EZ HICP Preview (Feb 3): Headline to Slip Amid Friendlier Core Messages?

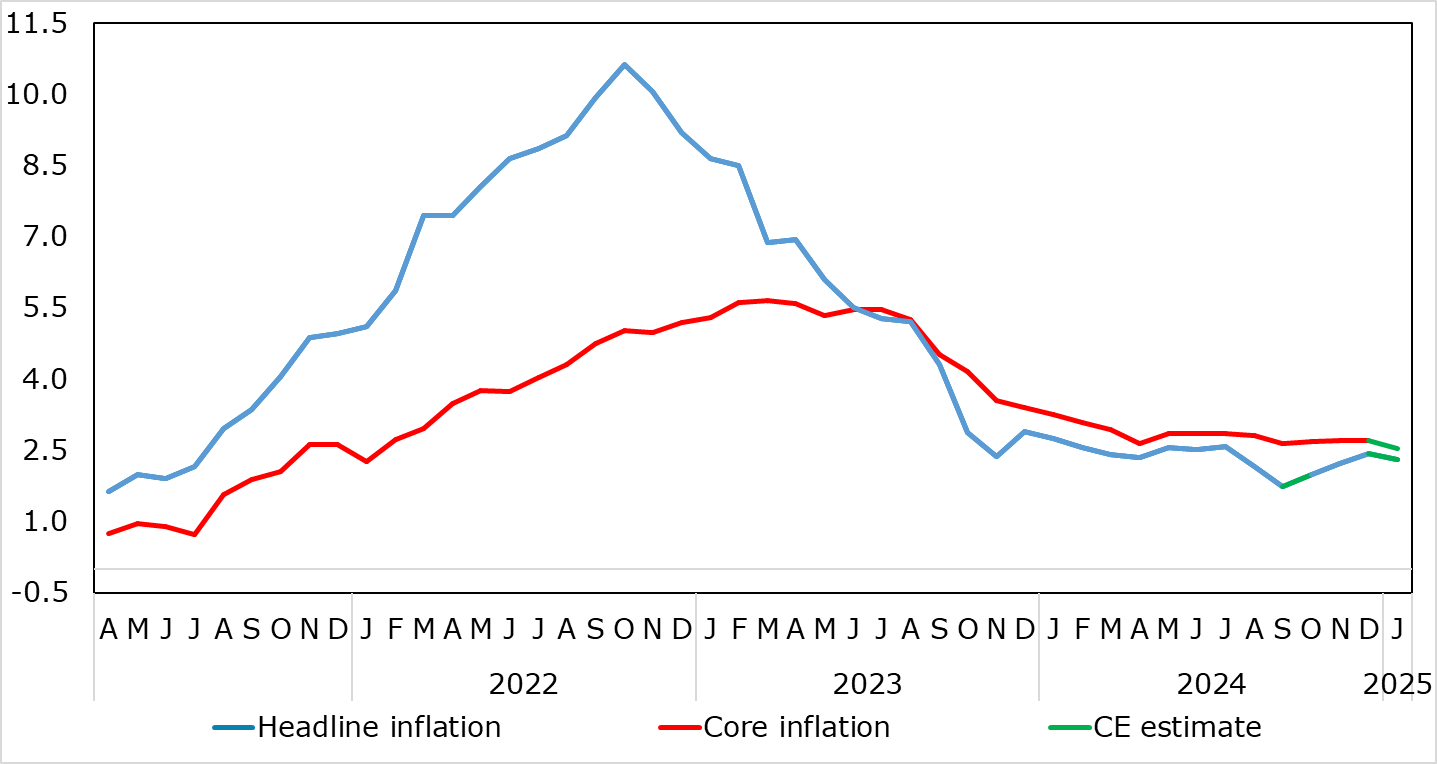

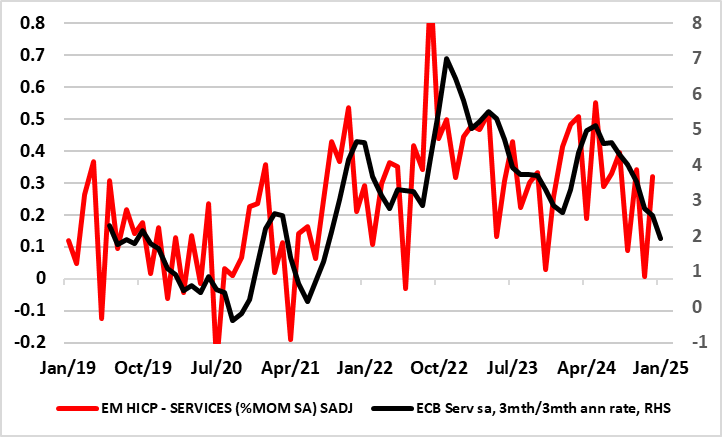

There were mixed messages in the December HICP numbers. For a second successive month, the headline rose 0.2 ppt, but to 2.4%, but where the core (again) stayed at 2.7%, partly due to what is seemingly stable services inflation. Once again, higher energy costs, mainly base effects, were the main factor behind the rise, and these factors may appear again in January data but where a belated fall in services inflation may see the headline slip back down to 2.3% (Figure 1). Indeed, shorter-term price momentum data already suggest that core and even services inflation are running around target (Figure 2) and given sharp falls in wage tracker data, we think headline y/y services inflation is succumbing, something backed up by surveys for the sector. Indeed, the core rate may drop 0.2 ppt in January partly driven by softer service price pressures.

Figure 1: Headline to Slip as Services Resilience Eases

Source: Eurostat, CE

Source: Eurostat, CE

However, there are some signs in retailing surveys suggesting disinflation may have stalled. But this may be of increasing secondary importance to most of the ECB Council as a) inflation is already consistent with target and b) a fresh and more demand driven disinflation could be triggered by what seems to be weaker real economy backdrop that could also exacerbate financial stability risks.

Regardless, the headline HICP rate may edge down a notch or two in January, partly due to energy base effects but also some rise in fuel costs in m/m terms, but with the core dropping. And with adjusted data showing even apparently resilient services inflation succumbing (Figure 2), this being something that has been noted by some of the ECB Council. Indeed, it was suggested in the December minutes that a moderation in services inflation dynamics was evident in the three-month-on-three-month seasonally adjusted services inflation rate which had fallen to 2.6% in November, from 3.4% in October, indicating a further softening in momentum – we suggest it fell further in January to around 2.1%!

