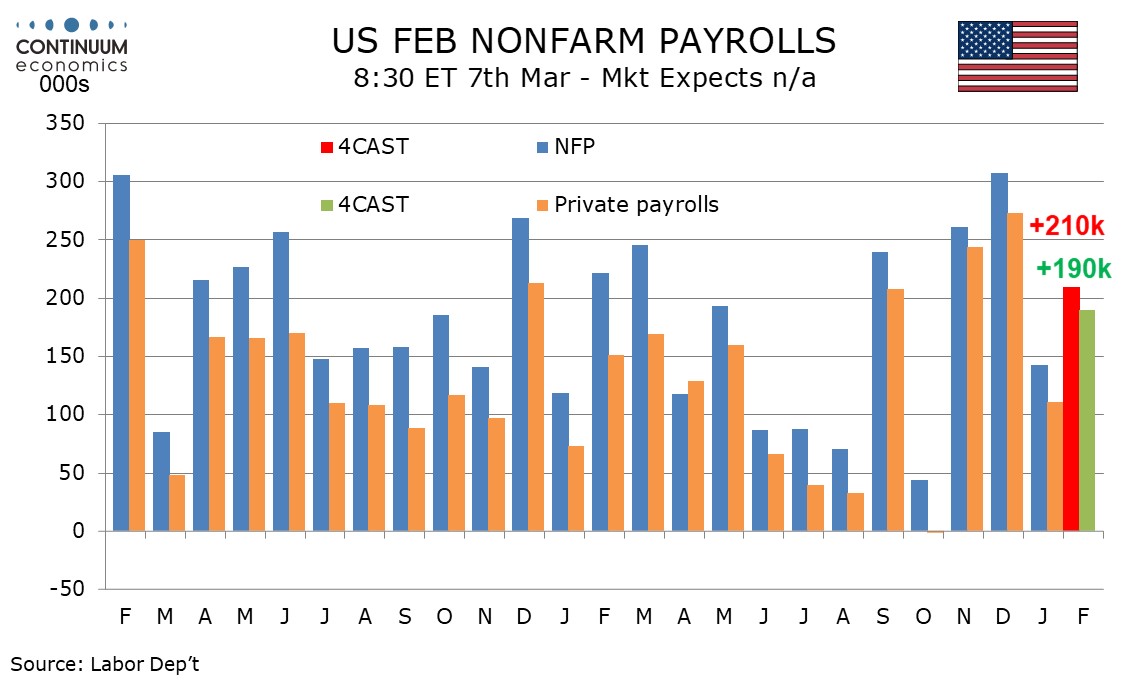

Preview: Due March 7 - U.S. February Employment (Non-Farm Payrolls) - Stronger than January, but slower than November and December

