FOMC leaves rates unchanged, dots unchanged but skew more hawkish

The FOMC has left rates unchanged at 4.25-4.5% as expected. The median dots are unchanged but economic activity forecasts are weaker and the inflation forecast for 2025 is significantly stronger showing concern over the impact of tariffs. The statement notes increased uncertainty and announced a slowing of the pace of Quantitative Tightening in April.

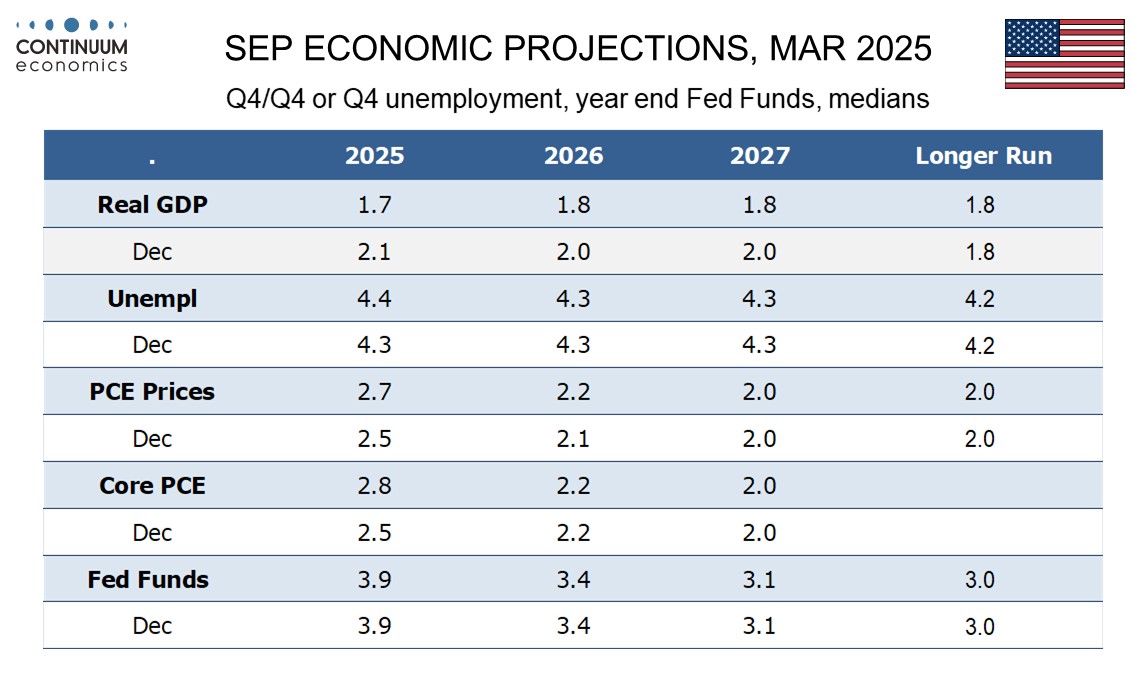

The Median dots still look for 50bps of easing in 2025, 50bps in 2026 and 25bps in 2027, taking the 2027 Fed Funds target to 3.125%, slightly above an unrevised 3.0% long run-neutral estimate. However the skew is now upwards, with the 2025 dots showing eight respondents above the median and only two below, contrasting December when five were below the median and four above.

This reflects increased worries over inflation, with 2025 core PCE prices seen at 2.8% rather than 2.5% though 2026 is still seen at 2.2% and 2027 on target at 2.0%, showing the tariff boost to inflation is seen as a one-time lift. 2025 GDP has been revised lower to 1.7% from 2.1% and 2026 and 2027 have been revised lower too, suggesting tariffs could cause a more sustained damage to growth prospects.

The statement has left the assessment of the economy unchanged from December but instead of stating that risks are balanced now states that uncertainty has increased. Quantitative Tightening is to be scaled back, as was hinted at in January minutes which noted debt ceiling concerns. Beginning in April the monthly redemption cap for USTs will fall quite sharply to $5bn from $25bn, though the cap on agency debt and mortgage-backed securities will remain at $35bn. That only USTs has seen a change in the QT plans is a sign that debt ceiling concerns are playing a key role in the decision. Fed Governor Waller dissented from the decision to slow the pace of QT but backed the unchanged rates decision.