South Africa: Medium Term Budget Policy Statement to be Announced on October 30

Bottom line: The coalition government will announce its first Medium-Term Budget Policy Statement (MTBPS) in Parliament on October 30, which is anticipated to set government policy goals and priorities and forecast macroeconomic trajectory and the fiscal framework over the next three years, including spending and revenue estimates along with the implementation of key structural reforms. We continue to think the fiscal deficit in South Africa is projected to remain elevated contributing both to the GDP and inflation prospects, given rising debt service, and sizeable spending on public wages and transfers, which remain as significant nuisances. The new government’s ability to agree on (and implement) needed fiscal and structural reforms will be key in 2025.

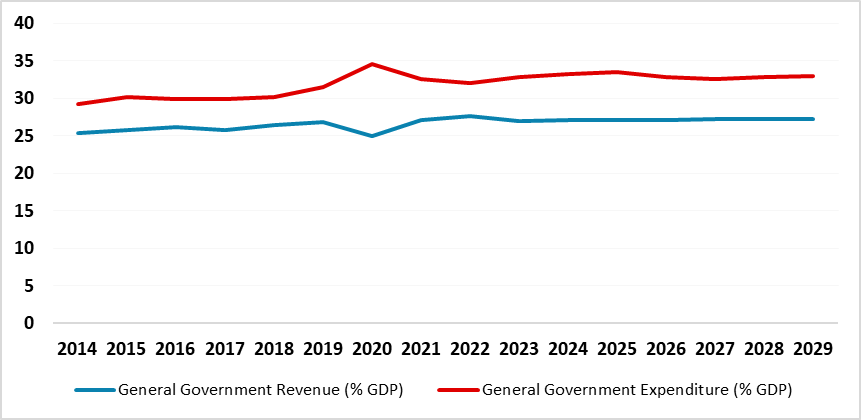

Figure 1: General Government Revenue and Expenditure 2014-2029 (% GDP)

Source: IMF

Despite there is a recent relief in power cuts (load-shedding) which remains suspended for 205 days as of October 18, acute financing needs continue to cause headaches for South Africa. Policy makers remain concerned about government debt trajectory and large domestic and international financing needs, which require tight policy currently to sustain inflation credibility.

In order to address fiscal problems, the Minister of Finance, Enoch Godongwana is expected to table the new MTBPS in Parliament on October 30. The MTBPS is anticipated to set government policy goals and priorities and forecast macroeconomic trajectory and the fiscal framework over the next three years, including spending and revenue estimates along with the implementation of key structural reforms.

Despite MTBPS, we think South Africa’s general government fiscal balance and debt trajectory remain cloudy as domestic sources dominate debt financing with long maturities risking financial sector-sovereign. Additionally, there is a recent increase in the government expenditures (% of GDP), and a fall in the revenue-to-GDP ratio.

According to the IMF Fiscal Report in April 2024, despite there was a steady increase in the revenues between 2020 and 2022, the revenue-to-GDP ratio plummeted from 27.7% in 2022 to 27% in 2023. The expenditure-to-GDP ratio rose from 32% of GDP in 2022 to 32.9% of GDP as of 2023 due to various reasons like wage increases, cushioned SOE transfers and grants to local governments (Figure 1). IMF forecasts expenditure-to-GDP ratio to continue its upward trend in 2024 and 2025 as well.

In addition to the mentioned fiscal report, IMF’s country report in September 2024 revealed that the fiscal deficit is projected to remain elevated over the medium term, given support to state-owned enterprises, rising debt service, and sizeable spending on public wages and transfers.

Taking into account that public finances weakened in 2023, we feel the country has need for large domestic and international financing as fiscal positions are weak. Despite the budget deficit remained in line with the revised budget target in 2024, debt-to-GDP ratio standing around 74% is well above the EM average of 58.9%.

Under these circumstances, we are of the view that the upcoming MTBPS should focus on prioritizing fiscal consolidation efforts to decrease public debt since it appears fiscal room remains limited to fund structural reforms, productive investments, social spending needs and renewable energy efforts. To achieve this, the country should enhance revenue (tax) collections, decrease cost of servicing the public debt, and improve the institutional fiscal framework. The new government’s ability to agree on (and implement) needed fiscal and structural reforms will be key in 2025.