Canada May CPI - A strong month after five straight subdued ones

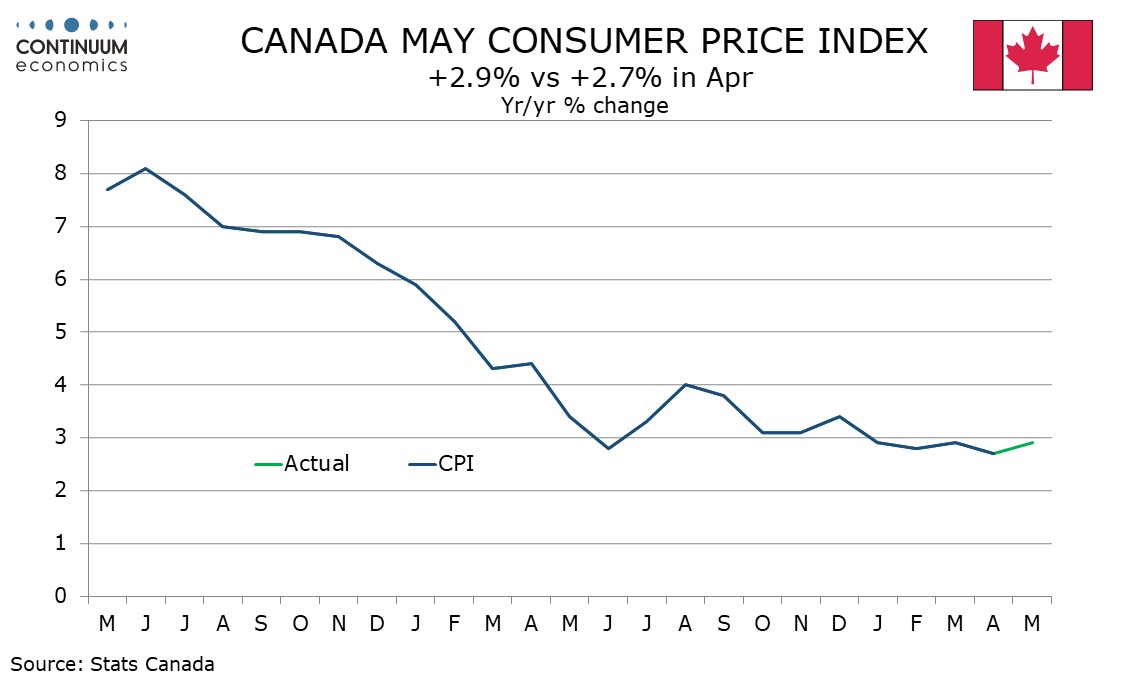

May’s Canadian CPI at 2.9% yr/yr from 2.7% has surprised on the upside and while the BoC will have June CPI data too to look at before its next meeting on July 24 this data makes a second straight easing at that meeting less likely.

