USD flows: Weaker on CPI, more downside seen

Weaker US CPI puts the USD at risk across the board. JPY has the most upside potential longer term, but AUD and GBP may be the best short term performers.

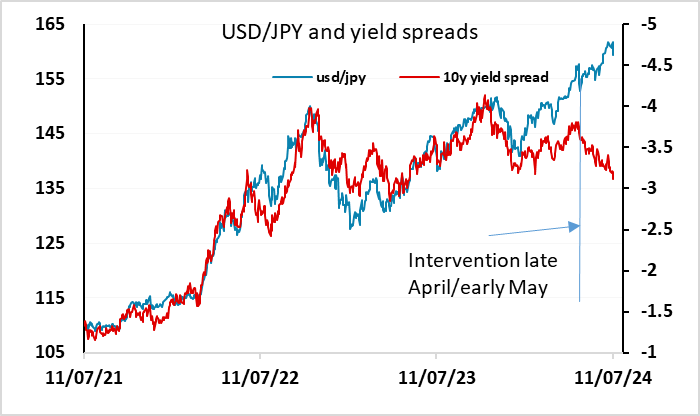

US CPI clearly on the soft side of expectations with a 0.1% decline in the headline and a 0.1% rise in the core. The data has triggered a sharp decline in US yields and the USD, with the JPY initially gaining the most benefit. The market now nearly fully prices a Fed cut in September, with three cuts now priced by year end, so there isn’t a lot more scope to price more easing from here.

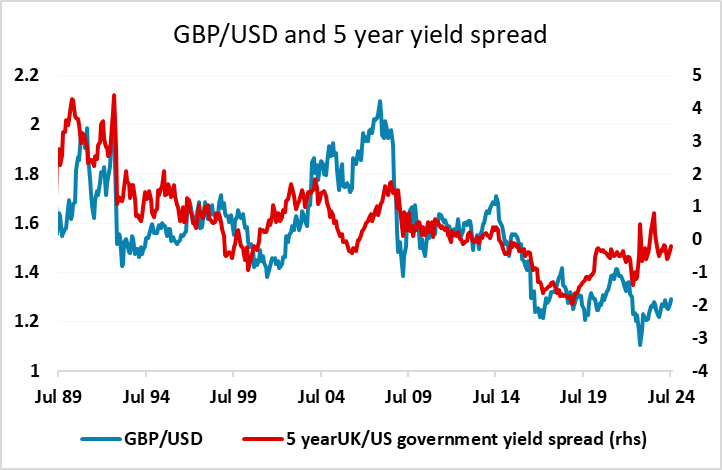

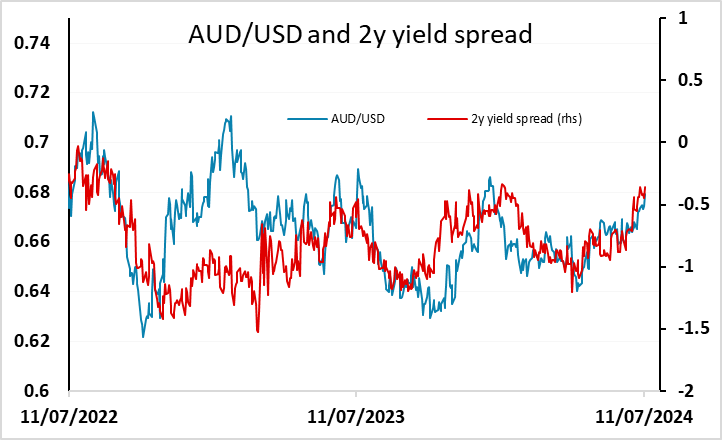

If USD/JPY were to move in line with the yield spread, there is a lot of downside scope, but this hasn’t been happening in the last couple of months, so there may be more scope for USD declines against the higher yielders, with the lower US rate profile supporting riskier assets. AUD/USD can target the year’s highs above 0.68, while GBP/USD has already broken to new highs for the year and may have the highs of last year at 1.3144 in its sights. EUR/USD has a more modest target at the June high of 1.0915. Logically, the JPY ought to benefit the most, as lower yields will typically also mean higher equity risk premia, which tends to favour the JPY in the crosses, but logic hasn’t had a lot to do with the JPY market of late.