FOMC Minutes from December 18 - Moving towards a more careful approach

Minutes from the December 17-18 meeting show the FOMC moving to a more cautious stance, which appears largely a response to recent disappointment on inflation data but uncertainty over policy following the election also seems to be playing a part.

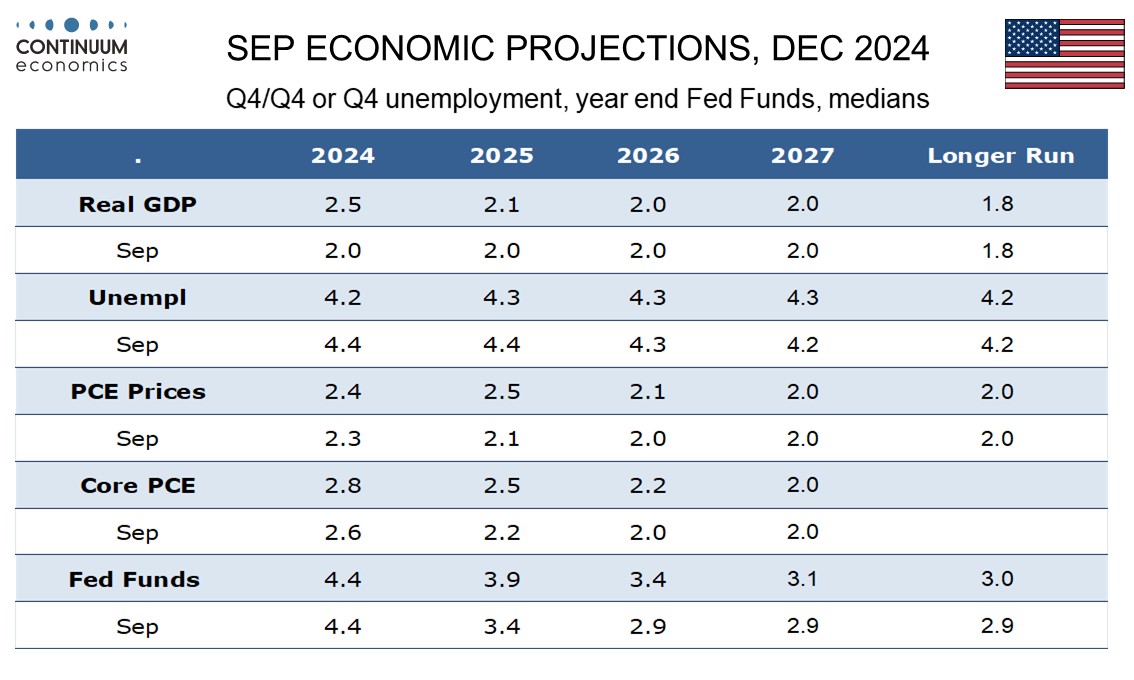

Inflation was still seen moving towards 2%, but recent higher than expected data and potential trade and immigration policy changes suggested the prices could take longer than expected. Upside surprises in activity data were also noted, but the strength of activity was seen as unlikely to be a source of inflationary pressures, nor was the labor market, though conditions were expected to remain solid. While the vast majority judged risks to the dual mandate to be roughly balanced almost all judged that upside risks to inflation had increased.

The vast majority of participants backed the decision to ease by 25bps, though a majority noted that their judgements had been finely balanced with some seeing merit in keeping rates unchanged. Participants indicated the FOMC was at or near the point at which it would be appropriate to slow the pace of easing, which implies not moving at each meeting after three straight moves totaling 100bps. However, if data came in about as expected, it was seen as appropriate to continue to move gradually toward a more neutral stance. Factors underlining the need for a more careful approach included recent elevated inflation readings, continued strength of spending, reduced downside risks to the labor market and increased upside risks to inflation. Uncertainty also justified a more careful stance.

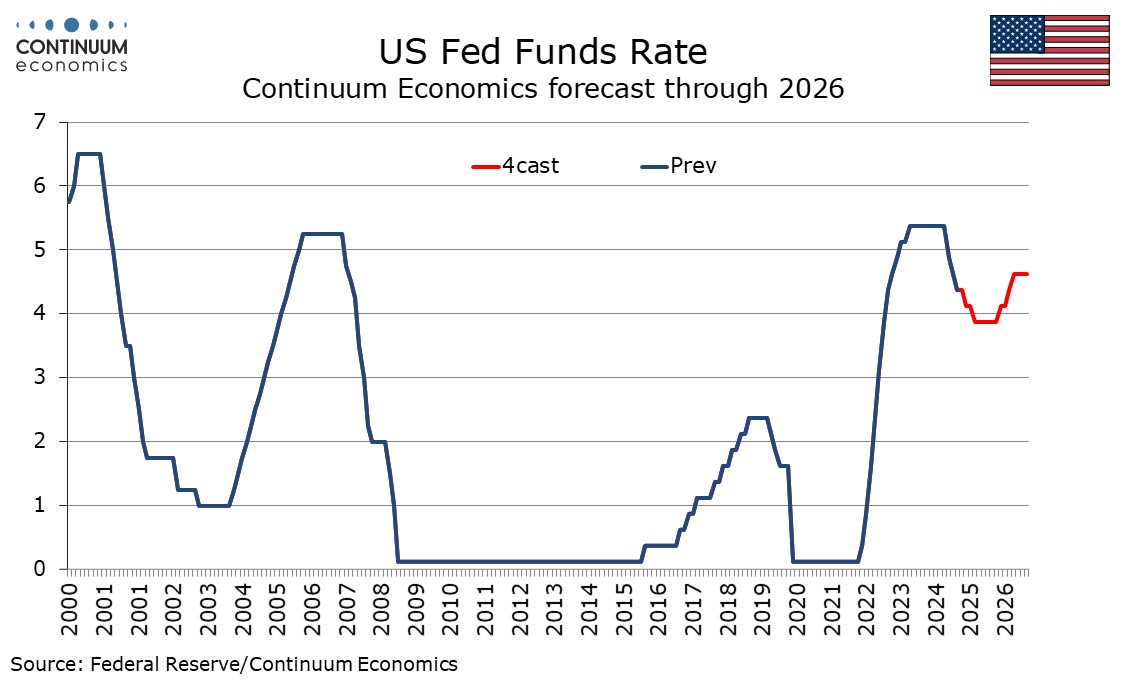

The minutes still show an FOMC with a central view of falling inflation justifying further easing but high uncertainty justifies increased caution. Respondents differed on whether placeholder assumptions on policy changes should be incorporated into the forecast. Early 2025 inflation data will be crucial given that recent years have tended to show strength at the start of the year, giving scope for yr/yr rates to drop if similar strength is not seen in early 2025. We expect 25bps of easing in Q1 and Q2 of 2025 but tightening in 2026 as tariffs help to support underlying resilience in inflation. However, with the timing and magnitude of tariffs and other policy changes highly uncertain, the policy outlook is too.