USD, JPY flows: USD and JPY weaker as equities strengthen

More new multi-year JPY lows on the crosses overnight as equity markets continue to rise

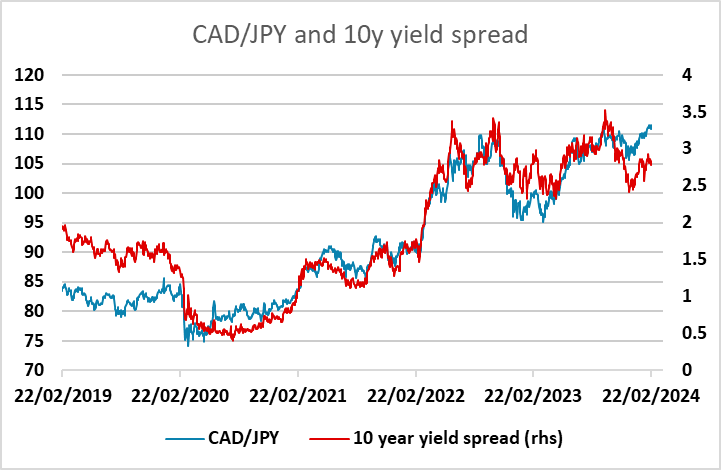

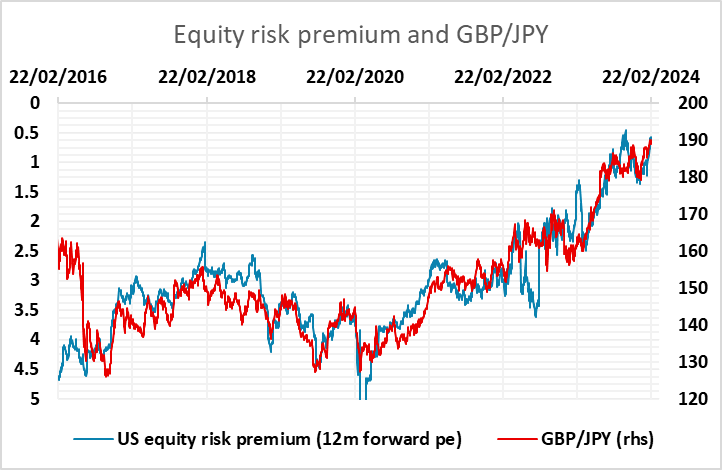

JPY weakness on the crosses has once again been the theme overnight. AUD/JPY hit its highest since December 2014, GBP/JPY its highest since August 2015, and CAD/JPY its highest since January 2008! The JPY was also weaker against the EUR and CHF, with EUR/JPY hitting another post-November high. Of course, in real terms the JPY is even weaker, as Japanese CPI has risen around 10-15% less than the European and North American CPIs since the beginning of 2020.

However, the overnight move has been about the USD weakening against the riskier currencies rather than the USD strengthening against the JPY. Equities benefited from Nvidia earnings beating estimate and indications that the Chinese government will introduce restrictions on institutions selling shares, and this helped risk sentiment, with equities generally higher. The Eurostoxx 50 futures hit their highest since 2000. As long as the equity tone remains positive, JPY weakness will be hard to oppose, and this is also likely to mean USD weakness against the riskier currencies, especially if non-US equity indices continue to outperform as they have so far this week.

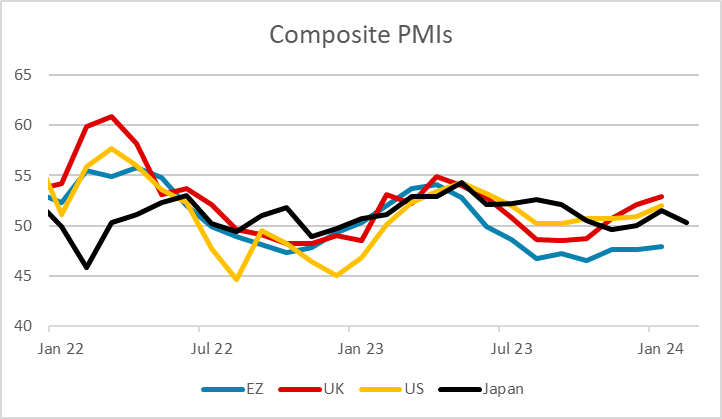

The focus today will be on the PMI data, with the slightly softer Japanese data overnight perhaps suggesting some downside risks. However, given current sentiment, weaker data that leads to some softening in yields would likely be positive for equities, and stronger data might not have a negative impact even if yields move higher. The risk positive currencies still look hard to oppose short term.