Banxico Review: Continuing the Pause

The Mexico Central Bank (Banxico) kept the policy rate unchanged at 11.0%, despite one member advocating a 25 basis points cut. Banxico hinted at potential rate cuts in 2024 due to a slowing economy and inflation outlook. An August cut remains possible but seems premature. Market and Banxico inflation expectations diverge, with the latter being more optimistic. Political risks, like a consensus of a Trump victory, could limit near-term rate cuts.

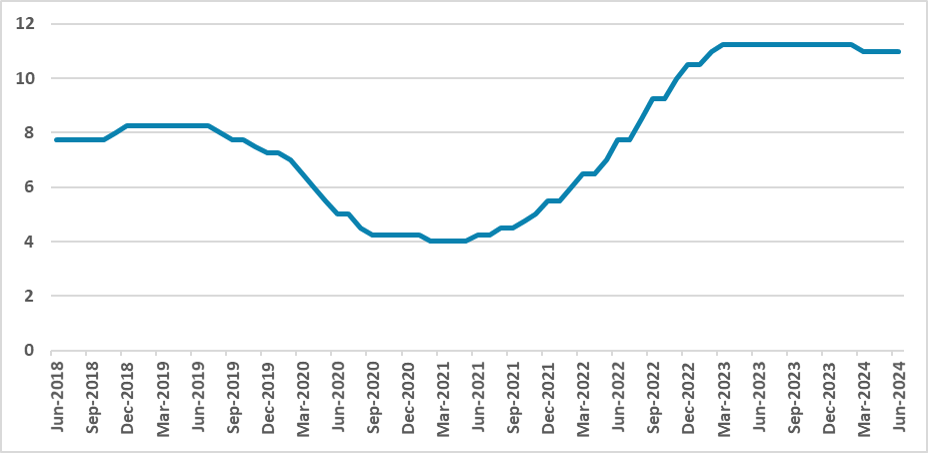

Figure 1: Mexico’s Policy Rate (%)

Source: Banxico

The Mexico Central Bank (Banxico) board has convened to decide the policy rate. The decision was to maintain the policy rate unchanged at 11.0%, as expected by most market participants. However, the decision was not unanimous, with one of the members, Omar Mejia, voting for a 25 basis points cut. This member was vocal in the last meeting, stating that despite pausing in May, conditions for a cut could appear in June, but he was alone in this thinking.

Indeed, it is tough to believe that conditions have not worsened since their May meeting. The tone of the communiqué was somewhat soft regarding the post-election volatility, stating only that for idiosyncratic reasons, the exchange rate depreciated, and long-term interest rates have risen. We will see more in the minutes, but it looks like Banxico views this volatility as transitory.

Banxico also hinted that they will still cut in 2024. They stated that the inflationary outlook would still allow adjustments in the policy rate moving forward. This means that an August cut is still on the radar. They also believe that economic activity has slowed down, with risks to the downside. If the Mexican economy indeed weakens, which is not our view, conditions for cuts will be on the radar. We believe that it will be too soon for an August cut. We still believe that the recent depreciation will have some inflationary effects and the economy will rebound a bit in the next few months.

Additionally, the view of a Trump victory in the U.S. would be bad news for the Mexican economy and would certainly diminish the room for cuts in the short term. We continue to see that Banxico will apply two cuts at the end of the year. Once it is clear when the Fed will cut, the Mexican Peso will recover, and inflation rates will have fallen in the second half of the year, allowing Banxico to cut.

It is also interesting to note the difference between Banxico's thinking and the markets. While markets expect that inflation will finish 2025 at 3.7%, according to Banxico's Expectations Survey, Banxico's modeling believes that it will converge towards 3.0%. This excessive optimism from Banxico could mean they will need to reassess their strategy for inflation convergence at some point.