U.S. May Personal Income and Spending slip, Core PCE Prices above consensus but not alarming

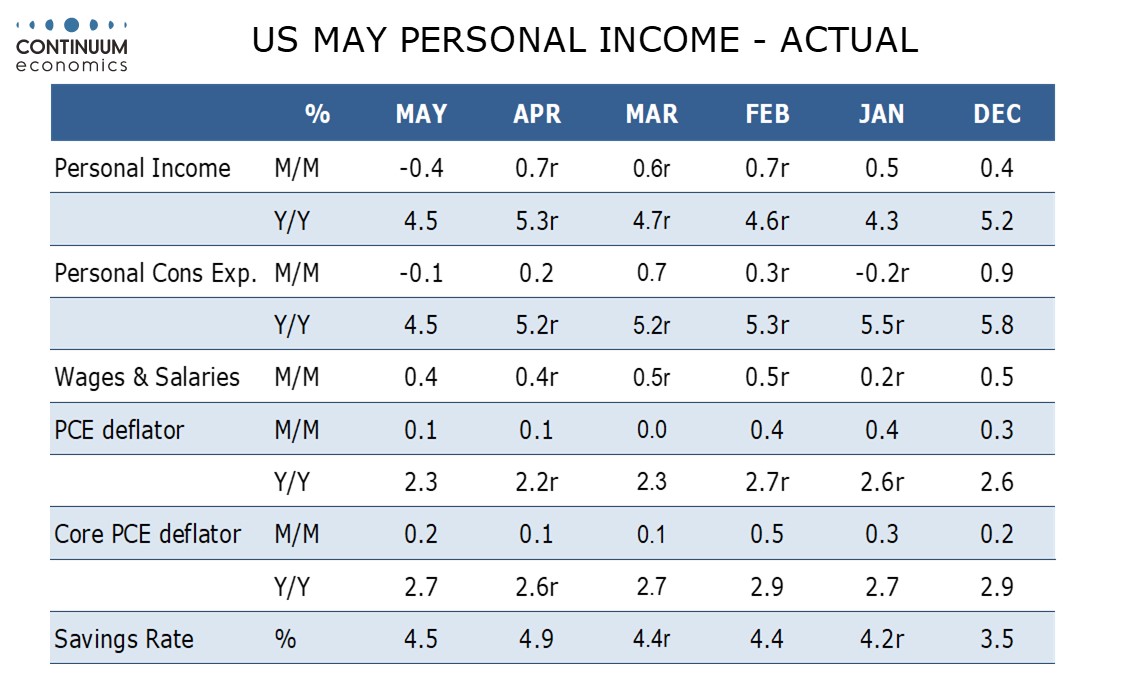

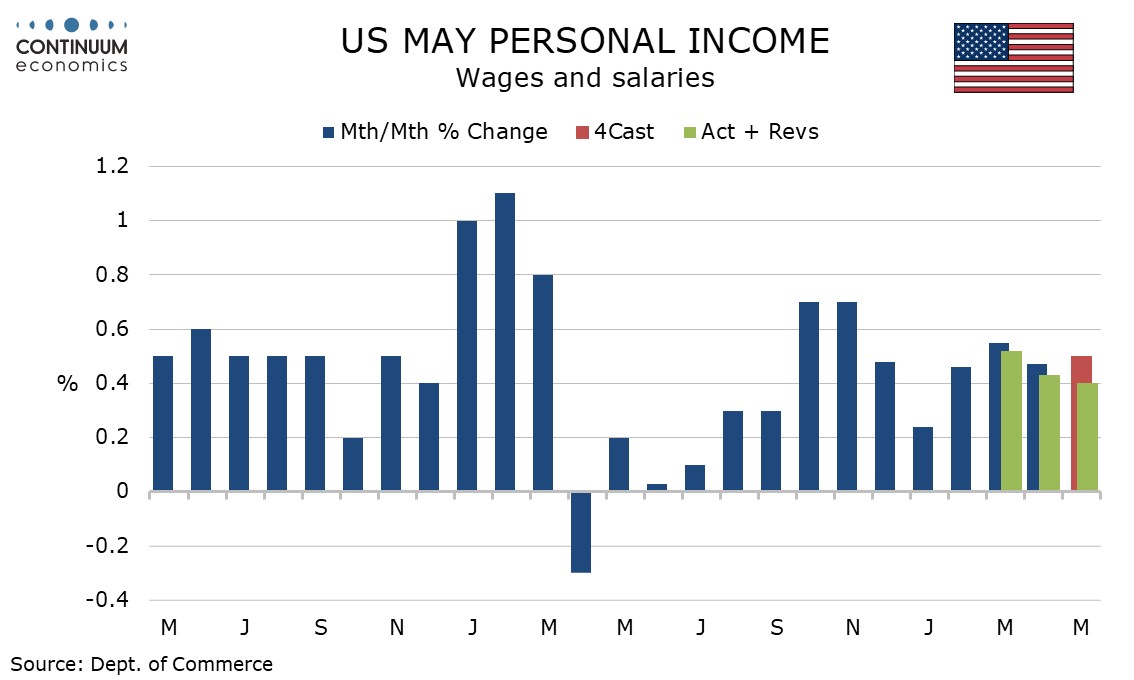

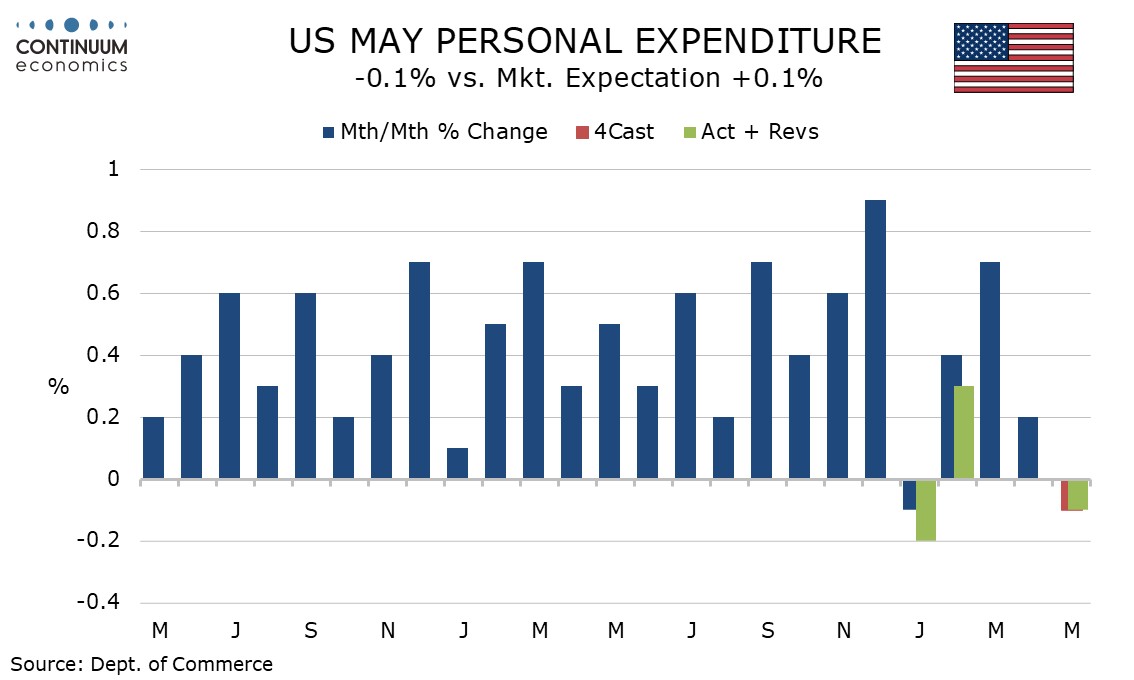

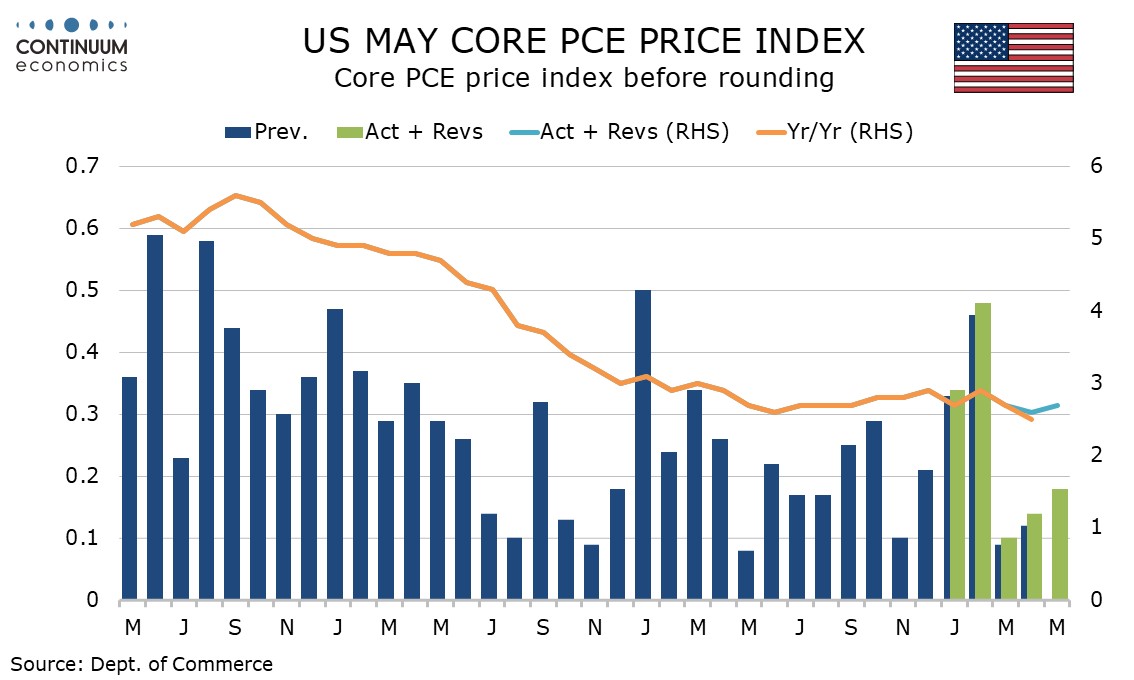

May’s core PCE price index, while not alarming, is at 0.2% a little firmer than expected, with yr/yr growth rising to 2.7% from an upwardly revised 2.6% (from 2.5%) in April. Personal income and spending data is weak, down by 0.4% and 0.,1% respectively.

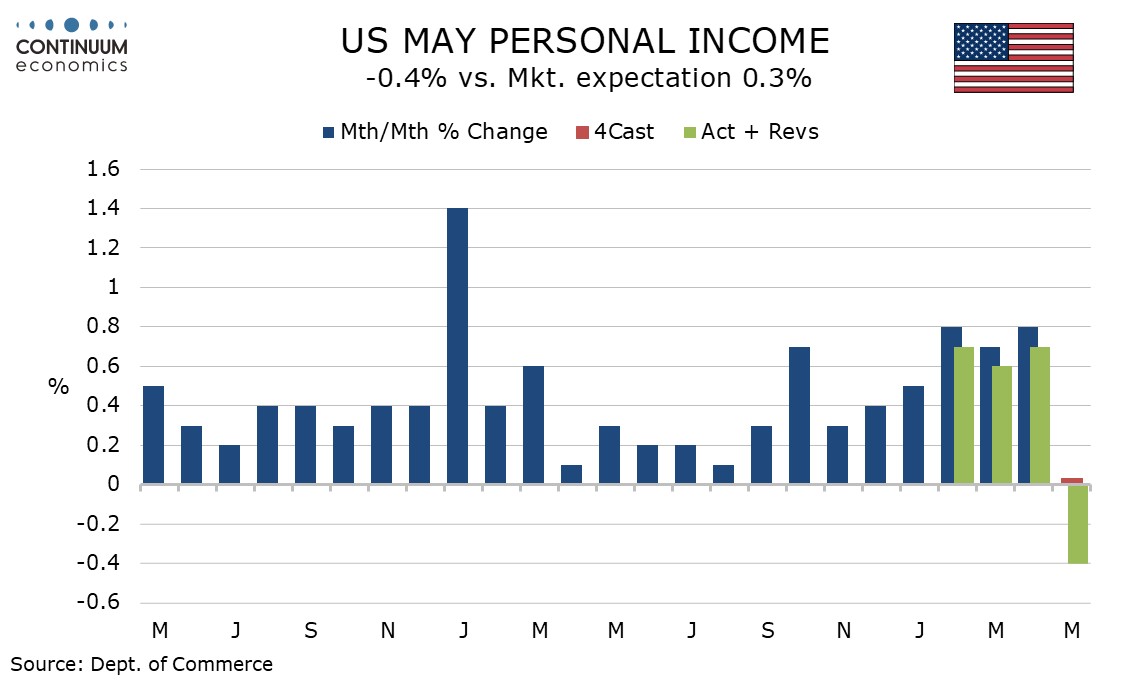

The data incorporates downward revisions to Q1 personal income and spending seen in yesterday’s GDP revision, while April personal income was also revised down, to 0.7% from 0.8%. May personal income