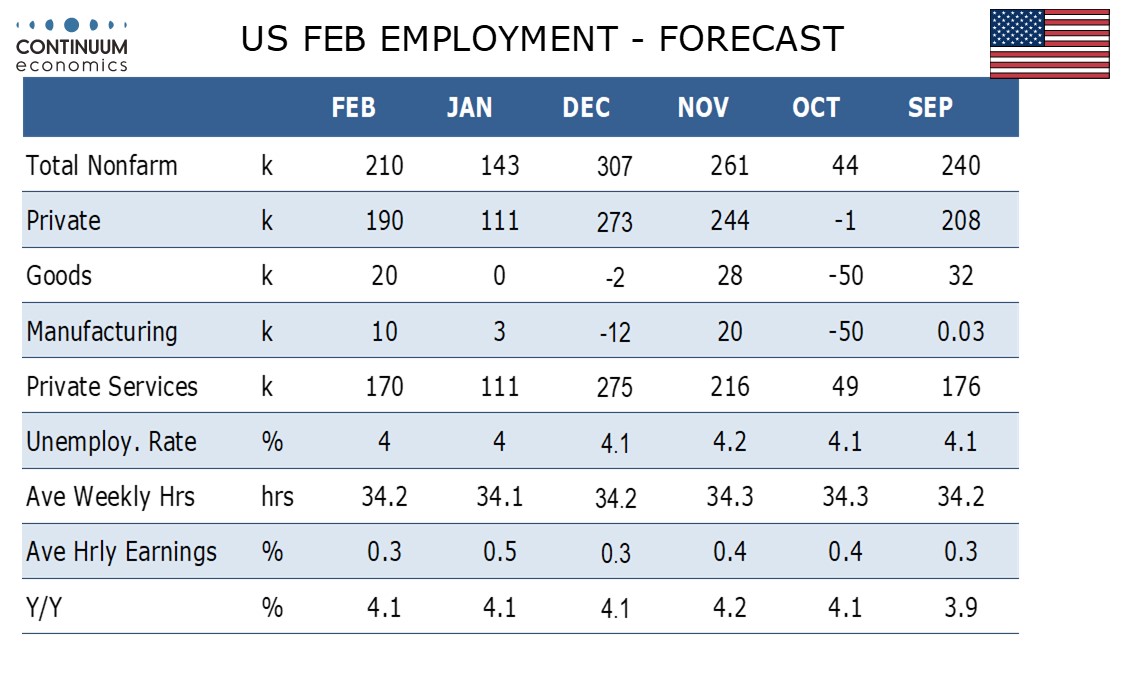

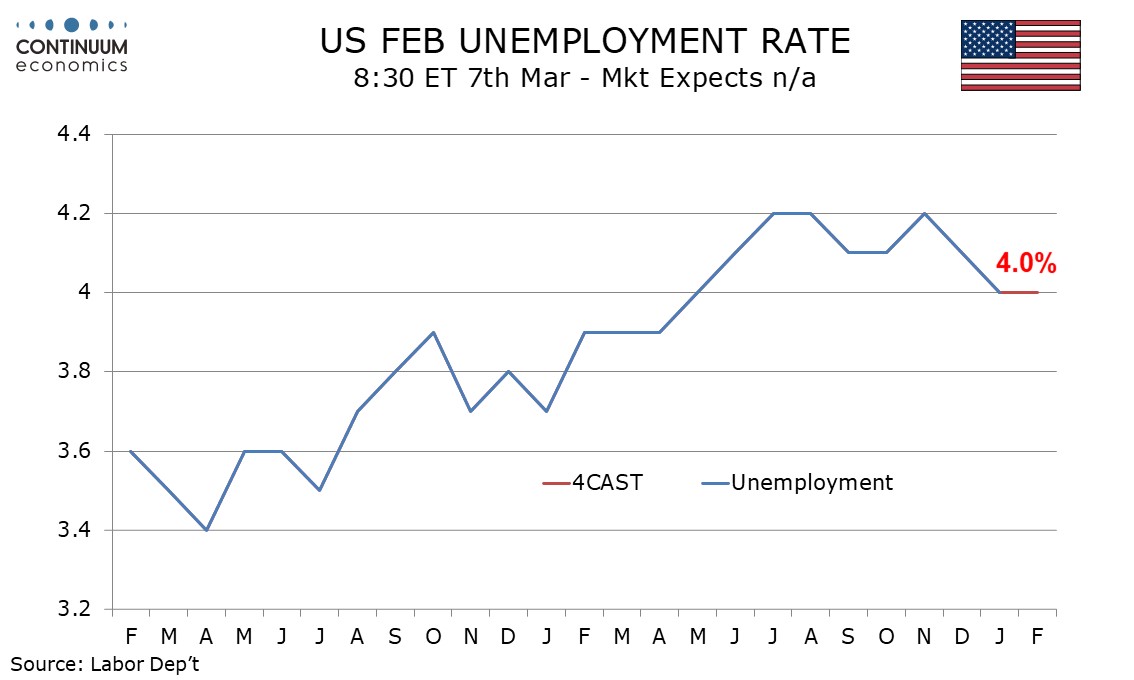

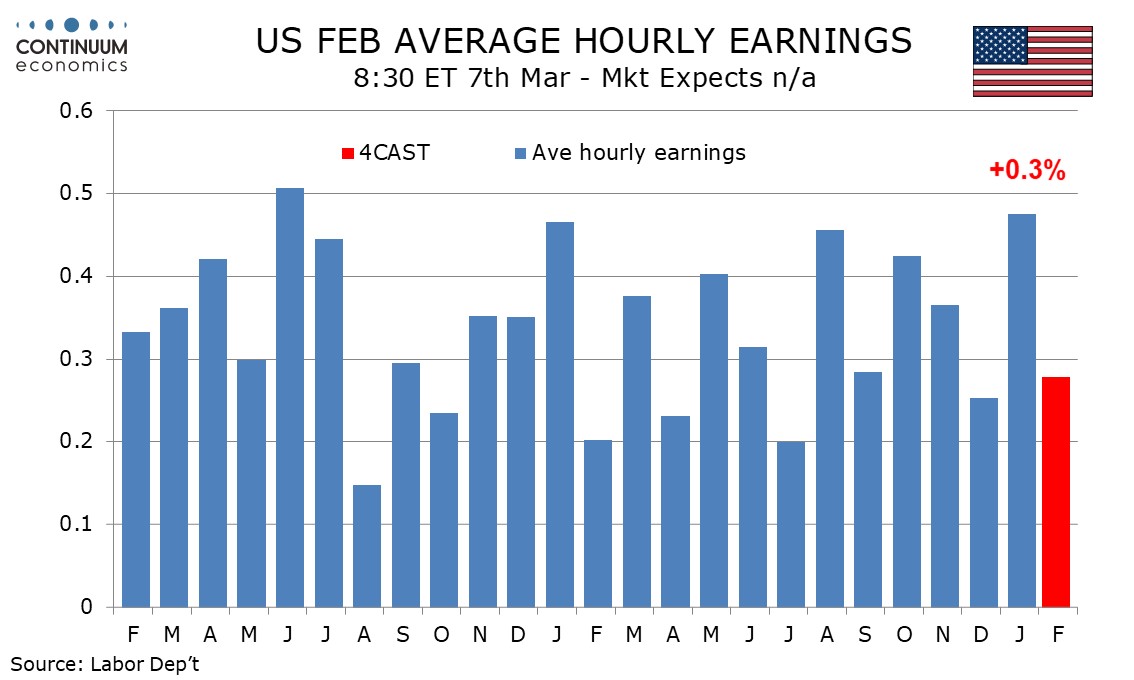

We expect a 210k increase in February’s non-farm payroll, with 190k in the private sector, slightly stronger than in January but slower than in November and December. We expect unemployment to remain at 4.0% and a 0.3% rise in average hourly earnings, following an above trend 0.5% in January.

January’s gain of 143k was probably restrained by bad weather, though gains of 307k in December and 261k in November were inflated by a rebound from October’s weak 44k, which was hit by two hurricanes and a strike at Boeing.

Our forecasts for February are slightly slower than January’s 3-month averages of 237k overall and 209k in the private sector, but stronger than the respective 6-month averages of 178k and 145k. This would be consistent with a recent acceleration in labor market momentum peaking, but no significant weakness yet emerging.

