Turkiye Inflation Preview: Inflation will Likely Soften to Around 30.5% in January

Bottom line: After hitting 30.9% annually in December, we expect Turkiye’s inflation will likely soften moderately to around 30.5% in January despite some noise is expected in next two months' readings as upside-tilted inflation risks will continue to limit the downward trend during the ongoing disinflationary process. Our average inflation forecast stand at 26.5% for 2026 since inflation expectations and pricing behavior remain fragile coupled with sticky housing and education prices. January print will be announced by Turkish Statistical Institute (TUIK) on February 3.

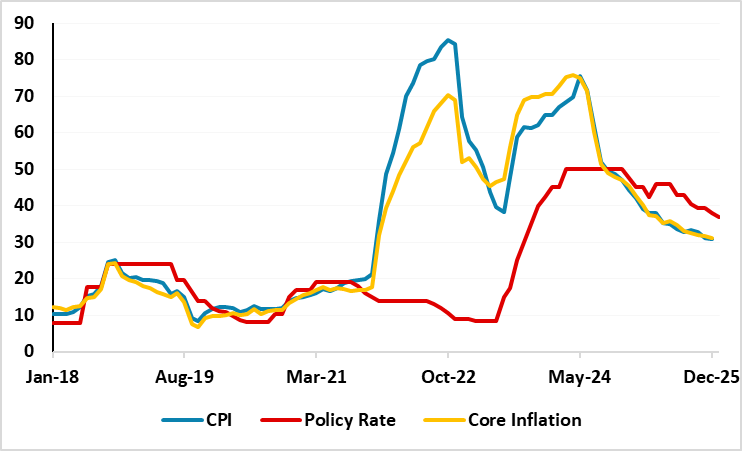

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – January 2026

Source: Continuum Economics

Turkiye’s annual inflation hit 30.9% in December driven by higher housing and education prices. We expect inflation will soften moderately to around 30.5% in January despite some noise is expected in next two months' readings as upside-tilted inflation risks will continue to limit the downward trend during the ongoing disinflationary process. January print will be announced by Turkish Statistical Institute (TUIK) on February 3. We also think moderate tax increases and 27% hike in minimum wage will partly support inflation trajectory despite risks. (Note: Labor and Social Security Minister Vedat Isikhan announced on December 23 that minimum wage in Turkiye will be increased by 27%. The new rate is effective from January 1).

Speaking about the inflation trajectory, the Central Bank of the Republic of Turkey (CBRT) stressed in its MPC statement on January 22 that tight monetary policy will be maintained until price stability is achieved. The CBRT indicated that the MPC will make its policy decisions so as to create the monetary and financial conditions necessary to reach the 5% inflation target in the medium term, adding that decisions will remain predictable, data-driven and transparent.

With the bank committed to disinflation towards its 5% target, we think CBRT will have to proceed carefully on interest-rate adjustments on a meeting-by-meeting basis in 2026 given risks such as sticky services prices coupled with unpredictable outlook for the global economy. We envisage upside surprises in food and energy prices and any accelerated TRY depreciation could derail recovery.

Our average inflation forecast stand at 26.5% for 2026 since inflation expectations and pricing behavior remain fragile coupled with sticky housing and education prices. (Note: According to the market participants survey published by the CBRT in January, market analysts in early 2026 forecasted CPI to be higher than the CBRT’s year-end CPI target between 13%-19%, with estimates around 25% due to persistent inflationary pressures).

As mentioned, we expect the slowdown in inflation to continue in 2026, but with a slower pace as the inflation will stay over the CBRT’s upper band at the end of the year. We continue to envisage it will be difficult to grind sticky inflation from 30%s to 10%s rapidly, taking into account that inflation becomes stickier requiring high interest to remain for some time, and CBRT will have to be cautious with the size of the rate cuts.