ECB Review: Policy Window Stays Very Open

Maybe the ECB is now thinking that it was too clear at its April Council meeting that rate cut would occur subsequently in June, basically then suggesting that something would have to occur to prevent such a move. This time, with policy rates held as very much expected, the policy window was merely left open, with nothing like any pointer to the speed and/or timing of further moves. That the easing cycle continues is clear as President Lagarde again noted that policy thinking was in a so-called third phase and made some almost-dovish hints in highlighting the softer aspects of the inflation picture. But any further moves may come with continued formal dissent and reservations. Such a possible lack of policy unanimity is not something the consensus-liking ECB Council may prefer. But with the ECB statement retaining its previous assessment of the medium-term inflation outlook (ie below target) and noting largely lower underlying inflation signs (Figure 1), it does not suggest that that hawkish minority have made any strides in affecting the rest of Council.

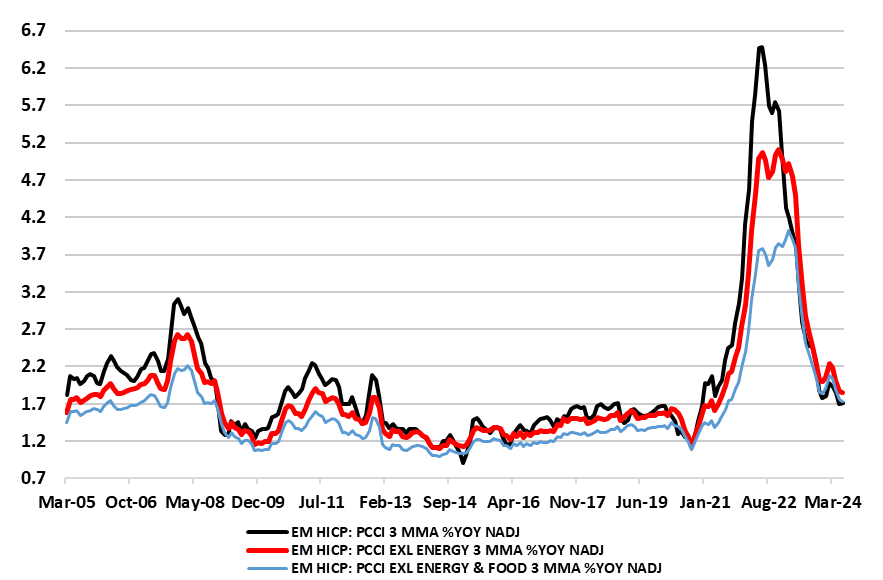

Figure 1: Underlying Price Pressures Back Below Target

Source: ECB, Persistent and Common Component of Inflation (PCCI), % chg y/y

Underlying Inflation Going the Right Way?

It is notable how the ECB stressed that most measures of underlying inflation were either stable or edged down in June, something backed up by PCCI data often cited by Chief Economist Lane as the best lead indicator of price trends (Figure 1). Indeed, these measures are all now even more clearly below the 2% target and actually only a couple of tenths above their pre-pandemic averages, possibly a result of what the ECB suggests has been a ‘buffeting’ in company profits. Admittedly, it is possible that if there are continued signs of price persistence (in services and/or wages) this may harden the hawkish reservations. But if this comes alongside formal projections still seeing headline HICP below target at the end of the forecast horizon, then the ECB may have no option but to ease (further).

Green Shoots Need Nurturing?

Data trends support this outlook too. A key ingredient today will have been recent (mixed) economy data but with fresh hints of higher wage pressures and less worrying bank lending signals. Indeed, this latest set of bank lending survey data will provide some reassurance in regard to the consumer, but less so as far as companies are concerned. It is clear that improving housing market prospects were the main driver of the increase in housing loan demand, this presumably a result of anticipated further rate cuts. In this regard, the Council will not feel that it has to ease any faster than it hitherto may have (covertly) considered, but should realize that without additional easing, the ‘green shoots’ in this BLS may not grow further.

Easing Restrictiveness

As to future policy nothing explicit was forthcoming, save to underline that policy will be data dependent and clearly not pre-committing to a particular rate path and to ‘keep policy rates sufficiently restrictive for as long as necessary’. It remains the very clear case that the ECB is not in the process of making policy expansionary, instead just making it less restrictive.

As for the reservations about the June rate cuts, Lagarde was not open about how they may have developed at this meeting (more will be learned with account due on Aug 22). But possibly these reservations spread no further within the Council not least due to their shortcomings. Indeed, there seemed to be irrational disagreement about interpreting data; what is/was the basis for assessing how data moved relative to expectations and even an implicit objection to the ECB having a symmetric target! Moreover, the ECB majority may feel that policy has been hiked relatively aggressively in both speed and extent in what Lagarde in June referred as the first policy phase.

Policy Outlook

Regardless, we still feel that neither Fed policy, nor the US$, are likely to delay any ECB move(s). Instead, and partly as the ECB remains focused on the labor costs updates, numbers produced quarterly, but also wants to amass a broad but fresh thrust of added insights, then subsequent rate cuts may only arrive in three-month intervals, ie September and December. This schedule also chimes with updated ECB projections. Hence, our long-standing view that the ECB may cut only a further 50 bp this year but with President Lagarde implicitly hinting more rate cuts are being considered back in June as the ECB has now entered a third policy phase, ie after hiking and then pausing. However, by year-end more durable evidence of labour costs easing should convince the ECB to continue easing and we see 100 bp further easing through 2025, with the deposit rate then nearing 2% and thus more in line with a perceived neutral setting but hardly moving into a clear expansionary stance.