saw a respectable 0.4% rise in wages and salaries, though April and May at 0.4% are down from 0.5% in February and March.

Personal income was depressed by a sharp fall in social security which reversed a sharp rise in April from the Social Security Fairness Act, passed at the end of Biden’s term providing a one-time boost. There was also a sharp fall in farm income, reflecting the pattern of payments from the Emergency Commodity Assistance Program.

Personal spending saw a 0.8% fall in goods consistent with retail sales data but also a below trend 0.1% increase in services. The latter follows a subdued 0.2% rise in April and Q1 data that was revised significantly lower in yesterday’s GDP revision so there is clearly some loss of momentum here.

The core PCE price index was up 0.179% before rounding, while each of the last four months was revised marginally higher before rounding, though there were no revisions after rounding. Overall PCE prices rose by 0.1% as expected, with yr/yr growth as expected at 2.3%, though April was revised to 2.2% yr/yr from 2.1%.

May’s PCE price data showed goods up 0.1% for a second straight month, so there is not much impact from tariffs there, and services up 0.2% after gains of 0.1% in April and 0.2% in March, and that is a slowing from trend previously was. Despite the modest upside surprise May’s core PCE price index is not worrying, though yr/yr data remains above target and the Fed is watching incoming data for the tariff-feed through that remains absent for now.