Easing Price Pressures to Influence Bank Indonesia Trajectory

Easing food inflation saw headline CPI decline to 2.1% yr/yr in July. Nonetheless, price pressures from a weakening IDR persist. Bank Indonesia will likely hold rates till Q4-2024.

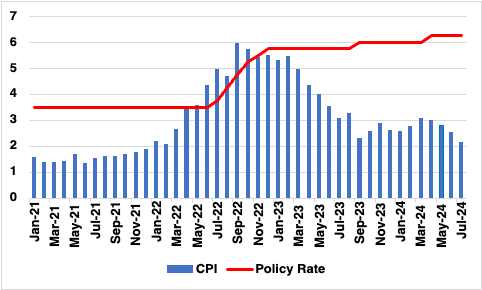

Figure 1: Indonesia Consumer Price Inflation and Main Policy Rate (%)

Source: Continuum Economics

Indonesia's consumer price index (CPI) revealed a noteworthy easing of inflationary pressures in July, according to data released by the Central Bureau of Statistics (BPS). CPI inflation fell to 2.13% yr/yr from 2.51% yr/yr in June, marking the lowest inflation rate since February 2022. In month-on-month (m/m) terms, consumer prices dropped by 0.18%. This moderation in inflation is likely to influence the monetary policy trajectory set by Bank Indonesia.

The primary driver behind the decline in inflation was a significant slowdown in food prices, which rose by 3.6% y/y, down from 4.9% in June. This marks the slowest pace of food price growth since August 2023, suggesting an easing of supply chain disruptions and improving agricultural conditions. Despite food prices remaining the principal inflationary factor—contributing 1.04 percentage points (pps) to the headline rate—other categories exhibited mixed performance. Disinflationary pressures were also noted in transport and health services, while personal care and education saw slight upward contributions to inflation at 0.3 pps and 0.2 pps, respectively.

The core inflation rate, which excludes volatile items such as food and energy, increased to 1.95% y/y from 1.90% in June, reaching its highest level since September 2023. The proximity of the headline inflation rate to core inflation suggests that the CPI inflation slowdown may have reached its nadir. This development indicates a more stable inflation environment, which could inform Bank Indonesia's policy decisions moving forward.

Producer price index (PPI) data also remained flat (0%) in Q2 2024, following a 2.4% contraction in Q1. This stall in PPI reflects the effects of a high base from 2023 but suggests that the earlier contraction was short-lived. Agriculture, manufacturing, and water management sectors reported some price growth, while sectors such as health and utilities exhibited slower price increases. Despite mining prices continuing to decline at a double-digit rate, the moderation compared to Q1 signifies potential resilience in other sectors.

Given these developments, the implications for Indonesia's monetary policy are significant. The easing of CPI inflation could provide Bank Indonesia with greater flexibility in adjusting interest rates. With inflation expectations stabilising, the central bank may opt to maintain a more accommodative stance, supporting economic growth amid global uncertainties. However, the upward trend in core inflation, coupled with the potential for marginal growth in producer prices in Q3, necessitates monitoring. Bank Indonesia, in our view, is likely to focus now on economic growth and reducing volatility in the exchange rate. Therefore, only a small 25bps rate cut in expected in Q4-2024.