Initial claims are still low, suggesting underlying labor market strength. Weather in February is likely to be less of a negative than in January, though unusually cold weather persisted. A 20k rise in government payrolls would be on the low side of recent trend as Federal layoffs start to rise, but State and Local government hiring is likely to remain firm.

We expect an unchanged unemployment rate of 4.0% with employment growth likely to modestly exceed that of the labor force, but not by enough to reduce the rate before rounding. Lower rates of immigration are likely to restrain labor force growth in the coming months, keeping the unemployment rate low.

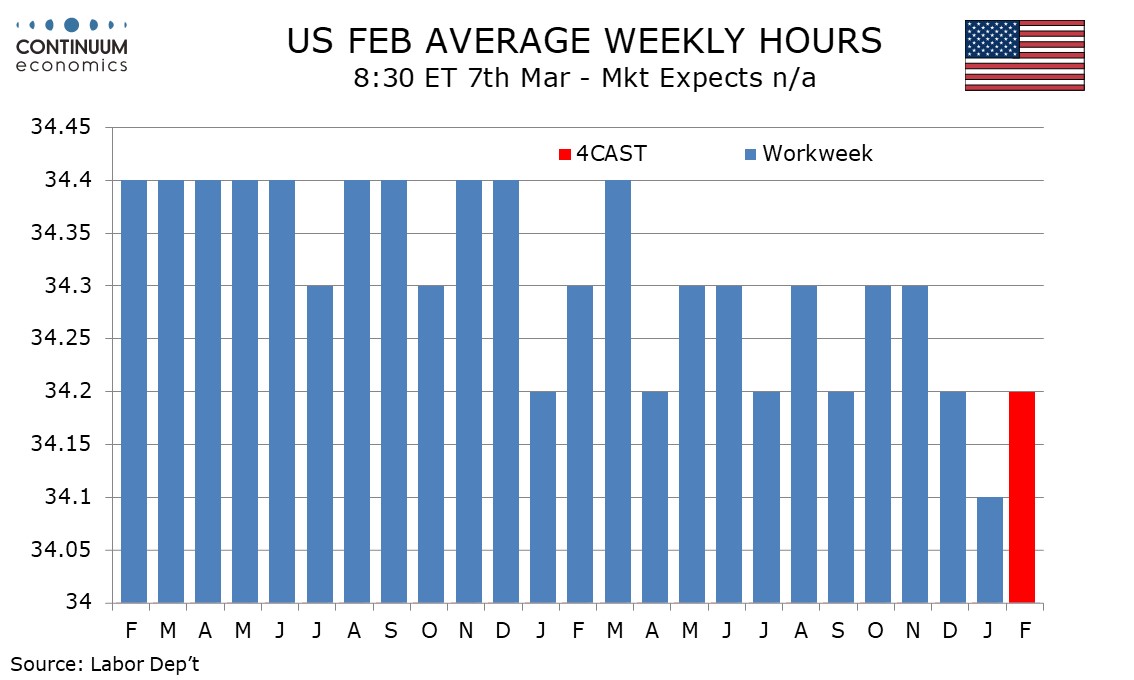

Less harsh weather is likely to see the workweek back at December’s pace of 34.2 hours, up from 34.1 in January which was probably restrained by weather. This will however remain below the 34.3 hours seen in October and November.

An above trend 0.5% rise in average hourly earnings may have been in part on a lower workweek, and we expect a marginally below trend gain in January to 0.28% before rounding, though yr/yr growth would then remain at 4.1% for a third straight month. A tight labor market argues against a sharp slowing in wages.