Preview: Due February 13 - U.S. January CPI - Subdued Start to the New Year

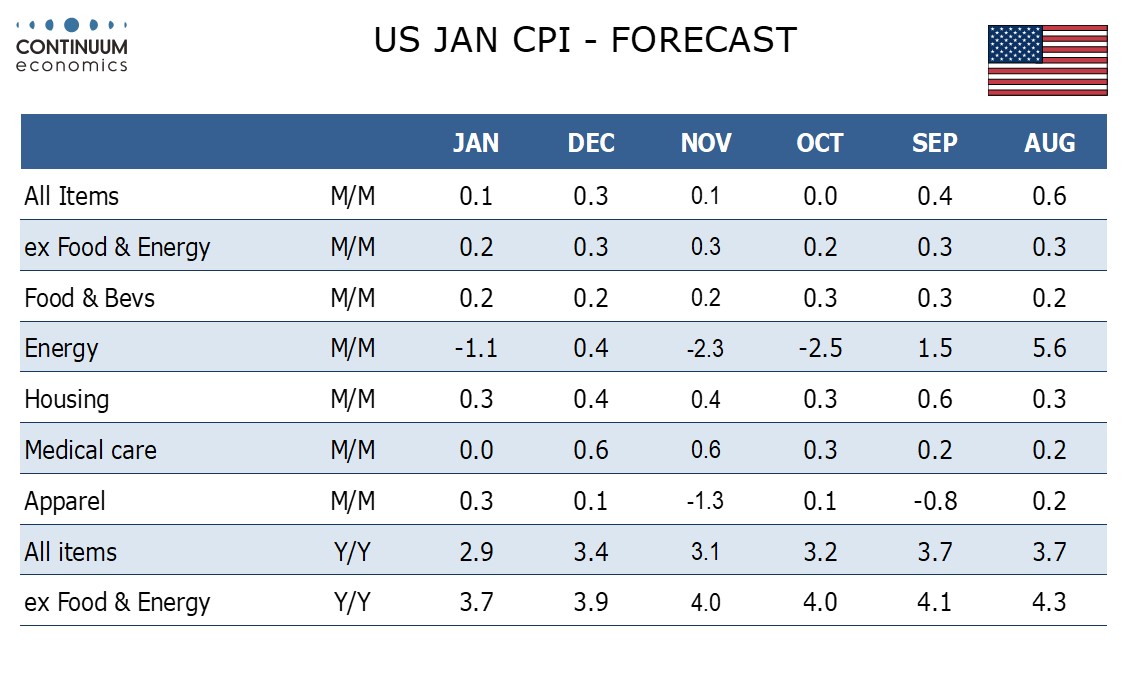

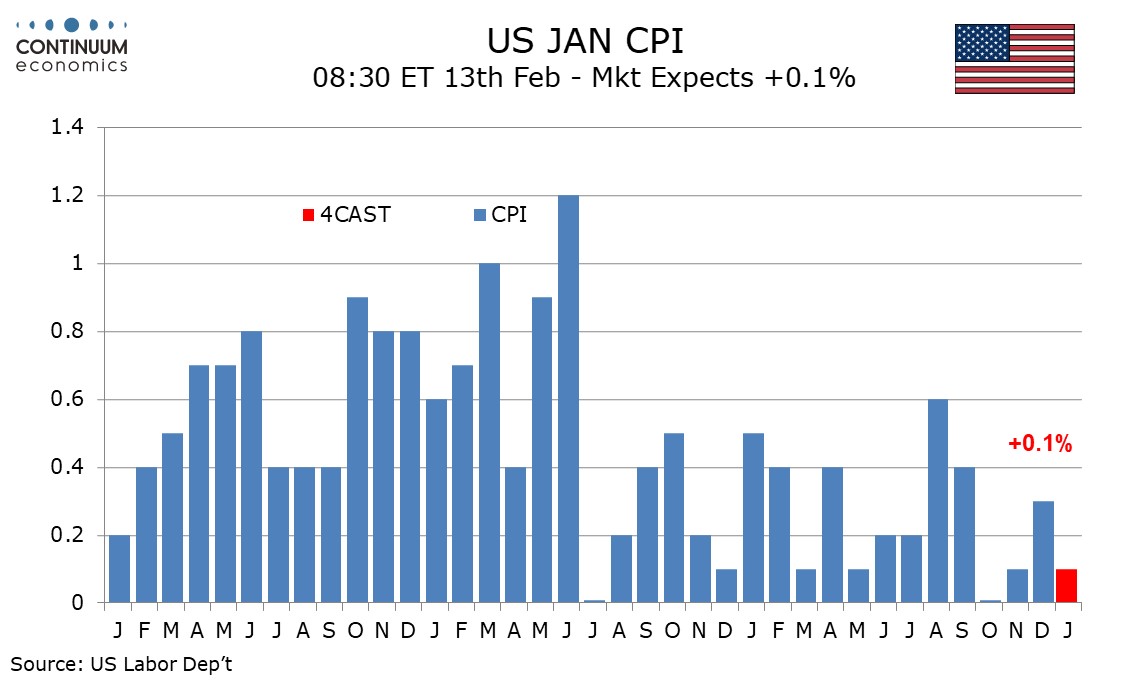

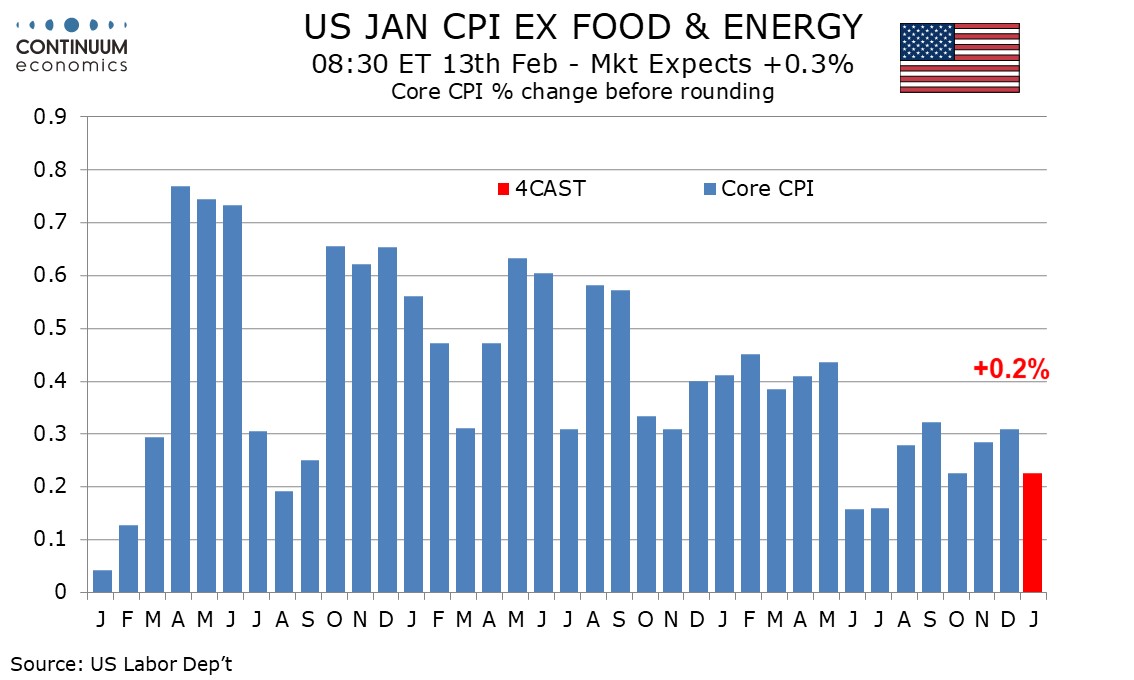

We expect January CPI to increase by 0.1% overall and 0.2% ex food and energy, with our forecasts before rounding being 0.13% overall and 0.23% ex food and energy. Still, the ex food and energy rate would then be slower than the 0.3% gains seen in November and December.

We write this preview before the February 9 release of updated seasonal adjustments. A year ago seasonal adjustments saw early 2022 data revised down and late 2022 revised up, and there is some risk for a repeat given early 2023 data being stronger than late 2023. Still, we do not expect any major revisions, and it should remain clear that inflation slowed in the second half of 2023.

January is an important month for CPI data as it reflects pricing decisions taken in the New Year. We feel the data will reflect the more subdued current inflation picture, and see only a modest increase. Housing is likely to remain relatively firm but risk is for some slowing, while medical care is likely to maintain its stronger tone of late 2023 on updated methodology. However elsewhere few significant inflationary pressures are likely to be visible. Strength in recreation seen in December and used autos seen in November are unlikely to be matched, with used autos in particular set for a weak month.

A modest decline in gasoline prices is likely to see overall CPI underperform the core rate. Food we expect to see a third straight 0.2% increase. We expect yr/yr CPI to slow to 2.9%, its slowest since March 2021, from 3.4%, while the yr/yr core rate slips to 3.9% from 3.7%. This would be the slowest since April 2021.