Preview: Due August 2 - U.S. July Employment (Non-Farm Payrolls) - Slightly slower, in part on weather

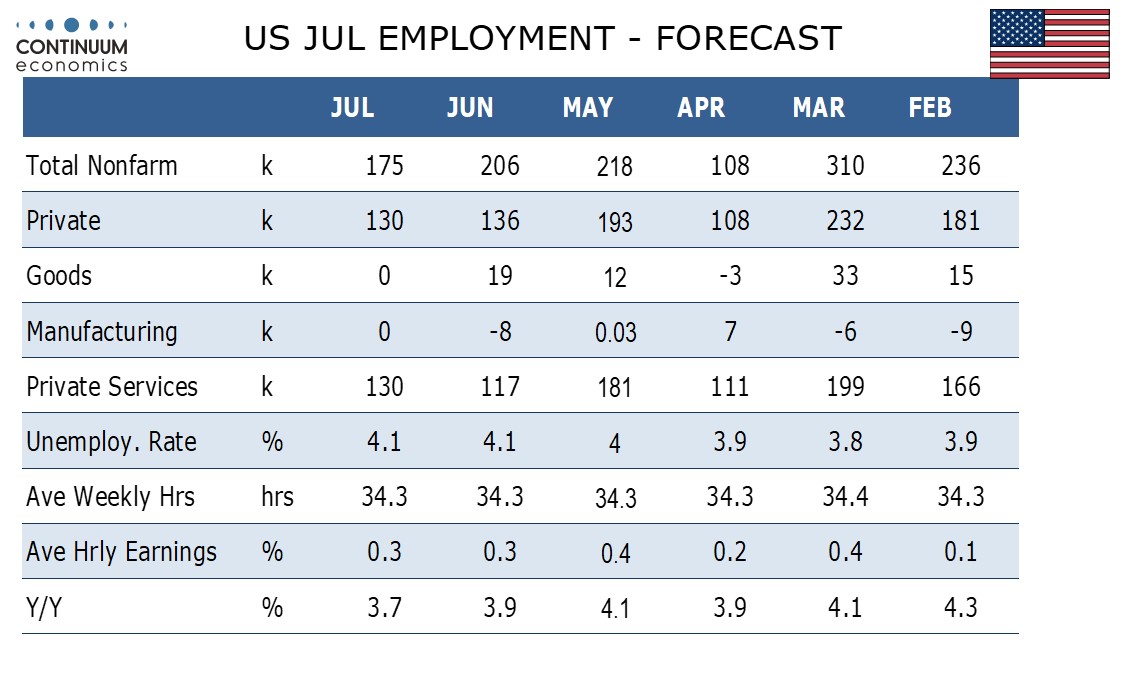

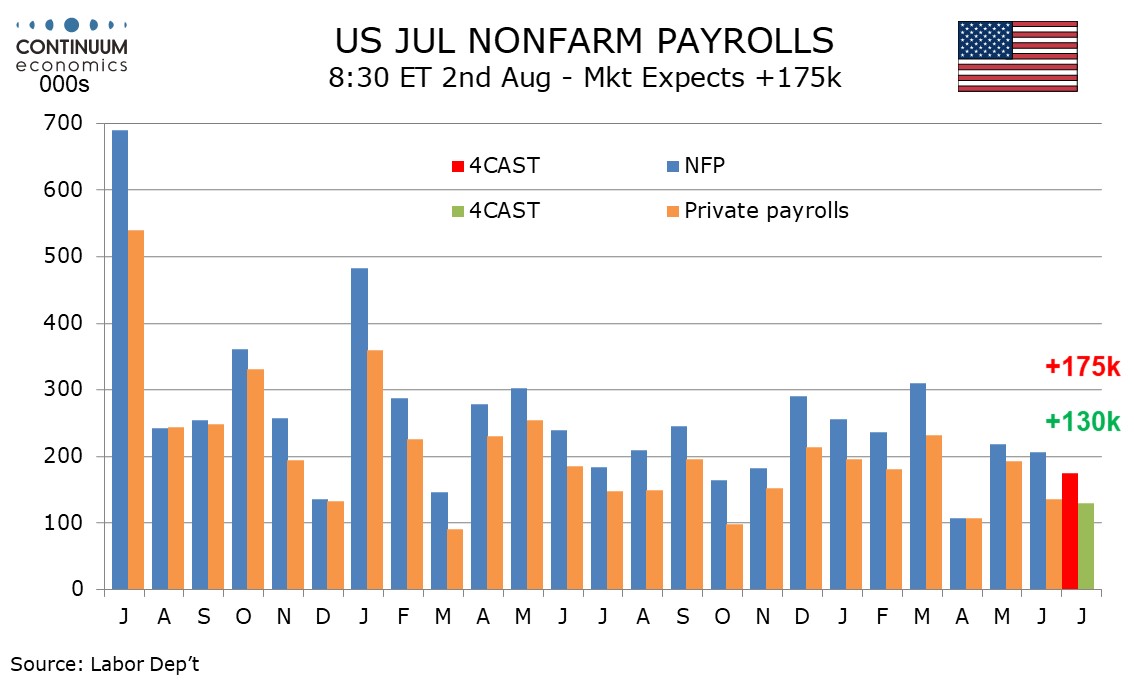

We expect July’s non-farm payroll to rise by 175k, 130k in the private sector, both slightly slower than in May and June but stronger than in April, suggesting only a moderate loss of momentum in the labor market. We expect an unchanged unemployment rate of 4.1% and a second straight 0.3% increase in average hourly earnings.

