JPY, CHF flows: Safe haven gains may be reaching near term limits

JPY gains have been mostly a reversal of the May/June overshoot, but have been extended by the recent risk sell off. JPY crosses now approaching levels that are consistent with current risk premia. CHF strength on risk weakness likely to paude as EUR/CHF finds support near 0.94

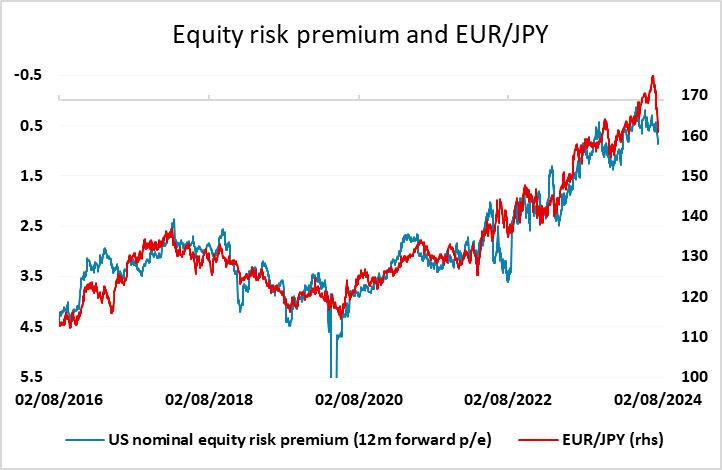

More risk negative trading seen overnight as equities continued to weaken, with USD/JPY once again trading below 149 and EUR/CHF pressuring 0.94. The main event focus today will be the US employment report, but the general risk fallout is dominating FX price action. However, based on the correlation with equity risk premia that has held for most of the last 8 years, most of the JPY strength we have seen has been a correction to the overshoot in JPY weakness that came after the first BoJ intervention in late April/early May, rather than a reaction to declining risk appetite. While we have also seen some rise in risk premia since the beginning of May, it’s only the last 5 figures or so of the decline in EUR/JPY that looks to be related to current weakening risk appetite. We are now approaching levels near 160 where EUR/JPY is back in line with the historic correlation with risk premia, so if we see the market calm down after the US employment data, we may see a pause or a correction in JPY strength.

The CHF has also been strong on the back of the risk sell off, but EUR/CHF is approaching big support at 0.94. There is less case for CHF strength than JPY strength on a valuation basis, and less reason to be negative about European equities than US equities based on valuation metrics, while European growth prospects look weak but stable. This morning’s Swiss CPI data was in line with consensus at 1.3% y/y, and is at levels which will make the SNB concerned about further significant CHF strength. So we would look for EUR/CHF to find support below 0.94, with a rebound likely if risk appetite recovers.