This backdrop has persuaded the recalcitrant ECB into a reassessment last month (as we expected) a change in forward guidance in which the ECB now accepts that on-target inflation is likely to be durable enough so that it no longer has to pursue policy restriction. In this regard, the first glimpse of the ECB’s 2027 economic projections supports this as they point to a second successive year of around-target inflation even on a core basis and also on the basis of markets assuming rates fall to around 2% in 2026 – hence, the ECB is largely endorsing such market thinking, showing just how much it has been forced to reassess in recent months. Indeed, this was only due to an assumed expanded European Union Emissions Trading System. If this were not included, without which inflation would drop below target in 2027

Figure 2: Even Services Inflation is Around Target in Shorter-Term Dynamics?

Source: Eurostat ECB, CE

But the dominant ECB issue now is the extent to which downside growth risks have turned into reality with it clear that growth worries have risen. Indeed, preserving growth does seem to have become the ECB policy priority. Moreover, these downside risks have other aspects, equally worrying, especially as, they could fan financial instability issues.

They are also accentuating the disinflation outlook enough to have made the ECB now admit that most measures of underlying inflation suggest that inflation will settle at around target. Amid what has been faster easing, the ECB must be considering what neutral policy and we think the implies around four 25 bp cuts in H1 2025, with an ensuing around-neutral 2% policy rate. But it is possible that amid a continued sub-par growth outlook into 2026, then further easing may be on the cards into 2026.

Regardless, we see headline inflation down to the 2% target in the next 2-3 months and then drifting 0.1-0.2 ppt either side for the rest of the year.