The initial claims 4-week average picked up in May and June but has been more stable into early July. There was however a bounce in the payroll survey week, led by Texas which appears related to Hurricane Beryl. This suggests an underlying picture similar to June’s but with Hurricane Beryl acting as a modest negative bringing a slightly below trend outcome. Goods, particularly mining and construction, are the most vulnerable sectors.

Seasonal adjustments for July are more neutral in the private sector after being negative through Q2 and that reduces downside risk. Seasonal adjustments are positive in government due to school closures, but we assume the seasonal adjustments will be appropriate. We expect a 45k rise in government, below the 70k seen in June and the 78k seen in March, but above May’s 25k and a flat April and keeping trend firm.

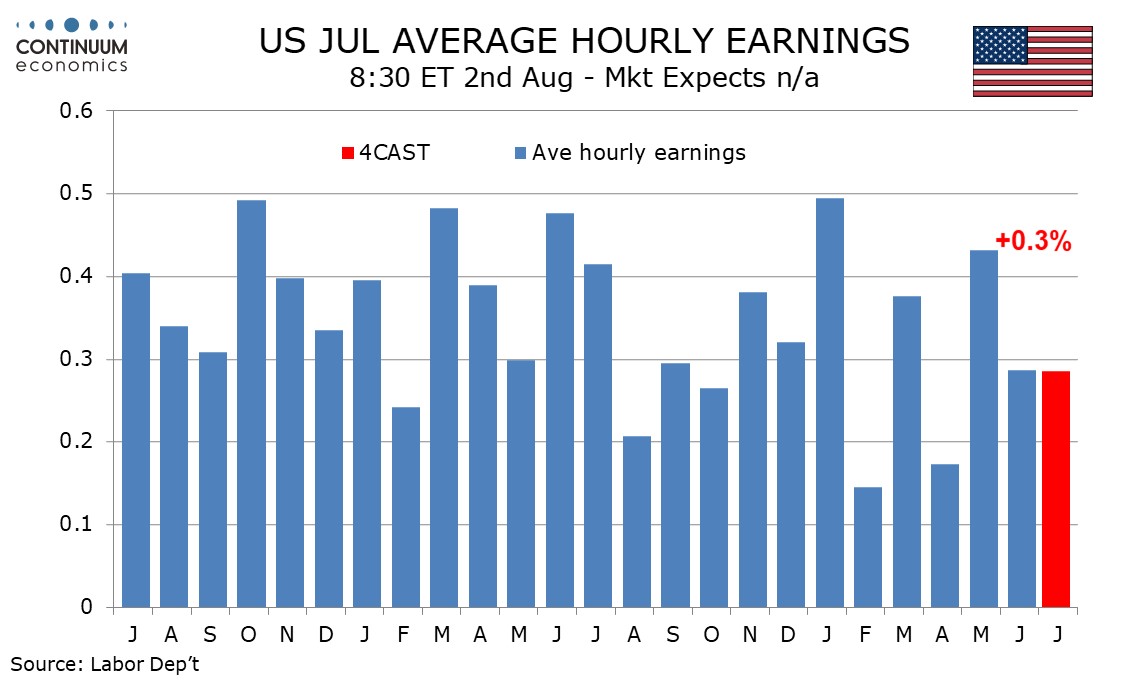

Average hourly earnings trend is now probably close to 0.3% per month, and we expect a similar outcome to June’s which rose by 0.29% before rounding. May at 0.43%, March at 0.38% and January at 0.50% were above trend, while April at 0.18% and February at 0.15% were below trend. Under our forecast yr/yr growth would slip to 3.7% from 3.9%, reaching its slowest since May 2021.