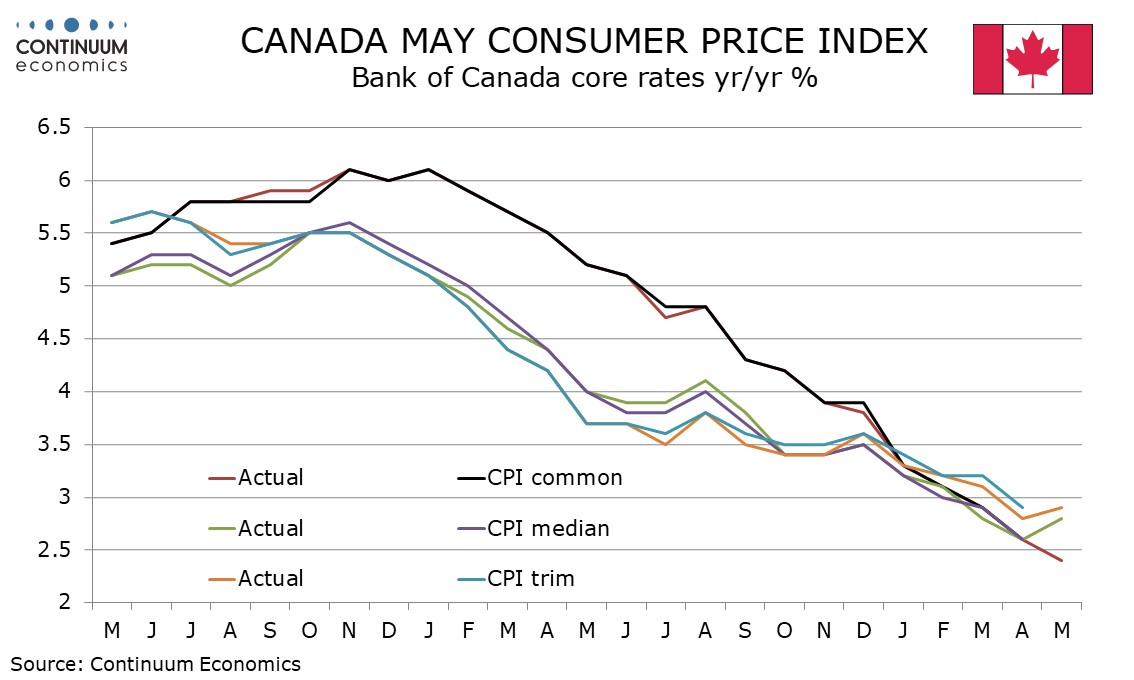

The data on the BoC’s core rates is mixed with CPI-median at 2.8% from 2.6% and CPI-trim at 2.9% from 2.8%, though CPI-common slipped to 2.4% from 2.6%. The BoC trends to see the former two as more important than CPI-common so they are likely to see the data as disappointing.

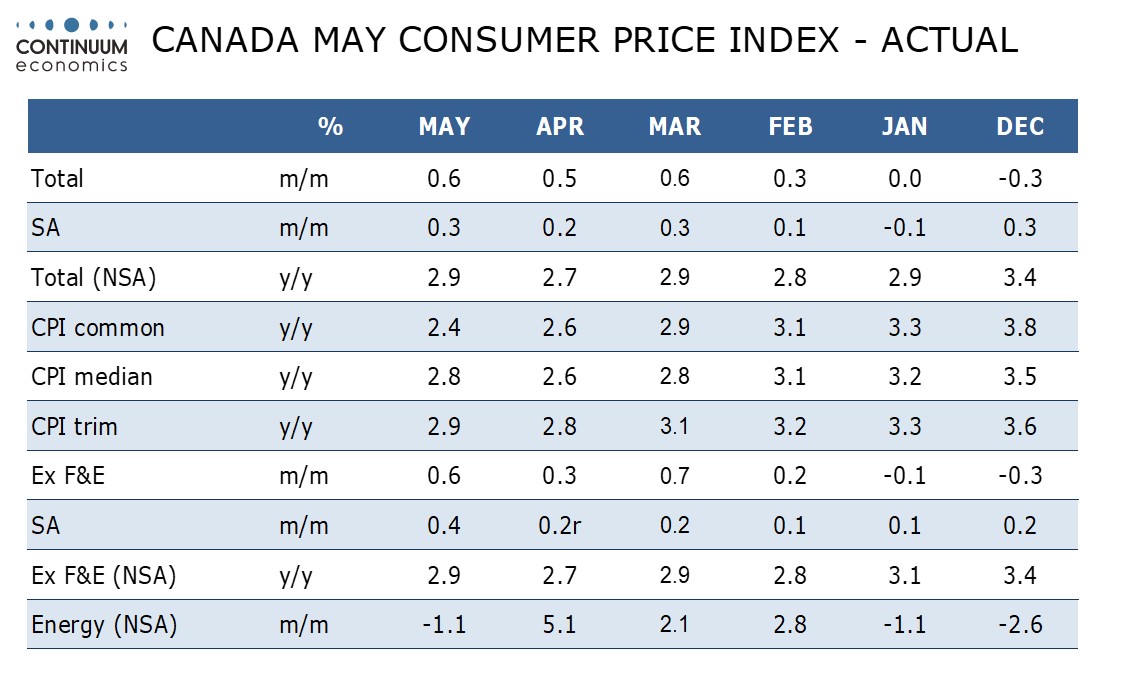

On the month CPI rose by 0.6% both overall and ex food and energy before seasonal adjustment with the seasonally adjusted gains 0.3% overall and 0.4% ex food and energy, the latter the strongest since July 2022. The preceding five months have not even seen a 0.3% adjusted ex food and energy gain, though April was revised up to 0.2% from 0.1%.

Seasonally adjusted data shows strength most pronounced in health and personal care at 0.7% and recreation, education and reading at 0.6%. Shelter remains quite firm at 0.4% but slowed from 0.5% in April.

While one strong month after five straight subdued ones is not a clear sign of an acceleration in trend it is a warning that even a lengthy string of subdued data is not grounds for complacency. The United States saw two straight subdued quarters in late 2023 before a strong quarter in Q1 2024. The BoC cannot exclude the possibility that we may see a multi-month correction higher after a multi-month soft streak.