt powder, and 12 other critical minerals. These changes aim to lower input costs, promote domestic value addition, and enhance India’s export competitiveness. However, the review of import tariffs on over 30 items, including luxury cars and solar cells, suggests that further trade policy adjustments are on the horizon.

Sectoral Highlights: Infrastructure, Manufacturing, and Energy Transition

Infrastructure Investment and Capex Push

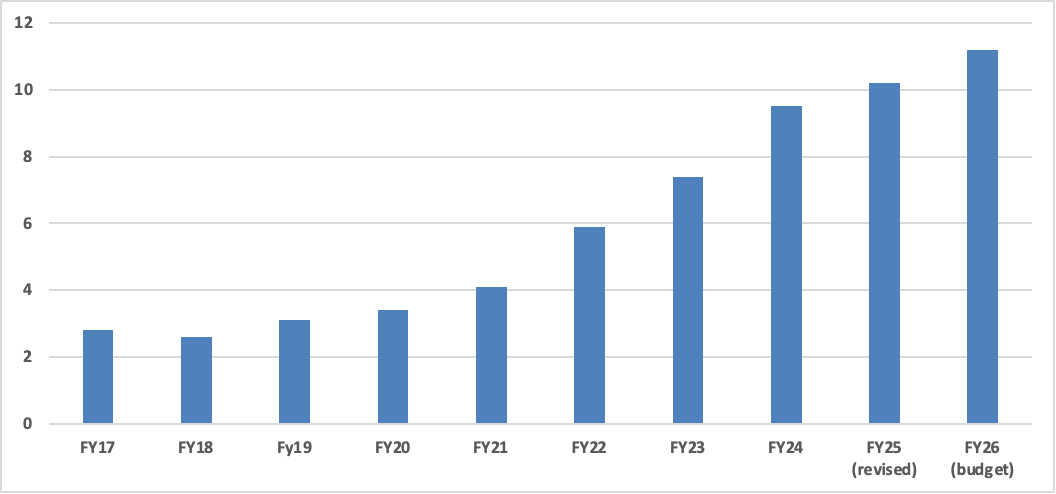

The budget maintains its strong capital expenditure focus, allocating INR 11.21tn (3.1% of GDP) towards infrastructure. This includes INR 1.5tn in interest-free loans to states to support capital projects. The Maritime Development Fund of INR 250bn aims to modernize port infrastructure, while the revamped UDAN scheme is set to enhance regional air connectivity. The government has also announced a second Asset Monetization Plan (2025-30), targeting INR 10tn in capital generation.

Figure 5: Government Capital Expenditure Trends (INR tn)

Source: Finance Ministry, Continuum Economics

Manufacturing and Industrial Growth

The National Manufacturing Mission has been introduced to support large-scale electronics manufacturing and sustainable production initiatives. The government’s decision to raise the FDI cap in insurance from 74% to 100% is a major policy shift, expected to attract significant foreign investment into India’s financial sector.

Energy Transition and Sustainability

The Nuclear Energy Mission (INR 200bn) focuses on the development of Small Modular Reactors (SMRs), while INR 50bn has been allocated for green hydrogen projects. The government has also expanded exemptions on lithium-ion battery imports, supporting India’s EV and renewable energy ecosystem.

Macroeconomic Risks and Global Uncertainties

Despite a robust growth outlook, the budget’s underlying risks remain tied to global and domestic uncertainties. Inflation has moderated to 4.3% y/y in January, but rising global commodity prices, climate-related shocks, and external demand risks could disrupt growth. Moreover, India’s debt-to-GDP ratio remains higher than many of its emerging market peers. While deficit reduction targets are encouraging, any slowdown in nominal GDP growth below the assumed 10.5% medium-term trajectory could make achieving debt reduction goals challenging. The government’s ability to adhere to its fiscal roadmap will be critical to avoiding potential sovereign rating pressures.

India’s FY26 budget successfully balances economic ambition with fiscal discipline, but political realities and economic uncertainties present challenges. The focus on rural welfare, tax relief for the middle class, and infrastructure expansion underscores a strategy to stimulate domestic demand ahead of the 2025 state elections. However, concerns over revenue generation, fiscal sustainability, and inflationary pressures persist.

The budget’s success will depend on the government’s ability to manage fiscal trade-offs while sustaining growth. If tax revenues fall short or pre-election spending pressures intensify, India’s deficit targets could slip, affecting investor confidence.