Moody's downgrades US debt as long-standing fiscal concerns mount

Moody’s downgraded US debt to AA1 from AAA after Friday’s close. The decision appears due to continued lack of action on the budget deficit rather that being triggered by any specific event, and brings Moody’s into line with S and P and Fitch. However the timing is awkward for markets, with the equity rally looking stretched and negotiations on the budget having run into a roadblock.

With equities having erased their losses following Liberation Day and more, this could be a trigger to call a halt to the rally, while Trump has suggested he may simply impose tariff levels on many countries as the 90-day period expires, being unable to make deals with every country individually. The UST market itself is at an awkward point, with the 30 year yield approaching 5%. The USD could come under increased pressure.

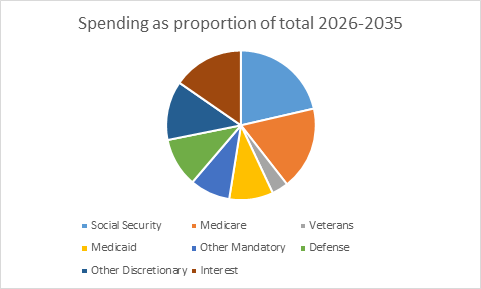

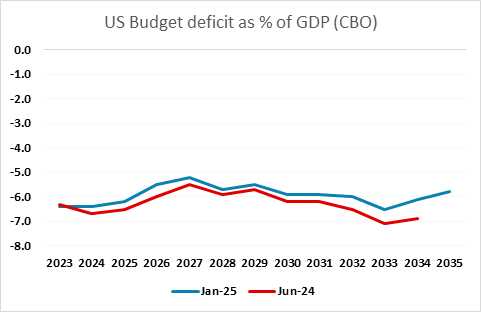

The decision may strengthen the resolve of Republican fiscal hawks who blocked the advance of the “Big Beautiful Bill” in the House Budget Committee on Friday. If they refuse to back down, House Republicans may have to choose between reducing the tax cut, with extension of the 2017 tax cut seen costing $4 trillion over 10 years, of painful cuts in spending, most obviously Medicaid which provides health insurance to those on low incomes. Both those choices would run into opposition. Moody’s is giving a bleak outline of the budget, suggesting the deficit could hit close to 9% of GDP by 2035, up from 6.4% in 2024, with rising interest and entitlement costs leading the deterioration. The CBO forecast is for a fairly stable if large deficit assuming no policy changes, including the 2017 tax cuts expiring on schedule.