USD, JPY, EUR, GBP flows: USD better bid

USD firmer, but basis for gains looks flimsy

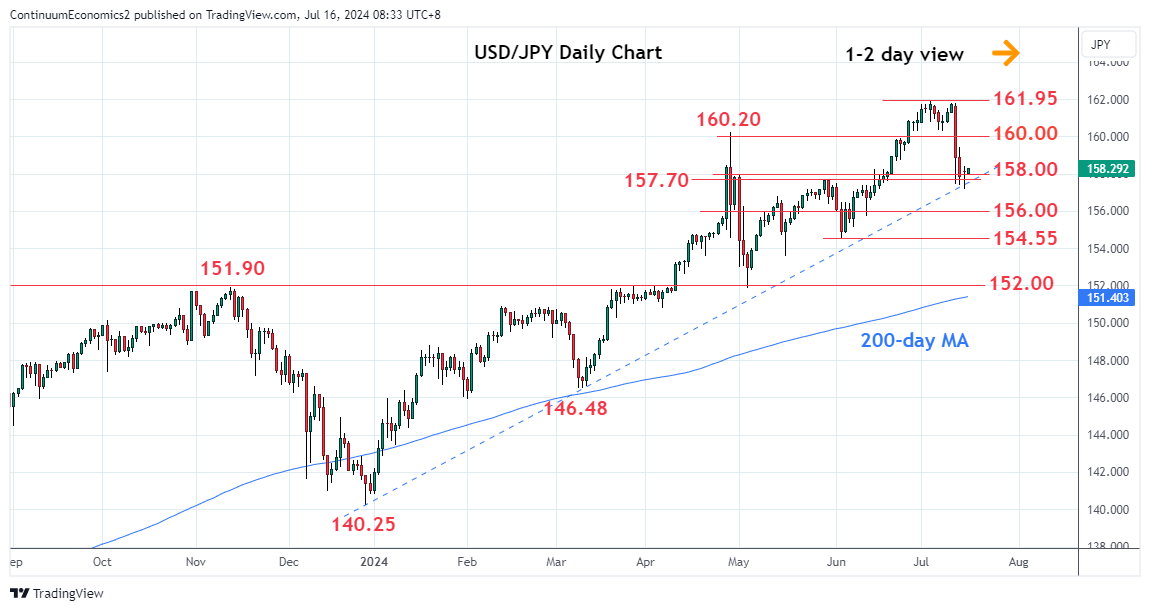

USD/JPY climbed higher through the Asian session, despite renewed verbal intervention, this time from chief cabinet secretary Hayashi. He said Japan stands ready to take all possible measures to counter excessively volatile currency moves, and it is important for currency rates to move stably reflecting fundamentals, while excessive volatility is undesirable. He didn’t confirm or deny whether the Japanese authorities had intervened last week, as is standard. Nevertheless, USD/JPY extended its recovery from the trendline support around 157.40 into the high 158s. The JPY is showing a mild recovery in early Europe, but the 157.40 area is now looking like key support near term, while any approach to 160 may well trigger intervention, so this may now represent the short term range.

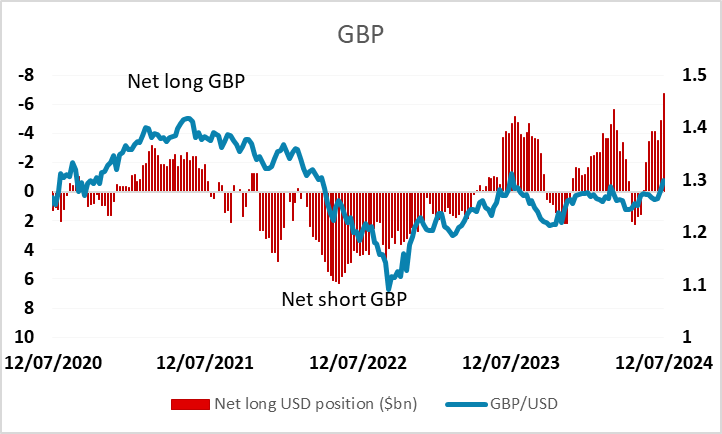

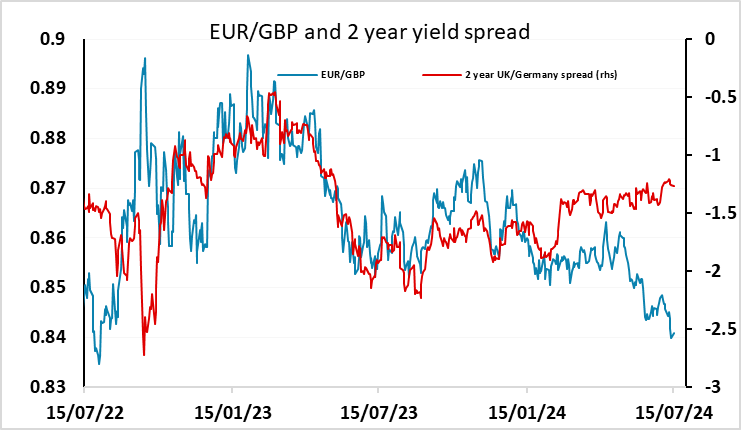

While USD/JPY was the biggest gainer overnight, the USD was generally stronger across the board, despite slightly softer US yields following Powell’s speech overnight when he indicated that progress was being made on reducing inflation, further increasing market expectations of a September Fed easing. The basis for USD strength looks a little flimsy given lower US yields, and EUR/USD should hold close to 1.09 ahead of the ECB meeting on Thursday. GBP remains one of the strongest currencies in the last couple of weeks, but is getting expensive against the EUR at these levels and is already very expensive against the JPY, while speculative positioning looks extended in the CFTC data. Risks may therefore be to the GBP downside with 1.30 looking like a bridge too far on GBP/USD for now.

CFTC data on net long GBP speculative positioning