USD, JPY flows: Steady to mild risk positive tone

Mildly more risk positive picture, but uncertainty remains. Likely Takaichi PM appointment offset by some BoJ hawkishness

A fairly quiet start on Monday, and not much on the calendar to liven things up. China trade tension was reduced a little on Friday by Trump’s comment that 100% tariffs were not sustainable, and risk sentiment has stabilised after the dip seen on the initial tariff announcement and subsequent US banking concerns. Even so, there are likely to be more chapters in the story, as at this stage there is no resolution and the tariffs are due to kick in on November 1st. Trump has a history of allowing the deadline to pass before backing down, which typically means we will have a second leg down in risk sentiment at some point, but for now the tone looks to be neutral to marginally risk positive.

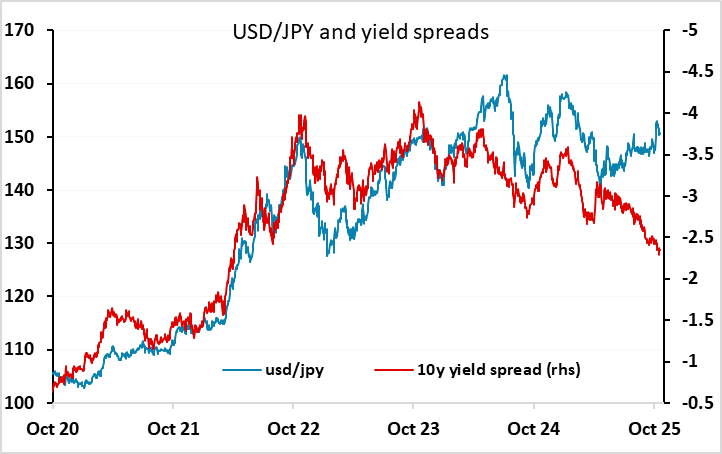

Some resolution looks likely in Japanese politics tomorrow as the LDP and the Innovation party have reached a coalition agreement which should see Takaichi installed as PM after tomorrow’s vote. The JPY weakened in early Asia but has recovered since. However, as long as the risk picture is neutral/friendly, and the market remains concerned about policy under Takaichi, the JPY seems likely to remain under a little pressure. But there have been some more hawkish comments from the BoJ’s Takat this morning, and any comments from Ueda that suggest a rate hike may still be possible at next week’s BoJ meeting could undermine the JPY bears.