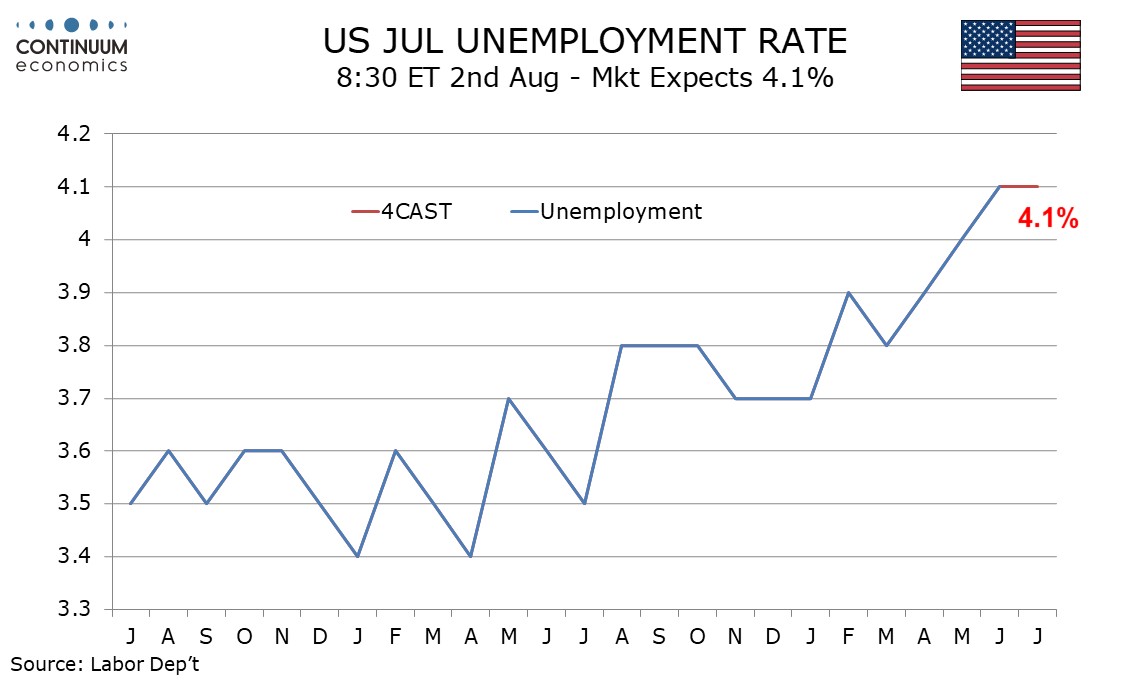

We expect an unchanged unemployment rate of 4.1% to follow three straight increases of 0.1%. Before rounding the rate may increase from June’s 4.053% but the rate is unlikely to reach 4.2% even after rounding, with a dip back to 4.0% looking more likely than a rise. Hurricane Beryl is likely to restrain the labor force as well as employment.

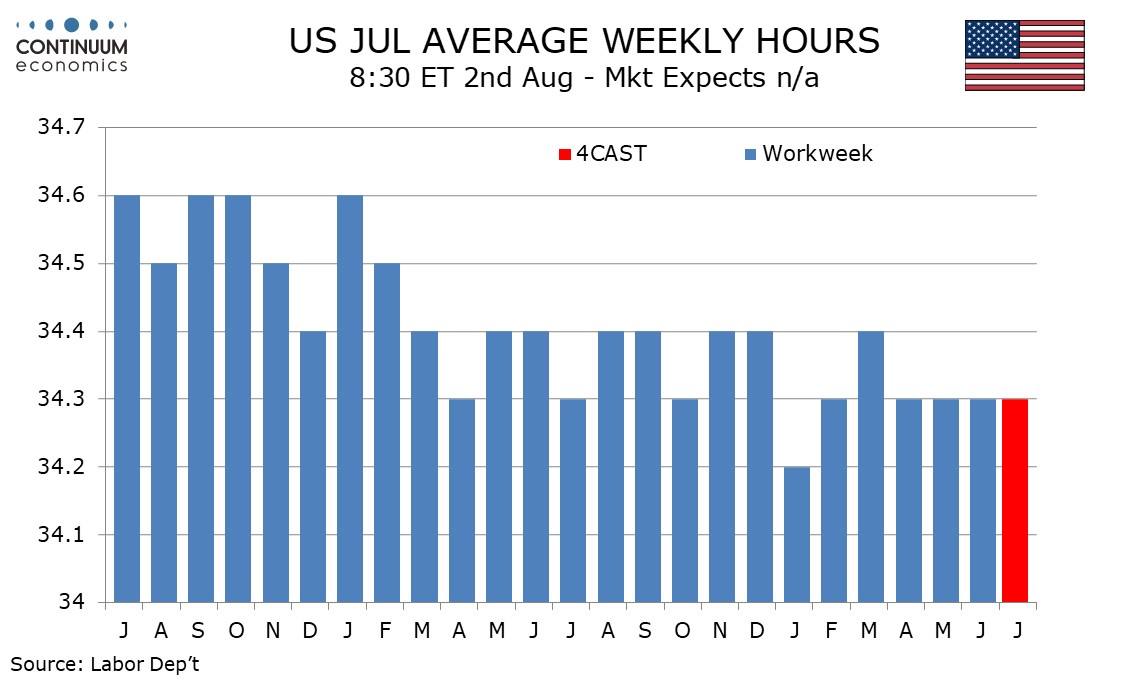

We expect a workweek of 34.3 hours for a fourth straight month, leaving aggregate hours worked up by a moderate 0.1% on the month.