Canada September Employment - Stronger particularly in the details but wages slower

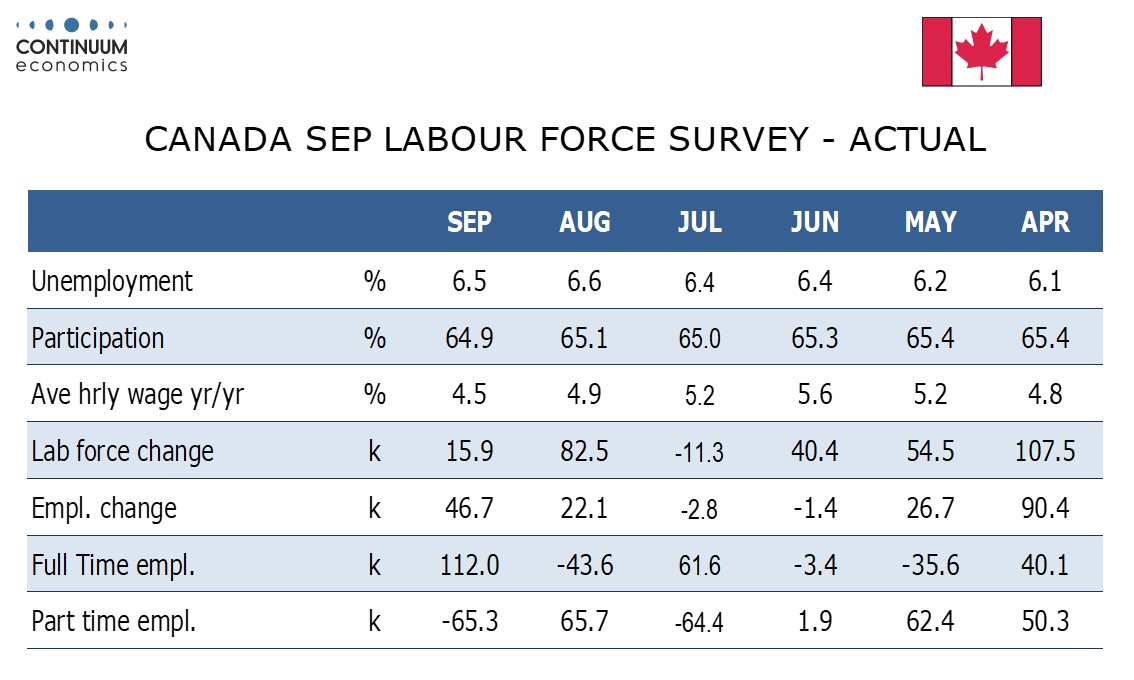

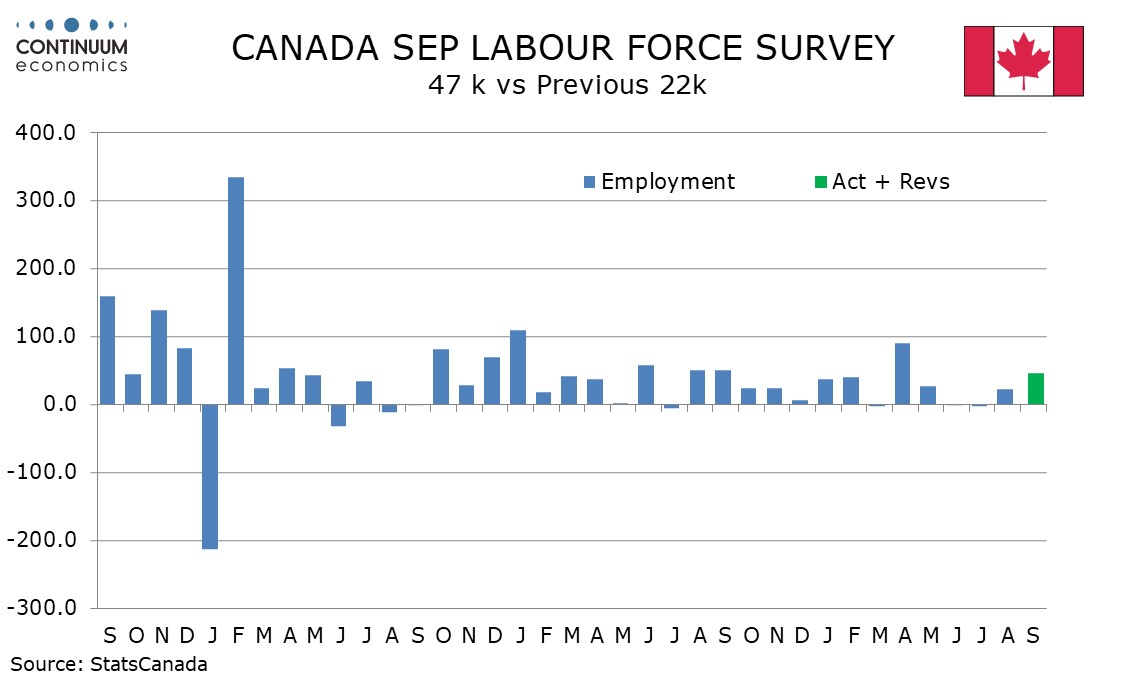

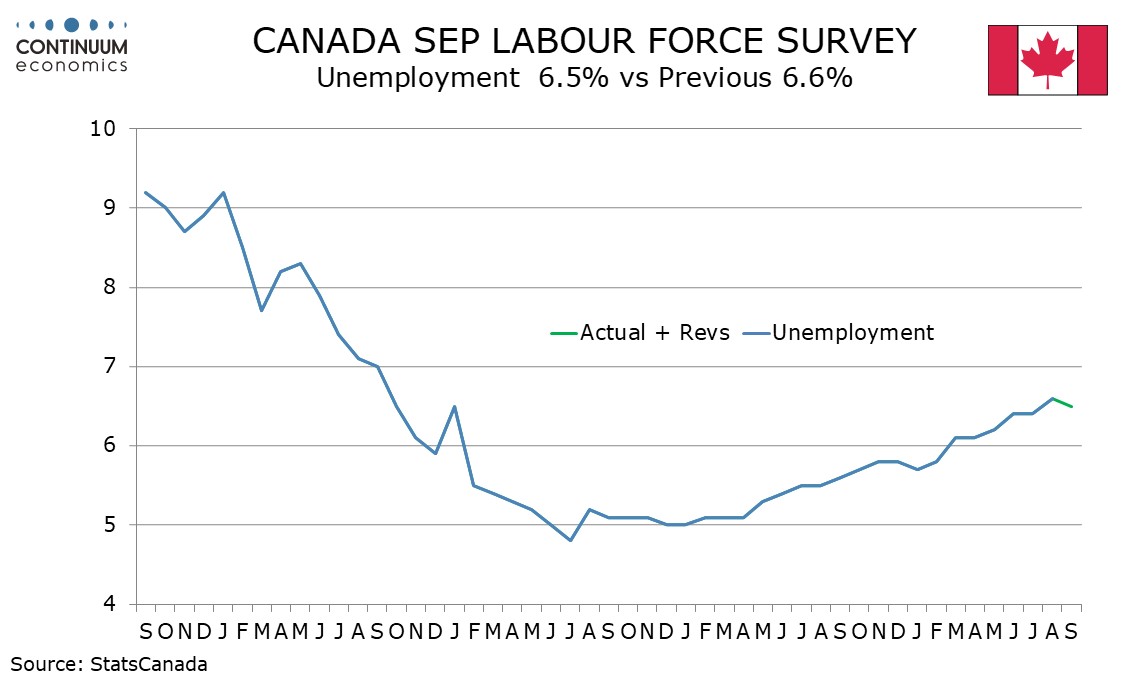

Following four straight fairly unimpressive reports, Canadian employment gained momentum in August with a stronger than expected 46.7k increase in employment that looks stronger still in its details, and a dip in unemployment to 6.5% from 6.6%. The data will make pleasant reading to the Bank of Canada, including a slowing in wage growth to 4.5% yr/yr from 4.9%.

The detail shows a very strong 112k increase in full time employment, rebounding from a 43.6k decline in August, while part time employment fell by 65.3k to reverse a 65.7k rise in August. Private sector employment saw a strong 61.2k increase while self-employment rose by 8.9k, partially offset by a 23.6k decline in the public sector.

Goods producing employment saw a marginal 3.6k decline with manufacturing falling by 4.6k and construction rising by 7.9k. Services rise by 50.2k, with three components (wholesale/retail, professional/scientific/technical, and information/culture/recreation) all up by a little more than 20k, offset by a fall of 11.2k in education, with most other components little changed.

Unemployment fell as the employment gain exceeded a below trend 15.9k fall in the labor force. Unemployment is still well above the 5.0% level that was seen at the start of 2023. This may be starting to put downward pressure on wages, with the softer data not fully explainable by year ago strength. The 4.5% yr/yr rise in the hourly wages of permanent employees is the slowest since June 2023. However, one month, either in wages or employment growth, does not make a trend.